Sub-Saharan Africa Stock Markets 2010 Review & 2011 ... - Imara

Sub-Saharan Africa Stock Markets 2010 Review & 2011 ... - Imara

Sub-Saharan Africa Stock Markets 2010 Review & 2011 ... - Imara

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Market <strong>Review</strong> for <strong>2010</strong><br />

The LuSE All-Share Index closed <strong>2010</strong> at 3,322.47 points<br />

ending the second consecutive year of net negative FPI, a<br />

trend which continued up until July <strong>2010</strong>. Market<br />

turnover for <strong>2010</strong> was 328% higher at ZMK 962bn versus<br />

ZMK 225bn in 2009. The acquisition of Zain Zambia (listed<br />

as Celtel Zambia), triggered by a mandatory offer,<br />

accounted for 67% of total turnover in <strong>2010</strong> and<br />

contributed significantly to the net positive FPI of USD<br />

101m in <strong>2010</strong>. Hence turnover grew by 41% to ZMK 316bn<br />

on a normalised basis whilst net FPI was a negative USD<br />

10m excluding the month of December, in which the<br />

mandatory offer transaction occurred. The picture<br />

painted by <strong>2010</strong> is a lot less optimistic when turnover and<br />

net FPI numbers are normalised, and the LuSE seems to<br />

still be lagging relative to the market climate in 2008.<br />

In the broader economy, copper prices recovered in <strong>2010</strong><br />

to circa USD 9,000/tonne which in turn led to higher<br />

Zambian copper production with <strong>2010</strong> year-end<br />

production forecasts at 720,000 tonnes. FDI was forecast<br />

at USD 3bn for <strong>2010</strong> and was predominantly mining<br />

related. The second successive record bumper-harvest of<br />

2.8 million tonnes kept CPI inflation at bay with year-end<br />

CPI at a low of 7.7% y-o-y. With the Kwacha remaining in<br />

the ZMK 4,600/USD to ZMK 4,800/USD region, exports<br />

grew to ZMK 28tn as at October <strong>2010</strong> whilst imports grew<br />

to ZMK 22tn as at October <strong>2010</strong> which resulted in a trade<br />

surplus of ZMK 6tn as at October <strong>2010</strong>.<br />

The yield on 91-day treasury bills opened the year at 5.4%<br />

and reached a low of 1.9% in April <strong>2010</strong> but closed <strong>2010</strong><br />

at a 12-month high of 7.7%. Higher up the maturity<br />

spectrum, 15-year bonds declined from 18.9% in January<br />

<strong>2010</strong> to 15.4% in December <strong>2010</strong>. The net result was a<br />

flattening of the yield curve which points to expectations<br />

of slower accelerating inflation going forward. Weighted<br />

average base-lending rates by commercial banks also<br />

reduced in tandem from 22.7% in January <strong>2010</strong> to 19.4%<br />

in December <strong>2010</strong>. In <strong>2010</strong>, loans and advances by<br />

commercial banks increased by 13.8% to ZMK 9.2tn.<br />

On the LuSE, corporate restructuring activity arose from<br />

the acquisition of Zain’s <strong>Africa</strong>n assets (excluding Sudan<br />

and Morocco) by Bharti Airtel Limited; and the acquisition<br />

of BP <strong>Africa</strong> Limited by Puma Energy Holdings Limited (a<br />

subsidiary of Trafigura Beheer). During the year, the Zain<br />

acquisition triggered a mandatory offer at the country<br />

level as per the provisions of the Securities Act of the<br />

laws of Zambia governing takeovers and mergers. The<br />

acquirer offered ZMK 710 per share to minorities which<br />

resulted in Bharti Airtel Zambia Holdings (BAZH) holding<br />

96.4% of the total issued and fully paid up share capital of<br />

Zain Zambia (listed as Celtel Zambia). The LuSE has just<br />

rejected BAZH’s application to delist from the exchange,<br />

and BAZH is expected to rapply. The sale of BP <strong>Africa</strong>’s<br />

Zambian assets is currently pending.<br />

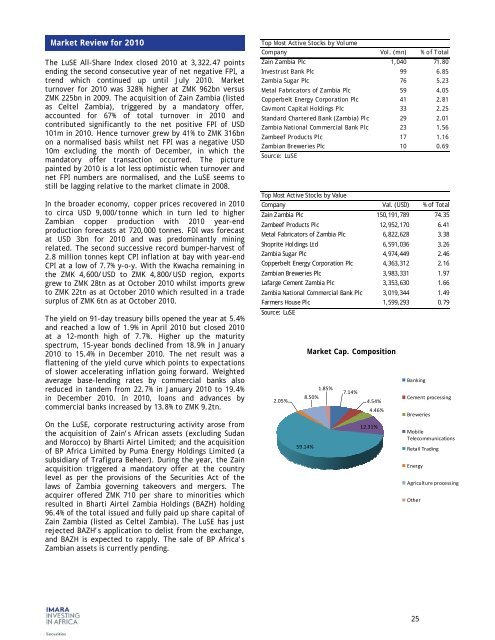

Top Most Active <strong>Stock</strong>s by Volume<br />

Company Vol. (mn) % of Total<br />

Zain Zambia Plc 1,040 71.80<br />

Investrust Bank Plc 99 6.85<br />

Zambia Sugar Plc 76 5.23<br />

Metal Fabricators of Zambia Plc 59 4.05<br />

Copperbelt Energy Corporation Plc 41 2.81<br />

Cavmont Capital Holdings Plc 33 2.25<br />

Standard Chartered Bank (Zambia) Plc 29 2.01<br />

Zambia National Commercial Bank Plc 23 1.56<br />

Zambeef Products Plc 17 1.16<br />

Zambian Breweries Plc 10 0.69<br />

Source: LuSE<br />

Top Most Active <strong>Stock</strong>s by Value<br />

Company Val. (USD) % of Total<br />

Zain Zambia Plc 150,191,789 74.35<br />

Zambeef Products Plc 12,952,170 6.41<br />

Metal Fabricators of Zambia Plc 6,822,628 3.38<br />

Shoprite Holdings Ltd 6,591,036 3.26<br />

Zambia Sugar Plc 4,974,449 2.46<br />

Copperbelt Energy Corporation Plc 4,363,312 2.16<br />

Zambian Breweries Plc 3,983,331 1.97<br />

Lafarge Cement Zambia Plc 3,353,630 1.66<br />

Zambia National Commercial Bank Plc 3,019,344 1.49<br />

Farmers House Plc 1,599,293 0.79<br />

Source: LuSE<br />

2.05%<br />

Market Cap. Composition<br />

8.50%<br />

59.14%<br />

1.85%<br />

7.14%<br />

4.54%<br />

4.46%<br />

12.31%<br />

Banking<br />

Cement processing<br />

Breweries<br />

Mobile<br />

Telecommunications<br />

Retail Trading<br />

Energy<br />

Agriculture processing<br />

Other<br />

25