Sub-Saharan Africa Stock Markets 2010 Review & 2011 ... - Imara

Sub-Saharan Africa Stock Markets 2010 Review & 2011 ... - Imara

Sub-Saharan Africa Stock Markets 2010 Review & 2011 ... - Imara

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

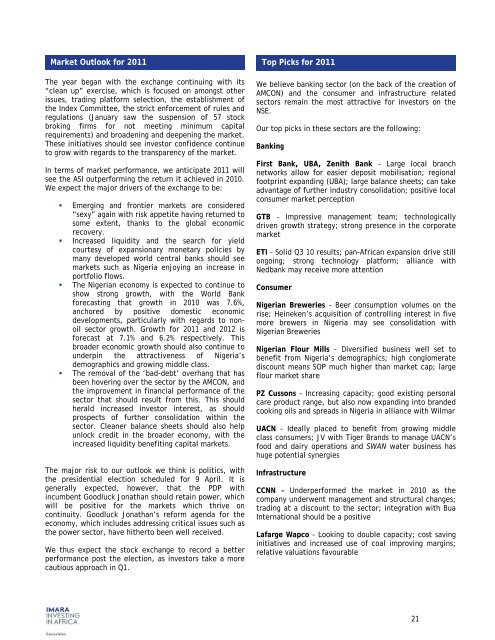

Market Outlook for <strong>2011</strong> Top Picks for <strong>2011</strong><br />

The year began with the exchange continuing with its<br />

“clean up” exercise, which is focused on amongst other<br />

issues, trading platform selection, the establishment of<br />

the Index Committee, the strict enforcement of rules and<br />

regulations (January saw the suspension of 57 stock<br />

broking firms for not meeting minimum capital<br />

requirements) and broadening and deepening the market.<br />

These initiatives should see investor confidence continue<br />

to grow with regards to the transparency of the market.<br />

In terms of market performance, we anticipate <strong>2011</strong> will<br />

see the ASI outperforming the return it achieved in <strong>2010</strong>.<br />

We expect the major drivers of the exchange to be:<br />

• Emerging and frontier markets are considered<br />

“sexy” again with risk appetite having returned to<br />

some extent, thanks to the global economic<br />

recovery.<br />

• Increased liquidity and the search for yield<br />

courtesy of expansionary monetary policies by<br />

many developed world central banks should see<br />

markets such as Nigeria enjoying an increase in<br />

portfolio flows.<br />

• The Nigerian economy is expected to continue to<br />

show strong growth, with the World Bank<br />

forecasting that growth in <strong>2010</strong> was 7.6%,<br />

anchored by positive domestic economic<br />

developments, particularly with regards to nonoil<br />

sector growth. Growth for <strong>2011</strong> and 2012 is<br />

forecast at 7.1% and 6.2% respectively. This<br />

broader economic growth should also continue to<br />

underpin the attractiveness of Nigeria’s<br />

demographics and growing middle class.<br />

• The removal of the ‘bad-debt’ overhang that has<br />

been hovering over the sector by the AMCON, and<br />

the improvement in financial performance of the<br />

sector that should result from this. This should<br />

herald increased investor interest, as should<br />

prospects of further consolidation within the<br />

sector. Cleaner balance sheets should also help<br />

unlock credit in the broader economy, with the<br />

increased liquidity benefiting capital markets.<br />

The major risk to our outlook we think is politics, with<br />

the presidential election scheduled for 9 April. It is<br />

generally expected, however, that the PDP with<br />

incumbent Goodluck Jonathan should retain power, which<br />

will be positive for the markets which thrive on<br />

continuity. Goodluck Jonathan’s reform agenda for the<br />

economy, which includes addressing critical issues such as<br />

the power sector, have hitherto been well received.<br />

We thus expect the stock exchange to record a better<br />

performance post the election, as investors take a more<br />

cautious approach in Q1.<br />

We believe banking sector (on the back of the creation of<br />

AMCON) and the consumer and infrastructure related<br />

sectors remain the most attractive for investors on the<br />

NSE.<br />

Our top picks in these sectors are the following:<br />

Banking<br />

First Bank, UBA, Zenith Bank – Large local branch<br />

networks allow for easier deposit mobilisation; regional<br />

footprint expanding (UBA); large balance sheets; can take<br />

advantage of further industry consolidation; positive local<br />

consumer market perception<br />

GTB – Impressive management team; technologically<br />

driven growth strategy; strong presence in the corporate<br />

market<br />

ETI – Solid Q3 10 results; pan-<strong>Africa</strong>n expansion drive still<br />

ongoing; strong technology platform; alliance with<br />

Nedbank may receive more attention<br />

Consumer<br />

Nigerian Breweries – Beer consumption volumes on the<br />

rise; Heineken’s acquisition of controlling interest in five<br />

more brewers in Nigeria may see consolidation with<br />

Nigerian Breweries<br />

Nigerian Flour Mills - Diversified business well set to<br />

benefit from Nigeria’s demographics; high conglomerate<br />

discount means SOP much higher than market cap; large<br />

flour market share<br />

PZ Cussons – Increasing capacity; good existing personal<br />

care product range, but also now expanding into branded<br />

cooking oils and spreads in Nigeria in alliance with Wilmar<br />

UACN – Ideally placed to benefit from growing middle<br />

class consumers; JV with Tiger Brands to manage UACN’s<br />

food and dairy operations and SWAN water business has<br />

huge potential synergies<br />

Infrastructure<br />

CCNN – Underperformed the market in <strong>2010</strong> as the<br />

company underwent management and structural changes;<br />

trading at a discount to the sector; integration with Bua<br />

International should be a positive<br />

Lafarge Wapco - Looking to double capacity; cost saving<br />

initiatives and increased use of coal improving margins;<br />

relative valuations favourable<br />

21