Imara African Cement Report Africa, the last cement frontier Angola ...

Imara African Cement Report Africa, the last cement frontier Angola ...

Imara African Cement Report Africa, the last cement frontier Angola ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

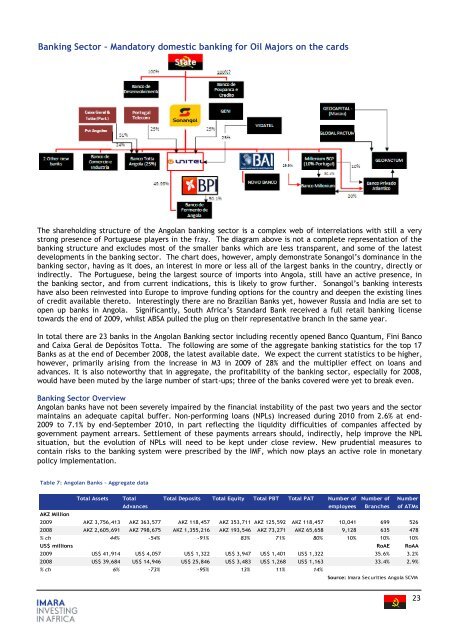

Banking Sector – Mandatory domestic banking for Oil Majors on <strong>the</strong> cards<br />

The shareholding structure of <strong>the</strong> <strong>Angola</strong>n banking sector is a complex web of interrelations with still a very<br />

strong presence of Portuguese players in <strong>the</strong> fray. The diagram above is not a complete representation of <strong>the</strong><br />

banking structure and excludes most of <strong>the</strong> smaller banks which are less transparent, and some of <strong>the</strong> latest<br />

developments in <strong>the</strong> banking sector. The chart does, however, amply demonstrate Sonangol‟s dominance in <strong>the</strong><br />

banking sector, having as it does, an interest in more or less all of <strong>the</strong> largest banks in <strong>the</strong> country, directly or<br />

indirectly. The Portuguese, being <strong>the</strong> largest source of imports into <strong>Angola</strong>, still have an active presence, in<br />

<strong>the</strong> banking sector, and from current indications, this is likely to grow fur<strong>the</strong>r. Sonangol‟s banking interests<br />

have also been reinvested into Europe to improve funding options for <strong>the</strong> country and deepen <strong>the</strong> existing lines<br />

of credit available <strong>the</strong>reto. Interestingly <strong>the</strong>re are no Brazilian Banks yet, however Russia and India are set to<br />

open up banks in <strong>Angola</strong>. Significantly, South <strong>Africa</strong>‟s Standard Bank received a full retail banking license<br />

towards <strong>the</strong> end of 2009, whilst ABSA pulled <strong>the</strong> plug on <strong>the</strong>ir representative branch in <strong>the</strong> same year.<br />

In total <strong>the</strong>re are 23 banks in <strong>the</strong> <strong>Angola</strong>n Banking sector including recently opened Banco Quantum, Fini Banco<br />

and Caixa Geral de Depósitos Totta. The following are some of <strong>the</strong> aggregate banking statistics for <strong>the</strong> top 17<br />

Banks as at <strong>the</strong> end of December 2008, <strong>the</strong> latest available date. We expect <strong>the</strong> current statistics to be higher,<br />

however, primarily arising from <strong>the</strong> increase in M3 in 2009 of 28% and <strong>the</strong> multiplier effect on loans and<br />

advances. It is also noteworthy that in aggregate, <strong>the</strong> profitability of <strong>the</strong> banking sector, especially for 2008,<br />

would have been muted by <strong>the</strong> large number of start-ups; three of <strong>the</strong> banks covered were yet to break even.<br />

Banking Sector Overview<br />

<strong>Angola</strong>n banks have not been severely impaired by <strong>the</strong> financial instability of <strong>the</strong> past two years and <strong>the</strong> sector<br />

maintains an adequate capital buffer. Non-performing loans (NPLs) increased during 2010 from 2.6% at end-<br />

2009 to 7.1% by end-September 2010, in part reflecting <strong>the</strong> liquidity difficulties of companies affected by<br />

government payment arrears. Settlement of <strong>the</strong>se payments arrears should, indirectly, help improve <strong>the</strong> NPL<br />

situation, but <strong>the</strong> evolution of NPLs will need to be kept under close review. New prudential measures to<br />

contain risks to <strong>the</strong> banking system were prescribed by <strong>the</strong> IMF, which now plays an active role in monetary<br />

policy implementation.<br />

Table 7: <strong>Angola</strong>n Banks - Aggregate data<br />

Total Assets Total<br />

Advances<br />

Total Deposits Total Equity Total PBT Total PAT Number of<br />

employees<br />

Number of<br />

Branches<br />

Number<br />

of ATMs<br />

AKZ Million<br />

2009 AKZ 3,756,413 AKZ 363,577 AKZ 118,457 AKZ 353,711 AKZ 125,592 AKZ 118,457 10,041 699 526<br />

2008 AKZ 2,605,691 AKZ 798,675 AKZ 1,355,216 AKZ 193,546 AKZ 73,271 AKZ 65,658 9,128 635 478<br />

% ch 44% -54% -91% 83% 71% 80% 10% 10% 10%<br />

US$ millions RoAE RoAA<br />

2009 US$ 41,914 US$ 4,057 US$ 1,322 US$ 3,947 US$ 1,401 US$ 1,322 35.6% 3.2%<br />

2008 US$ 39,684 US$ 14,946 US$ 25,846 US$ 3,483 US$ 1,268 US$ 1,163 33.4% 2.9%<br />

% ch 6% -73% -95% 13% 11% 14%<br />

Source: <strong>Imara</strong> Securities <strong>Angola</strong> SCVM<br />

23