Imara African Cement Report Africa, the last cement frontier Angola ...

Imara African Cement Report Africa, the last cement frontier Angola ...

Imara African Cement Report Africa, the last cement frontier Angola ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

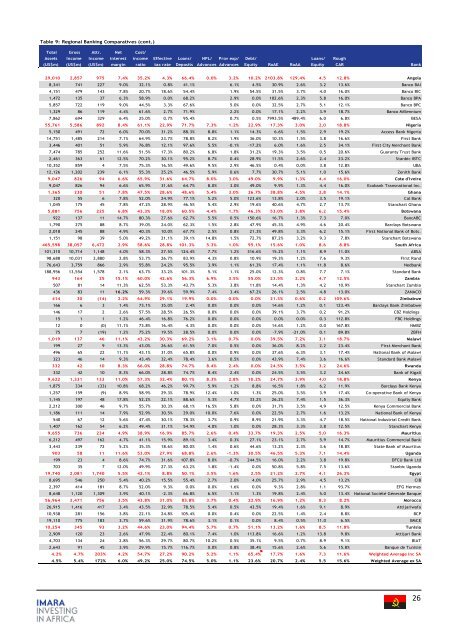

Table 9: Regional Banking Comparatives (cont.)<br />

Total<br />

Assets<br />

(US$m)<br />

Gross<br />

Income<br />

(US$m)<br />

Attr.<br />

Income<br />

(US$m)<br />

Net<br />

interest<br />

margin<br />

Cost/<br />

income<br />

ratio<br />

Effective<br />

tax rate<br />

Loans/<br />

Deposits<br />

NPL/ Prov exp/<br />

Advances Advances<br />

Debt/<br />

Equity<br />

RoAE<br />

RoAA<br />

Loans/<br />

Equity<br />

Rough<br />

CAR<br />

Bank<br />

29,010 2,857 975 7.4% 35.2% 4.3% 66.4% 0.0% 3.2% 10.2% 2103.8% 129.4% 4.5 12.8% <strong>Angola</strong><br />

8,341 741 227 9.0% 32.1% 0.8% 41.1% 6.1% 4.5% 30.9% 2.6% 3.2 13.6% Banco BAI<br />

4,151 479 143 7.8% 20.7% 18.6% 54.4% 1.9% 54.5% 31.5% 3.7% 4.0 16.0% Banco BIC<br />

1,472 135 37 6.3% 58.9% 0.0% 68.2% 2.9% 0.0% 102.6% 2.3% 5.8 16.0% Banco BPA<br />

5,857 722 119 9.0% 44.5% 3.3% 67.6% 5.0% 0.0% 32.5% 2.7% 5.1 12.1% Banco BPC<br />

1,329 86 119 4.4% 61.6% 2.7% 71.9% 2.2% 0.0% 17.1% 2.2% 3.9 18.7% Banco Millennium<br />

7,862 694 329 6.4% 25.0% 0.7% 95.4% 0.7% 0.5% 7993.5% 489.4% 6.0 6.8% BESA<br />

55,761 5,586 892 8.4% 61.1% 22.9% 71.7% 7.3% 1.2% 22.9% 17.3% 3.0% 2.0 18.8% Nigeria<br />

5,150 491 72 6.0% 70.0% 31.2% 88.3% 8.8% 1.1% 14.3% 6.6% 1.5% 2.9 19.2% Access Bank Nigeria<br />

14,751 1,485 214 7.1% 64.9% 23.7% 78.8% 8.2% 1.9% 36.0% 10.3% 1.5% 3.8 16.6% First Bank<br />

3,446 401 51 5.9% 76.8% 12.1% 97.6% 5.5% -0.1% -17.2% 6.0% 1.6% 2.5 34.1% First City Merchant Bank<br />

7,474 785 252 11.6% 51.5% 17.3% 80.2% 6.8% 1.8% 31.2% 19.3% 3.5% 0.5 20.6% Guaranty Trust Bank<br />

2,461 363 61 12.5% 70.2% 30.1% 95.2% 8.7% 0.4% 28.9% 11.5% 2.6% 2.4 23.2% Stanbic IBTC<br />

10,352 859 4 7.5% 75.3% 16.5% 49.6% 9.5% 2.9% 46.5% 0.4% 0.0% 3.8 12.8% UBA<br />

12,126 1,202 239 6.1% 55.3% 25.2% 46.5% 5.9% 0.6% 7.7% 30.7% 5.1% 1.0 15.6% Zenith Bank<br />

9,047 826 94 6.6% 65.9% 31.6% 64.7% 8.0% 3.0% 49.0% 9.9% 1.3% 4.4 16.0% Cote d'Ivoire<br />

9,047 826 94 6.6% 65.9% 31.6% 64.7% 8.0% 3.0% 49.0% 9.9% 1.3% 4.4 16.0% Ecobank Transnational Inc.<br />

1,365 230 51 7.8% 47.5% 28.6% 48.6% 5.4% 3.0% 26.7% 38.8% 4.5% 2.8 14.1% Ghana<br />

