Imara African Cement Report Africa, the last cement frontier Angola ...

Imara African Cement Report Africa, the last cement frontier Angola ...

Imara African Cement Report Africa, the last cement frontier Angola ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

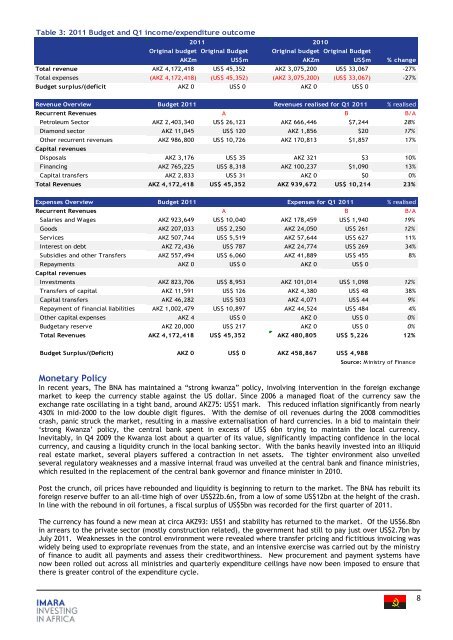

Table 3: 2011 Budget and Q1 income/expenditure outcome<br />

2011 2010<br />

Original budget<br />

AKZm<br />

Original Budget<br />

US$m<br />

Original budget<br />

AKZm<br />

Original Budget<br />

US$m % change<br />

Total revenue AKZ 4,172,418 US$ 45,352 AKZ 3,075,200 US$ 33,067 -27%<br />

Total expenses (AKZ 4,172,418) (US$ 45,352) (AKZ 3,075,200) (US$ 33,067) -27%<br />

Budget surplus/(deficit AKZ 0 US$ 0 AKZ 0 US$ 0<br />

Revenue Overview Budget 2011 Revenues realised for Q1 2011 % realised<br />

Recurrent Revenues A B B/A<br />

Petroleum Sector AKZ 2,403,340 US$ 26,123 AKZ 666,446 $7,244 28%<br />

Diamond sector AKZ 11,045 US$ 120 AKZ 1,856 $20 17%<br />

O<strong>the</strong>r recurrent revenues AKZ 986,800 US$ 10,726 AKZ 170,813 $1,857 17%<br />

Capital revenues<br />

Disposals AKZ 3,176 US$ 35 AKZ 321 $3 10%<br />

Financing AKZ 765,225 US$ 8,318 AKZ 100,237 $1,090 13%<br />

Capital transfers AKZ 2,833 US$ 31 AKZ 0 $0 0%<br />

Total Revenues AKZ 4,172,418 US$ 45,352 AKZ 939,672 US$ 10,214 23%<br />

Expenses Overview Budget 2011 Expenses for Q1 2011<br />

% realised<br />

Recurrent Revenues A B B/A<br />

Salaries and Wages AKZ 923,649 US$ 10,040 AKZ 178,459 US$ 1,940 19%<br />

Goods AKZ 207,033 US$ 2,250 AKZ 24,050 US$ 261 12%<br />

Services AKZ 507,744 US$ 5,519 AKZ 57,644 US$ 627 11%<br />

Interest on debt AKZ 72,436 US$ 787 AKZ 24,774 US$ 269 34%<br />

Subsidies and o<strong>the</strong>r Transfers AKZ 557,494 US$ 6,060 AKZ 41,889 US$ 455 8%<br />

Repayments AKZ 0 US$ 0 AKZ 0 US$ 0<br />

Capital revenues<br />

Investments AKZ 823,706 US$ 8,953 AKZ 101,014 US$ 1,098 12%<br />

Transfers of capital AKZ 11,591 US$ 126 AKZ 4,380 US$ 48 38%<br />

Capital transfers AKZ 46,282 US$ 503 AKZ 4,071 US$ 44 9%<br />

Repayment of financial liabilities AKZ 1,002,479 US$ 10,897 AKZ 44,524 US$ 484 4%<br />

O<strong>the</strong>r capital expenses AKZ 4 US$ 0 AKZ 0 US$ 0 0%<br />

Budgetary reserve AKZ 20,000 US$ 217 AKZ 0 US$ 0 0%<br />

Total Revenues AKZ 4,172,418 US$ 45,352 AKZ 480,805 US$ 5,226 12%<br />

Budget Surplus/(Deficit) AKZ 0 US$ 0 AKZ 458,867 US$ 4,988<br />

Source: Ministry of Finance<br />

Monetary Policy<br />

In recent years, The BNA has maintained a “strong kwanza” policy, involving intervention in <strong>the</strong> foreign exchange<br />

market to keep <strong>the</strong> currency stable against <strong>the</strong> US dollar. Since 2006 a managed float of <strong>the</strong> currency saw <strong>the</strong><br />

exchange rate oscillating in a tight band, around AKZ75: US$1 mark. This reduced inflation significantly from nearly<br />

430% in mid-2000 to <strong>the</strong> low double digit figures. With <strong>the</strong> demise of oil revenues during <strong>the</strong> 2008 commodities<br />

crash, panic struck <strong>the</strong> market, resulting in a massive externalisation of hard currencies. In a bid to maintain <strong>the</strong>ir<br />

„strong Kwanza‟ policy, <strong>the</strong> central bank spent in excess of US$ 6bn trying to maintain <strong>the</strong> local currency.<br />

Inevitably, in Q4 2009 <strong>the</strong> Kwanza lost about a quarter of its value, significantly impacting confidence in <strong>the</strong> local<br />

currency, and causing a liquidity crunch in <strong>the</strong> local banking sector. With <strong>the</strong> banks heavily invested into an illiquid<br />

real estate market, several players suffered a contraction in net assets. The tighter environment also unveiled<br />

several regulatory weaknesses and a massive internal fraud was unveiled at <strong>the</strong> central bank and finance ministries,<br />

which resulted in <strong>the</strong> repla<strong>cement</strong> of <strong>the</strong> central bank governor and finance minister in 2010.<br />

Post <strong>the</strong> crunch, oil prices have rebounded and liquidity is beginning to return to <strong>the</strong> market. The BNA has rebuilt its<br />

foreign reserve buffer to an all-time high of over US$22b.6n, from a low of some US$12bn at <strong>the</strong> height of <strong>the</strong> crash.<br />

In line with <strong>the</strong> rebound in oil fortunes, a fiscal surplus of US$5bn was recorded for <strong>the</strong> first quarter of 2011.<br />

The currency has found a new mean at circa AKZ93: US$1 and stability has returned to <strong>the</strong> market. Of <strong>the</strong> US$6.8bn<br />

in arrears to <strong>the</strong> private sector (mostly construction related), <strong>the</strong> government had still to pay just over US$2.7bn by<br />

July 2011. Weaknesses in <strong>the</strong> control environment were revealed where transfer pricing and fictitious invoicing was<br />

widely being used to expropriate revenues from <strong>the</strong> state, and an intensive exercise was carried out by <strong>the</strong> ministry<br />

of finance to audit all payments and assess <strong>the</strong>ir creditworthiness. New procurement and payment systems have<br />

now been rolled out across all ministries and quarterly expenditure ceilings have now been imposed to ensure that<br />

<strong>the</strong>re is greater control of <strong>the</strong> expenditure cycle.<br />

8