Imara African Cement Report Africa, the last cement frontier Angola ...

Imara African Cement Report Africa, the last cement frontier Angola ...

Imara African Cement Report Africa, the last cement frontier Angola ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Orascom<br />

Mobinil<br />

TNM<br />

Safaricom<br />

Econet<br />

Sonatel<br />

MTN<br />

Telecom<br />

Egypt<br />

Unitel<br />

Telecommunications Sector: Lucrative and still rapidly expanding<br />

Overview of <strong>the</strong> Telecoms sector<br />

Like many o<strong>the</strong>r sectors of <strong>Angola</strong>‟s economy, <strong>Angola</strong>‟s telecoms<br />

industry has more than a few tales to tell. The destruction that<br />

resulted from three decades of war severely damaged <strong>the</strong> country‟s<br />

fixed line network, which is still far from its potential. The breakneck<br />

pace of technological advan<strong>cement</strong> in mobile telephony however has<br />

had a more definitive impact on <strong>the</strong> local market, and leads <strong>the</strong> fixed<br />

line network by a significant margin, in volumes as well as revenues.<br />

The importation of technology and skills transfer can also be<br />

attributed to Unitel‟s partnership with Portugal Telecom (PTC:PL), an<br />

international mobile telecoms operator, capitalized at € 5,1bn that<br />

has operations in Brazil, <strong>Africa</strong> and Asia.<br />

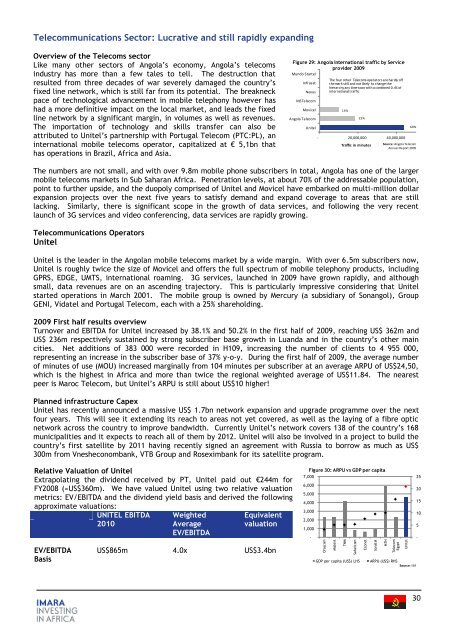

Figure 29: <strong>Angola</strong> International traffic by Service<br />

provider 2009<br />

Mundo Startel<br />

Infrasat<br />

Nexus<br />

MSTelecom<br />

Movicel<br />

<strong>Angola</strong> Telecom<br />

Unitel<br />

The four o<strong>the</strong>r Telecoms operators are hardly off<br />

<strong>the</strong> mark still and not likely to change <strong>the</strong><br />

hierarchy any time soon with a combined 0.4% of<br />

international traffic<br />

14%<br />

25%<br />

- 20,000,000 40,000,000<br />

Traffic in minutes<br />

60%<br />

Source: <strong>Angola</strong> Telecom<br />

Annual <strong>Report</strong> 2009<br />

The numbers are not small, and with over 9.8m mobile phone subscribers in total, <strong>Angola</strong> has one of <strong>the</strong> larger<br />

mobile telecoms markets in Sub Saharan <strong>Africa</strong>. Penetration levels, at about 70% of <strong>the</strong> addressable population,<br />

point to fur<strong>the</strong>r upside, and <strong>the</strong> duopoly comprised of Unitel and Movicel have embarked on multi-million dollar<br />

expansion projects over <strong>the</strong> next five years to satisfy demand and expand coverage to areas that are still<br />

lacking. Similarly, <strong>the</strong>re is significant scope in <strong>the</strong> growth of data services, and following <strong>the</strong> very recent<br />

launch of 3G services and video conferencing, data services are rapidly growing.<br />

Telecommunications Operators<br />

Unitel<br />

Unitel is <strong>the</strong> leader in <strong>the</strong> <strong>Angola</strong>n mobile telecoms market by a wide margin. With over 6.5m subscribers now,<br />

Unitel is roughly twice <strong>the</strong> size of Movicel and offers <strong>the</strong> full spectrum of mobile telephony products, including<br />

GPRS, EDGE, UMTS, international roaming. 3G services, launched in 2009 have grown rapidly, and although<br />

small, data revenues are on an ascending trajectory. This is particularly impressive considering that Unitel<br />

started operations in March 2001. The mobile group is owned by Mercury (a subsidiary of Sonangol), Group<br />

GENI, Vidatel and Portugal Telecom, each with a 25% shareholding.<br />

2009 First half results overview<br />

Turnover and EBITDA for Unitel increased by 38.1% and 50.2% in <strong>the</strong> first half of 2009, reaching US$ 362m and<br />

US$ 236m respectively sustained by strong subscriber base growth in Luanda and in <strong>the</strong> country‟s o<strong>the</strong>r main<br />

cities. Net additions of 383 000 were recorded in H109, increasing <strong>the</strong> number of clients to 4 955 000,<br />

representing an increase in <strong>the</strong> subscriber base of 37% y-o-y. During <strong>the</strong> first half of 2009, <strong>the</strong> average number<br />

of minutes of use (MOU) increased marginally from 104 minutes per subscriber at an average ARPU of US$24,50,<br />

which is <strong>the</strong> highest in <strong>Africa</strong> and more than twice <strong>the</strong> regional weighted average of US$11.84. The nearest<br />

peer is Maroc Telecom, but Unitel‟s ARPU is still about US$10 higher!<br />

Planned infrastructure Capex<br />

Unitel has recently announced a massive US$ 1.7bn network expansion and upgrade programme over <strong>the</strong> next<br />

four years. This will see it extending its reach to areas not yet covered, as well as <strong>the</strong> laying of a fibre optic<br />

network across <strong>the</strong> country to improve bandwidth. Currently Unitel‟s network covers 138 of <strong>the</strong> country‟s 168<br />

municipalities and it expects to reach all of <strong>the</strong>m by 2012. Unitel will also be involved in a project to build <strong>the</strong><br />

country‟s first satellite by 2011 having recently signed an agreement with Russia to borrow as much as US$<br />

300m from Vnesheconombank, VTB Group and Roseximbank for its satellite program.<br />

Relative Valuation of Unitel<br />

Extrapolating <strong>the</strong> dividend received by PT, Unitel paid out €244m for<br />

FY2008 (≈US$360m). We have valued Unitel using two relative valuation<br />

metrics: EV/EBITDA and <strong>the</strong> dividend yield basis and derived <strong>the</strong> following<br />

approximate valuations:<br />

UNITEL EBITDA<br />

2010<br />

Weighted<br />

Average<br />

EV/EBITDA<br />

Equivalent<br />

valuation<br />

Figure 30: ARPU vs GDP per capita<br />

7,000<br />

6,000<br />

5,000<br />

4,000<br />

3,000<br />

2,000<br />

1,000<br />

-<br />

25<br />

20<br />

15<br />

10<br />

5<br />

-<br />

EV/EBITDA<br />

Basis<br />

US$865m 4.0x US$3.4bn<br />

GDP per capita (US$) LHS<br />

ARPU (US$) RHS<br />

Source: ISA<br />

30