Sub-Saharan Africa Stock Markets 2010 Review & 2011 ... - Imara

Sub-Saharan Africa Stock Markets 2010 Review & 2011 ... - Imara

Sub-Saharan Africa Stock Markets 2010 Review & 2011 ... - Imara

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Market <strong>Review</strong> for <strong>2010</strong><br />

Spurred by a solid performance across the board, the ALSI<br />

gained 62.19% to end the year at 1,188.07 points.<br />

However, a materially weakening currency versus the<br />

dollar, particularly towards the end of the year and which<br />

has continued into <strong>2011</strong> as the election approaches meant<br />

the USD return was a relatively lower 33.81%. The<br />

currency weakness has been attributed to high dollar<br />

demand from the energy sector, tight supply, speculative<br />

trading by offshore players and elevated state<br />

expenditure.<br />

Of the twelve counters that were listed at the beginning<br />

of the year, nine closed in the black while three ended in<br />

the red. BATU was the top performer, up 431.69% in USD<br />

terms, as it saw a re-rating after it more than doubled its<br />

2009 earnings.<br />

Market capitalisation increased by 78.98%% over the<br />

course of the year to close at USD 5.6bn. EABL was the<br />

most capitalised counter with 35.81% of the total. SBU<br />

was the most highly capitalised local listing, with 10.74%.<br />

Total volumes for the year were up 82.39% to 224.8m<br />

shares while value traded increased by 75.38% to USD<br />

18.4m, both metrics boosted by the listing of NIC in<br />

March. SBU remained the most active stock by volumes<br />

and value, with 39.83% and 52.02% contributions<br />

respectively. The liquidity ratio remained very low, with<br />

some of the cross listings still only seeing all of their<br />

trades occurring in Nairobi. Nevertheless a slight<br />

improvement was recorded to 0.33% from the 0.28%<br />

achieved in 2009.<br />

Market Outlook for <strong>2011</strong><br />

The market will be watching the presidential election<br />

with interest, given that the challenger has already<br />

threatened an “Egypt style” response should the<br />

opposition feel the election was rigged. Political risk will<br />

thus be somewhat higher until the electoral process is<br />

complete. With cross listings dominating the market,<br />

however, events in Kenya are more likely to have an<br />

impact on the direction of the exchange, we believe.<br />

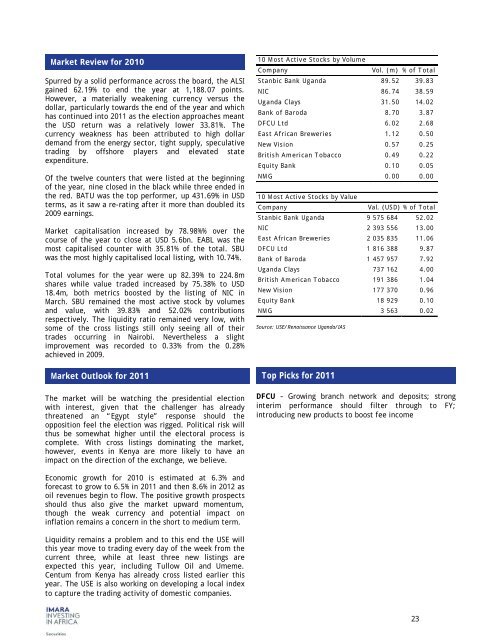

10 Most Active <strong>Stock</strong>s by Volume<br />

Company<br />

Vol. (m) % of Total<br />

Stanbic Bank Uganda 89.52 39.83<br />

NIC 86.74 38.59<br />

Uganda Clays 31.50 14.02<br />

Bank of Baroda 8.70 3.87<br />

DFCU Ltd 6.02 2.68<br />

East <strong>Africa</strong>n Breweries 1.12 0.50<br />

New Vision 0.57 0.25<br />

British American Tobacco 0.49 0.22<br />

Equity Bank 0.10 0.05<br />

NMG 0.00 0.00<br />

10 Most Active <strong>Stock</strong>s by Value<br />

Company<br />

Val. (USD) % of Total<br />

Stanbic Bank Uganda 9 575 684 52.02<br />

NIC 2 393 556 13.00<br />

East <strong>Africa</strong>n Breweries 2 035 835 11.06<br />

DFCU Ltd 1 816 388 9.87<br />

Bank of Baroda 1 457 957 7.92<br />

Uganda Clays 737 162 4.00<br />

British American Tobacco 191 386 1.04<br />

New Vision 177 370 0.96<br />

Equity Bank 18 929 0.10<br />

NMG 3 563 0.02<br />

Source: USE/Renaissance Uganda/IAS<br />

Top Picks for <strong>2011</strong><br />

DFCU – Growing branch network and deposits; strong<br />

interim performance should filter through to FY;<br />

introducing new products to boost fee income<br />

Economic growth for <strong>2010</strong> is estimated at 6.3% and<br />

forecast to grow to 6.5% in <strong>2011</strong> and then 8.6% in 2012 as<br />

oil revenues begin to flow. The positive growth prospects<br />

should thus also give the market upward momentum,<br />

though the weak currency and potential impact on<br />

inflation remains a concern in the short to medium term.<br />

Liquidity remains a problem and to this end the USE will<br />

this year move to trading every day of the week from the<br />

current three, while at least three new listings are<br />

expected this year, including Tullow Oil and Umeme.<br />

Centum from Kenya has already cross listed earlier this<br />

year. The USE is also working on developing a local index<br />

to capture the trading activity of domestic companies.<br />

23