Imara African Cement Report Africa, the last cement frontier Angola ...

Imara African Cement Report Africa, the last cement frontier Angola ...

Imara African Cement Report Africa, the last cement frontier Angola ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

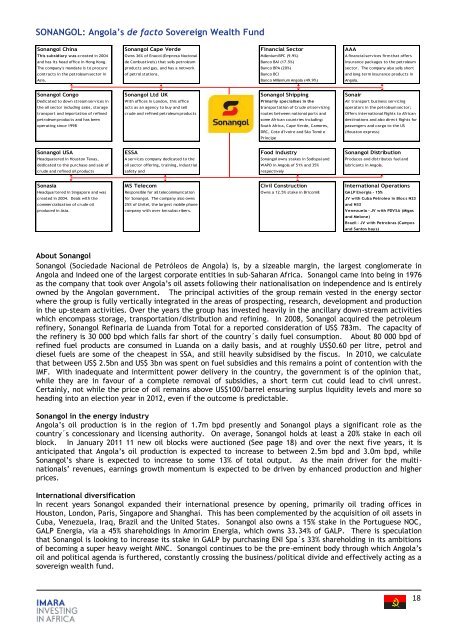

SONANGOL: <strong>Angola</strong>’s de facto Sovereign Wealth Fund<br />

Sonangol China<br />

This subsidiary was c reated in 2004<br />

and has its head office in Hong Kong.<br />

The company's mandate is to procure<br />

contracts in <strong>the</strong> petroleum sector in<br />

Asia.<br />

Sonangol Cape Verde<br />

Owns 36% of Enacol (Empresa Nacional<br />

de Combustíveis) that sells petroleum<br />

products and gas, and has a network<br />

of petrol stations.<br />

Financial Sector<br />

Millenium BPC (9.9%)<br />

Banco BAI (17.5%)<br />

Banco BPA (20%)<br />

Banco BCI<br />

Banco Millenium <strong>Angola</strong> (49.9%)<br />

AAA<br />

A financial services firm that offers<br />

insurance packages to <strong>the</strong> petroleum<br />

sector. The company also sells short<br />

and long term insurance products in<br />

<strong>Angola</strong>.<br />

Sonangol Congo<br />

Dedicated to down stream services in<br />

<strong>the</strong> oil sector including sales, storage<br />

transport and importation of refined<br />

petroleum products and has been<br />

operating since 1998<br />

Sonangol Ltd UK<br />

With offices in London, this office<br />

acts as an agency to buy and sell<br />

crude and refined petroleum products<br />

Sonangol<br />

Sonangol Shipping<br />

Primarily specialises in <strong>the</strong><br />

transportation of Crude oil servicing<br />

routes between national ports and<br />

some <strong><strong>Africa</strong>n</strong> countries including:<br />

South <strong>Africa</strong>, Cape Verde, Camores,<br />

DRC, Cote d'Ivoire and São Tomé e<br />

Príncipe<br />

Sonair<br />

Air transport business servicing<br />

operators in <strong>the</strong> petroleum sector;<br />

Offers international flights to <strong><strong>Africa</strong>n</strong><br />

destinations and also direct flights for<br />

passengers and cargo to <strong>the</strong> US<br />

(Houston express)<br />

Sonangol USA<br />

Headquatered in Houston Texas,<br />

dedicated to <strong>the</strong> purchase and sale of<br />

crude and refined oil products<br />

ESSA<br />

A services company dedicated to <strong>the</strong><br />

oil sector offering, training, industrial<br />

safety and<br />

Food Industry<br />

Sonangol owns stakes in Sodispal and<br />

WAPO in <strong>Angola</strong> of 51% and 35%<br />

respectively<br />

Sonangol Distribution<br />

Produces and distributes fuel and<br />

lubricants in <strong>Angola</strong>.<br />

Sonasia<br />

Headquartered in Singapore and was<br />

created in 2004. Deals with <strong>the</strong><br />

commercialisation of crude oil<br />

produced in Asia.<br />

MS Telecom<br />

Responsible for all telecommunication<br />

for Sonangol. The company also owns<br />

25% of Unitel, <strong>the</strong> largest mobile phone<br />

company with over 6m subscribers.<br />

Civil Construction<br />

Owns a 12.5% stake in Bricomill<br />

International Operations<br />

GALP Energia - 15%<br />

JV with Cuba Petroleo in Blocs N23<br />

and N33<br />

Venezuela - JV with PDVSA (Migas<br />

and Melone)<br />

Brazil - JV with Petrobras (Campos<br />

and Santos bays)<br />

About Sonangol<br />

Sonangol (Sociedade Nacional de Petróleos de <strong>Angola</strong>) is, by a sizeable margin, <strong>the</strong> largest conglomerate in<br />

