Imara African Cement Report Africa, the last cement frontier Angola ...

Imara African Cement Report Africa, the last cement frontier Angola ...

Imara African Cement Report Africa, the last cement frontier Angola ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Oil Majors in <strong>Angola</strong>´s Petroleum Sector – The scramble intensifies<br />

The start of a new wave of oil driven prosperity<br />

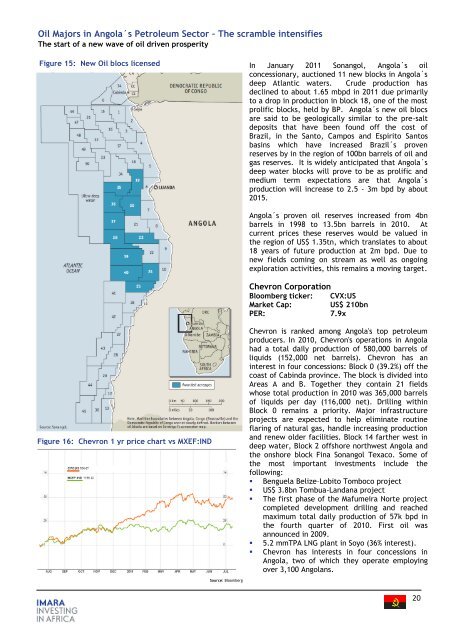

Figure 15: New Oil blocs licensed<br />

In January 2011 Sonangol, <strong>Angola</strong>´s oil<br />

concessionary, auctioned 11 new blocks in <strong>Angola</strong>´s<br />

deep Atlantic waters. Crude production has<br />

declined to about 1.65 mbpd in 2011 due primarily<br />

to a drop in production in block 18, one of <strong>the</strong> most<br />

prolific blocks, held by BP. <strong>Angola</strong>´s new oil blocs<br />

are said to be geologically similar to <strong>the</strong> pre-salt<br />

deposits that have been found off <strong>the</strong> cost of<br />

Brazil, in <strong>the</strong> Santo, Campos and Espirito Santos<br />

basins which have increased Brazil´s proven<br />

reserves by in <strong>the</strong> region of 100bn barrels of oil and<br />

gas reserves. It is widely anticipated that <strong>Angola</strong>´s<br />

deep water blocks will prove to be as prolific and<br />

medium term expectations are that <strong>Angola</strong>´s<br />

production will increase to 2.5 - 3m bpd by about<br />

2015.<br />

<strong>Angola</strong>´s proven oil reserves increased from 4bn<br />

barrels in 1998 to 13.5bn barrels in 2010. At<br />

current prices <strong>the</strong>se reserves would be valued in<br />

<strong>the</strong> region of US$ 1.35tn, which translates to about<br />

18 years of future production at 2m bpd. Due to<br />

new fields coming on stream as well as ongoing<br />

exploration activities, this remains a moving target.<br />

Chevron Corporation<br />

Bloomberg ticker: CVX:US<br />

Market Cap:<br />

US$ 210bn<br />

PER: 7.9x<br />

Figure 16: Chevron 1 yr price chart vs MXEF:IND<br />

Chevron is ranked among <strong>Angola</strong>'s top petroleum<br />

producers. In 2010, Chevron's operations in <strong>Angola</strong><br />

had a total daily production of 580,000 barrels of<br />

liquids (152,000 net barrels). Chevron has an<br />

interest in four concessions: Block 0 (39.2%) off <strong>the</strong><br />

coast of Cabinda province. The block is divided into<br />

Areas A and B. Toge<strong>the</strong>r <strong>the</strong>y contain 21 fields<br />

whose total production in 2010 was 365,000 barrels<br />

of liquids per day (116,000 net). Drilling within<br />

Block 0 remains a priority. Major infrastructure<br />

projects are expected to help eliminate routine<br />

flaring of natural gas, handle increasing production<br />

and renew older facilities. Block 14 far<strong>the</strong>r west in<br />

deep water, Block 2 offshore northwest <strong>Angola</strong> and<br />

<strong>the</strong> onshore block Fina Sonangol Texaco. Some of<br />

<strong>the</strong> most important investments include <strong>the</strong><br />

following:<br />

• Benguela Belize–Lobito Tomboco project<br />

• US$ 3.8bn Tombua-Landana project<br />

• The first phase of <strong>the</strong> Mafumeira Norte project<br />

completed development drilling and reached<br />

maximum total daily production of 57k bpd in<br />

<strong>the</strong> fourth quarter of 2010. First oil was<br />

announced in 2009.<br />

• 5.2 mmTPA LNG plant in Soyo (36% interest).<br />

• Chevron has interests in four concessions in<br />

<strong>Angola</strong>, two of which <strong>the</strong>y operate employing<br />

over 3,100 <strong>Angola</strong>ns.<br />

Source: Bloomberg<br />

20