320 55 6 7.8% 52.0% 24.9% 77.1% 5.2% 5.0% 123.6% 13.8% 2.0% 3.5 19.1% Cal Bank<br />

1,045 175 45 7.8% 47.2% 28.9% 46.5% 5.4% 2.9% 19.6% 40.6% 4.7% 2.7 13.7% Stanchart Ghana<br />

5,881 756 225 6.8% 43.3% 18.0% 60.5% 4.4% 1.7% 46.3% 53.0% 3.8% 6.2 15.4% Botswana<br />

922 137 11 14.7% 80.3% 27.6% 62.7% 5.5% 0.5% 150.6% 16.7% 1.3% 7.3 7.0% BancABC<br />

1,790 275 88 8.7% 39.0% 24.0% 62.3% 1.5% 2.8% 47.9% 45.3% 4.9% 4.6 20.4% Barclays Botswana<br />

2,018 245 88 4.9% 40.3% 10.0% 67.7% 2.5% 0.8% 21.3% 49.8% 3.3% 6.2 15.1% First National Bank of Bots.<br />

1,151 98 39 5.0% 49.2% 21.1% 39.1% 14.8% 1.5% 72.7% 87.2% 3.2% 9.3 7.8% Stanchart Botswana<br />

465,598 38,057 6,472 2.9% 58.6% 28.8% 101.3% 5.3% 1.0% 95.1% 15.6% 1.0% 8.6 8.8% South <strong>Africa</strong><br />

101,310 10,714 1,148 4.0% 58.3% 27.5% 124.4% 7.7% 1.2% 316.6% 15.2% 1.1% 8.9 11.0% ABSA<br />

98,688 10,031 2,880 2.8% 53.7% 26.7% 83.9% 4.3% 0.8% 10.9% 19.3% 1.2% 7.6 9.3% First Rand<br />

76,643 3,759 866 2.9% 55.8% 24.2% 95.5% 3.9% 1.1% 61.3% 17.4% 1.1% 11.8 8.6% Nedbank<br />

188,956 13,554 1,578 2.1% 63.7% 33.2% 101.3% 5.1% 1.1% 25.0% 12.3% 0.8% 7.7 7.1% Standard Bank<br />

943 164 25 15.1% 60.0% 42.6% 56.3% 6.9% 3.5% 55.0% 23.5% 2.2% 4.7 12.5% Zambia<br />

507 81 14 11.3% 62.5% 53.3% 43.7% 5.3% 3.8% 11.8% 14.4% 1.3% 4.2 10.9% Stanchart Zambia<br />

436 83 11 16.2% 59.3% 39.6% 59.9% 7.4% 3.4% 67.2% 26.1% 2.5% 4.8 13.0% ZANACO<br />

414 30 (14) 2.2% 64.9% 29.1% 19.9% 0.0% 0.0% 0.0% 21.3% 0.6% 0.2 109.6% Zimbabwe<br />

166 6 3 1.4% 73.1% 35.0% 2.4% 0.0% 0.0% 0.0% 14.6% 1.2% 0.1 123.4% Barclays Bank Zimbabwe<br />

146 17 2 2.6% 57.5% 28.5% 26.5% 0.0% 0.0% 0.0% 39.1% 3.7% 0.2 91.2% CBZ Holdings<br />

15 1 1 1.2% 46.4% 16.8% 76.2% 0.0% 0.0% 0.0% 0.0% 0.0% 0.3 112.8% FBC Holdings<br />

12 0 (0) 11.1% 73.8% 16.4% 4.3% 0.0% 0.0% 0.0% 14.6% 1.2% 0.0 167.8% NMBZ<br />

75 7 (19) 1.2% 75.2% 19.5% 28.5% 0.0% 0.0% 0.0% -7.9% -21.0% 0.1 89.8% ZBFH<br />

1,019 137 46 11.1% 43.2% 30.3% 69.2% 3.1% 0.7% 0.0% 39.5% 7.2% 3.1 18.7% Malawi<br />

199 27 9 13.3% 43.0% 26.6% 61.5% 7.0% 0.5% 0.0% 36.0% 8.2% 2.2 23.4% First Merchant Bank<br />

496 65 22 11.1% 43.1% 31.0% 65.8% 0.0% 0.9% 0.0% 37.6% 6.3% 3.1 17.4% National Bank of Malawi<br />

323 46 14 9.3% 43.4% 32.4% 78.4% 3.6% 0.5% 0.0% 43.9% 7.4% 3.6 16.6% Standard Bank Malawi<br />

332 42 10 8.3% 66.0% 28.8% 74.7% 8.4% 2.4% 0.0% 24.5% 3.5% 3.2 24.6% Rwanda<br />

332 42 10 8.3% 66.0% 28.8% 74.7% 8.4% 2.4% 0.0% 24.5% 3.5% 3.2 24.6% Bank of Kigali<br />

9,622 1,331 133 11.0% 57.3% 32.4% 80.1% 8.3% 2.8% 10.2% 24.7% 3.9% 4.0 18.8% Kenya<br />