<strong>Angola</strong> and indeed one of <strong>the</strong> largest corporate entities in sub-Saharan <strong>Africa</strong>. Sonangol came into being in 1976<br />

as <strong>the</strong> company that took over <strong>Angola</strong>‟s oil assets following <strong>the</strong>ir nationalisation on independence and is entirely<br />

owned by <strong>the</strong> <strong>Angola</strong>n government. The principal activities of <strong>the</strong> group remain vested in <strong>the</strong> energy sector<br />

where <strong>the</strong> group is fully vertically integrated in <strong>the</strong> areas of prospecting, research, development and production<br />

in <strong>the</strong> up-steam activities. Over <strong>the</strong> years <strong>the</strong> group has invested heavily in <strong>the</strong> ancillary down-stream activities<br />

which encompass storage, transportation/distribution and refining. In 2008, Sonangol acquired <strong>the</strong> petroleum<br />

refinery, Sonangol Refinaria de Luanda from Total for a reported consideration of US$ 783m. The capacity of<br />

<strong>the</strong> refinery is 30 000 bpd which falls far short of <strong>the</strong> country´s daily fuel consumption. About 80 000 bpd of<br />

refined fuel products are consumed in Luanda on a daily basis, and at roughly US$0.60 per litre, petrol and<br />

diesel fuels are some of <strong>the</strong> cheapest in SSA, and still heavily subsidised by <strong>the</strong> fiscus. In 2010, we calculate<br />

that between US$ 2.5bn and US$ 3bn was spent on fuel subsidies and this remains a point of contention with <strong>the</strong><br />

IMF. With inadequate and intermittent power delivery in <strong>the</strong> country, <strong>the</strong> government is of <strong>the</strong> opinion that,<br />

while <strong>the</strong>y are in favour of a complete removal of subsidies, a short term cut could lead to civil unrest.<br />

Certainly, not while <strong>the</strong> price of oil remains above US$100/barrel ensuring surplus liquidity levels and more so<br />

heading into an election year in 2012, even if <strong>the</strong> outcome is predictable.<br />

Sonangol in <strong>the</strong> energy industry<br />

<strong>Angola</strong>‟s oil production is in <strong>the</strong> region of 1.7m bpd presently and Sonangol plays a significant role as <strong>the</strong><br />

country´s concessionary and licensing authority. On average, Sonangol holds at least a 20% stake in each oil<br />

block. In January 2011 11 new oil blocks were auctioned (See page 18) and over <strong>the</strong> next five years, it is<br />

anticipated that <strong>Angola</strong>‟s oil production is expected to increase to between 2.5m bpd and 3.0m bpd, while<br />

Sonangol‟s share is expected to increase to some 13% of total output. As <strong>the</strong> main driver for <strong>the</strong> multinationals‟<br />

revenues, earnings growth momentum is expected to be driven by enhanced production and higher<br />

prices.<br />

International diversification<br />

In recent years Sonangol expanded <strong>the</strong>ir international presence by opening, primarily oil trading offices in<br />

Houston, London, Paris, Singapore and Shanghai. This has been complemented by <strong>the</strong> acquisition of oil assets in<br />

Cuba, Venezuela, Iraq, Brazil and <strong>the</strong> United States. Sonangol also owns a 15% stake in <strong>the</strong> Portuguese NOC,<br />

GALP Energia, via a 45% shareholdings in Amorim Energia, which owns 33.34% of GALP. There is speculation<br />

that Sonangol is looking to increase its stake in GALP by purchasing ENI Spa´s 33% shareholding in its ambitions<br />

of becoming a super heavy weight MNC. Sonangol continues to be <strong>the</strong> pre-eminent body through which <strong>Angola</strong>‟s<br />

oil and political agenda is fur<strong>the</strong>red, constantly crossing <strong>the</strong> business/political divide and effectively acting as a<br />

sovereign wealth fund.<br />

18