Imara African Cement Report Africa, the last cement frontier Angola ...

Imara African Cement Report Africa, the last cement frontier Angola ...

Imara African Cement Report Africa, the last cement frontier Angola ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Constraints to <strong>the</strong> growth story<br />

<strong>Angola</strong> continues to rank at <strong>the</strong> bottom of <strong>the</strong> World Bank‟s Doing Business<br />

ranking, which tracks reforms aimed at simplifying business regulations,<br />

streng<strong>the</strong>ning property rights, opening up access to credit and enforcing<br />

contracts. In „Starting a new business‟ category <strong>Angola</strong> ranked 164 out of <strong>the</strong> 183<br />

economies analysed, unchanged from 2010. Deterioration was also recorded for<br />

<strong>the</strong> registration of properties, obtaining credit locally, <strong>the</strong> payment of taxes and<br />

closing a business. Undoubtedly, <strong>Angola</strong> remains one of <strong>the</strong> most difficult<br />

countries in which to do business.<br />

On <strong>the</strong> positive side, dealing with construction permits became easier, as did <strong>the</strong><br />

protection of investors and cross border trade.<br />

Though progress has been made in rehabilitating <strong>Angola</strong>‟s war-torn<br />

infrastructure, must has still to be done. It seems ironic that a country with <strong>the</strong><br />

capability to pump oil from wells 3 000 metres deep, cannot supply its largest<br />

city with running water and electricity.<br />

Commuting problems continue to harm businesses in <strong>the</strong> city and major problems<br />

also persist in <strong>the</strong> port of Luanda, which cannot keep pace with <strong>the</strong> rapid<br />

development of <strong>the</strong> economy and <strong>the</strong> huge volume of cargo entering <strong>the</strong> country.<br />

Delays at <strong>the</strong> port prevent <strong>the</strong> entrance of goods, which helps to inflate prices<br />

for goods and services. Initial start-up costs for businesses are prohibitively high,<br />

hampering local participation in <strong>the</strong> economy and power outages are common,<br />

especially in Luanda. Less than 20% of <strong>Angola</strong>'s population has access to<br />

electricity and 68% of businesses generate <strong>the</strong>ir own power. An acute shortage of<br />

skilled staff also undermines private sector growth.<br />

<strong>Angola</strong> needs to do even more to improve <strong>the</strong> ease of establishing a business<br />

within its borders. To this end, priority should be given to creating a healthy<br />

business environment for domestic and foreign investors; implementing structural<br />

reforms, continuing to rehabilitate infrastructure, increasing transparency in<br />

government procurement, and reforming <strong>the</strong> legal system.<br />

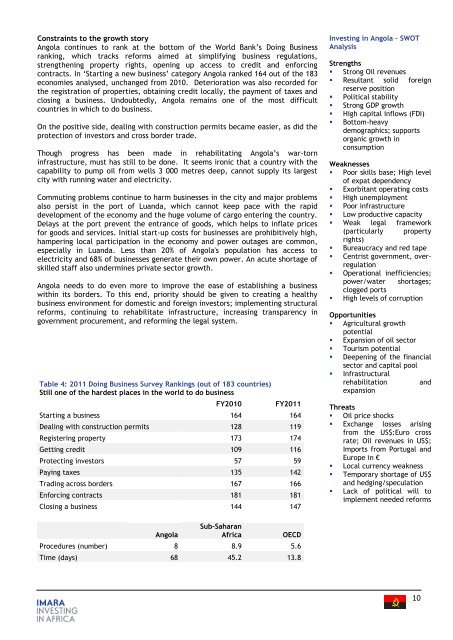

Table 4: 2011 Doing Business Survey Rankings (out of 183 countries)<br />

Still one of <strong>the</strong> hardest places in <strong>the</strong> world to do business<br />

FY2010<br />

FY2011<br />

Starting a business 164 164<br />

Dealing with construction permits 128 119<br />

Registering property 173 174<br />

Getting credit 109 116<br />

Protecting investors 57 59<br />

Paying taxes 135 142<br />

Trading across borders 167 166<br />

Enforcing contracts 181 181<br />

Closing a business 144 147<br />

Investing in <strong>Angola</strong> – SWOT<br />

Analysis<br />

Strengths<br />

• Strong Oil revenues<br />

• Resultant solid foreign<br />

reserve position<br />

• Political stability<br />

• Strong GDP growth<br />

• High capital inflows (FDI)<br />

• Bottom-heavy<br />

demographics; supports<br />

organic growth in<br />

consumption<br />

Weaknesses<br />

• Poor skills base; High level<br />

of expat dependency<br />

• Exorbitant operating costs<br />

• High unemployment<br />

• Poor infrastructure<br />

• Low productive capacity<br />

• Weak legal framework<br />

(particularly property<br />

rights)<br />

• Bureaucracy and red tape<br />

• Centrist government, overregulation<br />

• Operational inefficiencies;<br />

power/water shortages;<br />

clogged ports<br />

• High levels of corruption<br />

Opportunities<br />

• Agricultural growth<br />

potential<br />

• Expansion of oil sector<br />

• Tourism potential<br />

• Deepening of <strong>the</strong> financial<br />

sector and capital pool<br />

• Infrastructural<br />

rehabilitation and<br />

expansion<br />

Threats<br />

• Oil price shocks<br />

• Exchange losses arising<br />

from <strong>the</strong> US$:Euro cross<br />

rate; Oil revenues in US$;<br />

Imports from Portugal and<br />

Europe in €<br />

• Local currency weakness<br />

• Temporary shortage of US$<br />

and hedging/speculation<br />

• Lack of political will to<br />

implement needed reforms<br />

<strong>Angola</strong><br />

Sub-Saharan<br />

<strong>Africa</strong><br />

OECD<br />

Procedures (number) 8 8.9 5.6<br />

Time (days) 68 45.2 13.8<br />

10