1,875 334 (33) 10.8% 68.2% 46.2% 99.7% 5.9% 1.2% 8.8% 16.5% 1.8% 6.2 11.9% Barclays Bank Kenya<br />

1,257 159 (9) 8.9% 58.9% 29.3% 78.9% 12.4% 1.0% 1.3% 25.0% 3.5% 3.9 17.4% Co-operative Bank of Kenya<br />

1,145 197 48 17.8% 52.2% 22.1% 88.6% 5.3% 4.7% 33.2% 26.2% 7.4% 1.5 36.3% Equity Bank<br />

2,212 300 46 9.7% 55.7% 30.3% 68.1% 16.5% 5.8% 0.0% 31.7% 3.5% 4.9 12.5% Kenya Commercial Bank<br />

1,186 111 14 7.9% 52.9% 30.5% 29.0% 10.0% 7.6% 0.0% 22.5% 2.7% 1.6 13.2% National Bank of Kenya<br />

540 67 12 5.6% 47.4% 30.1% 78.3% 3.7% 0.9% 8.9% 21.9% 3.3% 4.7 18.5% National Industrial Credit Bank<br />

1,407 162 54 6.2% 49.4% 31.1% 54.9% 4.0% 1.0% 0.0% 28.3% 3.3% 3.8 12.5% Stanchart Kenya<br />

9,655 736 234 4.9% 38.9% 16.9% 85.7% 2.6% 0.4% 33.7% 19.3% 2.5% 5.0 16.3% Mauritius<br />

6,212 497 162 4.7% 41.1% 15.9% 89.1% 3.4% 0.3% 27.1% 23.1% 2.7% 5.9 14.7% Mauritius Commercial Bank<br />

3,443 239 72 5.2% 35.3% 18.6% 80.0% 1.4% 0.6% 44.6% 13.2% 2.3% 3.6 18.8% State Bank of Mauritius<br />

903 58 11 11.6% 53.0% 27.9% 68.8% 2.6% -1.3% 30.5% 46.5% 5.3% 7.1 14.4% Uganda<br />

199 23 4 8.6% 74.7% 31.6% 107.8% 8.0% -0.7% 244.5% 16.0% 2.2% 3.8 19.8% DFCU Bank Ltd<br />

703 35 7 12.0% 49.9% 27.3% 63.2% 1.8% -1.4% 0.0% 50.8% 5.8% 7.5 13.6% Stanbic Uganda<br />

19,740 2,081 1,740 5.5% 42.1% 8.8% 50.1% 3.5% 1.6% 2.5% 21.2% 2.7% 4.1 26.3% Egypt<br />

8,695 546 250 5.4% 40.2% 15.5% 55.4% 2.7% 2.0% 4.0% 25.7% 2.9% 4.5 13.2% CIB<br />

2,397 414 181 8.7% 52.0% 9.3% 0.0% 0.0% 1.6% 0.0% 9.3% 2.8% 1.1 93.7% EFG Hermes<br />

8,648 1,120 1,309 3.9% 40.1% -2.3% 66.8% 6.5% 1.1% 1.3% 19.8% 2.4% 5.0 13.4% National Société Génerale Banque<br />

56,964 2,471 756 3.5% 43.8% 31.0% 83.8% 3.7% 0.4% 22.9% 16.9% 1.2% 8.3 8.2% Morocco<br />

26,915 1,416 417 3.4% 43.5% 32.9% 78.5% 5.4% 0.5% 43.5% 19.4% 1.6% 9.1 8.9% Attijariwafa<br />

10,938 281 156 3.8% 22.1% 24.8% 105.4% 0.0% 0.4% 0.0% 22.5% 1.4% 2.4 8.8% BCP<br />

19,110 775 183 3.7% 59.6% 31.9% 78.6% 3.1% 0.1% 0.0% 8.4% 0.5% 11.0 6.5% BMCE<br />

10,254 345 93 3.2% 44.6% 23.0% 94.4% 5.7% 0.7% 51.1% 13.2% 1.6% 8.5 11.8% Tunisia<br />

2,909 120 23 2.6% 47.9% 22.4% 80.1% 7.4% 1.0% 113.8% 16.6% 1.2% 13.8 9.8% Attijari Bank<br />

4,703 134 24 2.8% 56.3% 29.7% 80.7% 10.2% 0.5% 35.1% 9.5% 0.7% 8.9 9.1% BIAT<br />

2,643 91 45 3.9% 29.9% 15.7% 116.7% 0.0% 0.8% 38.4% 15.6% 2.6% 5.6 15.8% Banque de Tunisie<br />

4.2% 4.7% 203% 4.2% 54.7% 27.2% 90.2% 5.2% 1.1% 65.4% 17.7% 1.6% 7.3 11.6% Weighted Average inc SA<br />

4.5% 5.4% 172% 6.0% 49.2% 25.0% 74.5% 5.0% 1.1% 23.6% 20.7% 2.4% 5.5 15.6% Weighted Average ex SA<br />

26