Imara African Cement Report Africa, the last cement frontier Angola ...

Imara African Cement Report Africa, the last cement frontier Angola ...

Imara African Cement Report Africa, the last cement frontier Angola ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Telephonic listings of <strong>Angola</strong> (ELTA <strong>Angola</strong>)<br />

ELTA was founded in 1998 and publishes <strong>the</strong> ELTA Phonebook, as Golden Pages, fax and e-mail listings and <strong>the</strong><br />

official tourism guide for <strong>Angola</strong>. The National Phone Book - Yellow pages and a larger business directory listing<br />

is also available. ELTA‟s mandate is to promote business by increasing transparency and facilitating<br />

communications in <strong>the</strong> business sector. <strong>Angola</strong> Telecom owns 18% of ELTA.<br />

Multitel<br />

Multitel has been present in <strong>the</strong> <strong>Angola</strong>n market since 1999. Its main activity involves <strong>the</strong> exploitation and<br />

provision of national and international telecommunication and data services. It is licensed through a concession<br />

contract awarded by Inacom to provide data communication services for public use.<br />

Multitel is a private limited company under <strong>Angola</strong>n law with capital stock of US$ 500,000. Its main partners<br />

are PT Ventures SGPS (40%), <strong>Angola</strong> Telecom (30%) and BCI – Banco de Comércio e Indústria (20%).<br />

Multitel's activity is focused on <strong>the</strong> corporate market, a sector in which it has in-depth knowledge and<br />

experience. Aware of <strong>the</strong> challenges to which companies and organizations are always subjected, and in order<br />

to respond to <strong>the</strong>ir increasingly more demanding requirements, Multitel positions itself as an “Operator and<br />

Integrator”, in a model that is based on <strong>the</strong> convergence of telecommunications and information technologies<br />

founded on <strong>the</strong> constant search for innovative and personalised solutions for its Clients.<br />

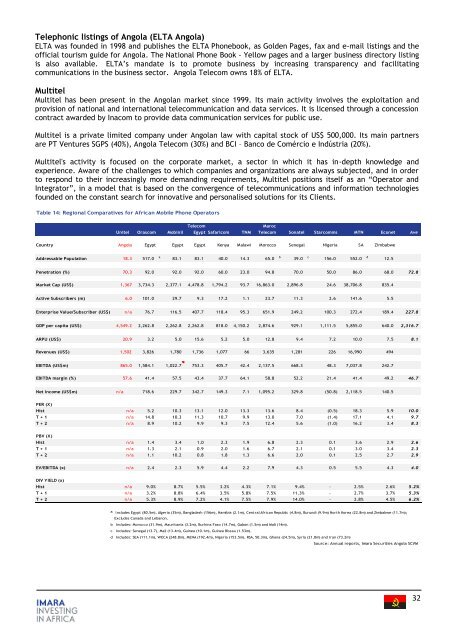

Table 14: Regional Comparatives for <strong><strong>Africa</strong>n</strong> Mobile Phone Operators<br />

Unitel Orascom Mobinil<br />

Telecom<br />

Egypt Safaricom<br />

TNM<br />

Maroc<br />

Telecom Sonatel Starcomms MTN Econet Ave<br />

Country <strong>Angola</strong> Egypt Egypt Egypt Kenya Malawi Morocco Senegal Nigeria SA Zimbabwe<br />

Addressable Population 18.3 517.0 a 83.1 83.1 40.0 14.3 65.0 b 39.0 c 156.0 552.0 d 12.5<br />

Penetration (%) 70.3 92.0 92.0 92.0 60.0 23.0 94.8 70.0 50.0 86.0 68.0 72.8<br />

Market Cap (US$) 1,367 3,734.3 2,377.1 4,478.8 1,794.2 93.7 16,863.0 2,896.8 24.6 38,706.8 835.4<br />

Active Subscribers (m) 6.0 101.0 29.7 9.3 17.2 1.1 23.7 11.3 2.6 141.6 5.5<br />

Enterprise Value/Subscriber (US$) n/a 76.7 116.5 407.7 118.4 95.3 651.9 249.2 100.3 272.4 189.4 227.8<br />

GDP per capita (US$) 4,549.2 2,262.8 2,262.8 2,262.8 818.0 4,150.2 2,874.6 929.1 1,111.5 5,855.0 640.0 2,316.7<br />

ARPU (US$) 20.9 3.2 5.0 15.6 5.2 5.0 12.8 9.4 7.2 10.0 7.5 8.1<br />

Revenues (US$) 1,502 3,826 1,780 1,736 1,077 66 3,635 1,281 226 16,990 494<br />

EBITDA (US$m) 865.0 1,584.1 1,022.7 753.3 405.7 42.4 2,137.5 668.3 48.3 7,037.8 242.7<br />

EBITDA margin (%) 57.6 41.4 57.5 43.4 37.7 64.1 58.8 52.2 21.4 41.4 49.2 46.7<br />

Net Income (US$m) n/a 718.6 229.7 342.7 149.3 7.1 1,095.2 329.8 (50.8) 2,118.5 140.5<br />

PER (X)<br />

Hist n/a 5.2 10.3 13.1 12.0 13.3 13.6 8.4 (0.5) 18.3 5.9 10.0<br />

T + 1 n/a 14.8 10.3 11.3 10.7 9.9 13.0 7.0 (1.4) 17.1 4.1 9.7<br />

T + 2 n/a 8.9 10.2 9.9 9.3 7.5 12.4 5.6 (1.0) 16.2 3.4 8.3<br />

PBV (X)<br />

Hist n/a 1.4 3.4 1.0 2.3 1.9 6.8 2.3 0.1 3.6 2.9 2.6<br />

T + 1 n/a 1.3 2.1 0.9 2.0 1.6 6.7 2.1 0.1 3.0 3.4 2.3<br />

T + 2 n/a 1.1 10.2 0.8 1.8 1.3 6.6 2.0 0.1 2.5 2.7 2.9<br />

EV/EBITDA (x) n/a 2.4 2.3 5.9 4.4 2.2 7.9 4.3 0.5 5.5 4.3 4.0<br />

DIV YIELD (x)<br />

Hist n/a 9.0% 8.7% 5.5% 3.2% 4.3% 7.1% 9.4% - 2.5% 2.6% 5.2%<br />

T + 1 n/a 3.2% 8.8% 6.4% 3.5% 5.8% 7.5% 11.3% - 2.7% 3.7% 5.3%<br />

T + 2 n/a 5.3% 8.9% 7.2% 4.1% 7.5% 7.9% 14.0% - 2.8% 4.5% 6.2%<br />

a Includes Egypt (80.5m), Algeria (35m), Bangladesh (156m), Namibia (2.1m), Central <strong><strong>Africa</strong>n</strong> Republic (4.8m), Burundi (9.9m) North Korea (22.8m) and Zimbabwe (11.7m);<br />

Excludes Canada and Lebanon.<br />

b Includes: Morocco (31.9m), Mauritania (3.2m), Burkina Faso (14.7m), Gabon (1.5m) and Mali (14m).<br />

c Includes: Senegal (13.7), Mali (13.4m), Guinea (10.1m), Guinea Bissau (1.53m).<br />

d Includes: SEA (111.1m), WECA (248.8m), MENA (192.4m), Nigeria (153.5m), RSA, 50.3m), Ghana (24.5m), Syria (21.8m) and Iran (73.2m)<br />

Source: Annual reports, <strong>Imara</strong> Securities <strong>Angola</strong> SCVM<br />

32