Estimation in Financial Models - RiskLab

Estimation in Financial Models - RiskLab

Estimation in Financial Models - RiskLab

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

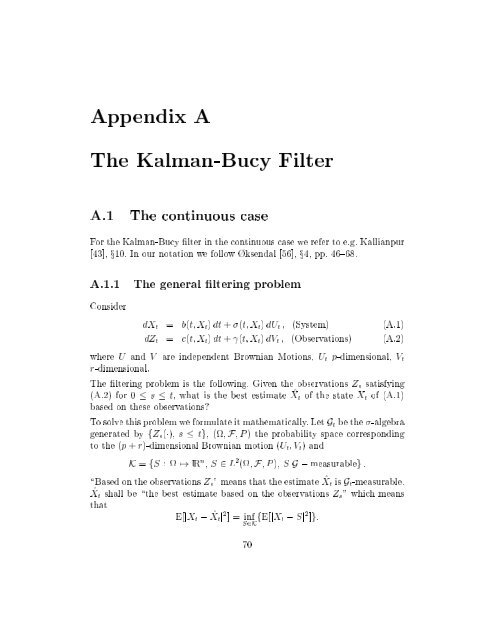

Appendix A<br />

The Kalman-Bucy Filter<br />

A.1 The cont<strong>in</strong>uous case<br />

For the Kalman-Bucy lter <strong>in</strong> the cont<strong>in</strong>uous case we refer to e.g. Kallianpur<br />

[43], x10. In our notation we follow ksendal [56], x4, pp. 46{68.<br />

A.1.1<br />

The general lter<strong>in</strong>g problem<br />

Consider<br />

dX t = b(t; X t ) dt + (t; X t ) dU t ; (System) (A.1)<br />

dZ t = c(t; X t ) dt + (t; X t ) dV t ; (Observations) (A.2)<br />

where U and V are <strong>in</strong>dependent Brownian Motions, U t p-dimensional, V t<br />

r-dimensional.<br />

The lter<strong>in</strong>g problem is the follow<strong>in</strong>g. Given the observations Z s satisfy<strong>in</strong>g<br />

(A.2) for 0 s t, what is the best estimate ^X t of the state X t of (A.1)<br />

based on these observations?<br />

To solve this problem we formulate it mathematically. Let G t be the -algebra<br />

generated by fZ s (); s tg, (; F;P) the probability space correspond<strong>in</strong>g<br />

to the (p + r)-dimensional Brownian motion (U t ;V t ) and<br />

K = fS : 7! IR n ; S 2 L 2 (; F;P); SG,measurableg :<br />

\Based on the observations Z s " means that the estimate ^X t is G t -measurable.<br />

^X t shall be \the best estimate based on the observations Z s " which means<br />

that<br />

E[jX t , ^X t j 2 ]= <strong>in</strong>f<br />

S2K fE[jX t , Sj 2 ]g:<br />

70