Sub-Saharan Africa Stock Markets 2010 Review & 2011 ... - Imara

Sub-Saharan Africa Stock Markets 2010 Review & 2011 ... - Imara

Sub-Saharan Africa Stock Markets 2010 Review & 2011 ... - Imara

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Market <strong>Review</strong> for <strong>2010</strong><br />

Both major indices saw a relatively strong performance in<br />

<strong>2010</strong>, certainly in local currency terms, with the BRVM<br />

Composite up 20.48% while the BRVM 10 gained 27.41%. In<br />

USD terms, the BRVM Composite and BRVM 10 were<br />

11.96% and 18.39% higher respectively, as the currency<br />

weakened over the course of the year.<br />

Fourteen counters closed the year in the black, against 25<br />

in the red, with the best performing sector being the<br />

agricultural stocks, led by SAPH (+152.34%) and Palm<br />

(+96.97%), which both saw significant appreciation as<br />

investors expect them to benefit for rising rubber and<br />

palm oil prices respectively. Juggernaut Sonatel also had<br />

a strong year, closing 28.33% higher. The agriculture<br />

sector gained 103.24%, followed by the public services (of<br />

which Sonatel is a constituent) up 22.82% and the<br />

financials up 20.49%.<br />

Market capitalisation increased by 23.63% over the course<br />

of the year to close at USD 7.2bn. Sonatel remained the<br />

most capitalised counter on the exchange with 44.37%,<br />

followed by ETI with 13.42% and Solibra with 4.74%.<br />

Total volumes for the year were flat, up just 1.01% to<br />

28.3m shares, while value traded fared marginally better,<br />

up 3.70% to XOF 65.4bn, or circa USD 135.2m. ETI was by<br />

far the most active stock by volumes, contributing 94.68%<br />

of the total. Value traded was led by the market cap<br />

leader, Sonatel, which had 56.28% l, well ahead of SAPH<br />

at number two with 11.13%. The liquidity ratio remained<br />

low, deteriorating to 1.89% from 2.25% in 2009.<br />

Market Outlook for <strong>2011</strong><br />

The political crisis in Cote d’Ivoire has continued into<br />

<strong>2011</strong>, and despite numerous attempts at mediation by the<br />

<strong>Africa</strong>n Union and other organisations, Gbagbo is digging<br />

in his heels, with a Kenya/Zimbabwe style “solution” of a<br />

government of national unity perhaps occupying his mind.<br />

While initially we thought the exchange would continue<br />

relatively unscathed as it has been by the political<br />

fallout, security concerns have seen the BRVM closing its<br />

doors in Cote d’Ivoire, at least until 28 February. We<br />

assume there are contingencies for it to relocate to one<br />

of the other member states where necessary, but this<br />

scenario is likely to spook investors in the short term.<br />

Whilst we expect a positive outturn for both indices, we<br />

think the year end return may fall short of that witnessed<br />

in <strong>2010</strong>, with the agricultural sector having already rerated<br />

significantly, although rising prices for the<br />

commodities it produces should see more upside. The<br />

financial and telecoms sectors will also be key<br />

determinants of market direction this year, with the<br />

Ivorian focused banks in particular likely to see some<br />

fallout from the electoral crisis.<br />

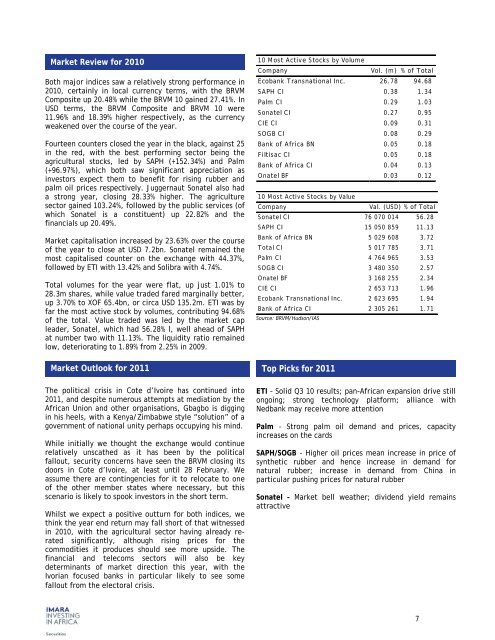

10 Most Active <strong>Stock</strong>s by Volume<br />

Company<br />

Vol. (m) % of Total<br />

Ecobank Transnational Inc. 26.78 94.68<br />

SAPH CI 0.38 1.34<br />

Palm CI 0.29 1.03<br />

Sonatel CI 0.27 0.95<br />

CIE CI 0.09 0.31<br />

SOGB CI 0.08 0.29<br />

Bank of <strong>Africa</strong> BN 0.05 0.18<br />

Filtisac CI 0.05 0.18<br />

Bank of <strong>Africa</strong> CI 0.04 0.13<br />

Onatel BF 0.03 0.12<br />

10 Most Active <strong>Stock</strong>s by Value<br />

Company<br />

Val. (USD) % of Total<br />

Sonatel CI 76 070 014 56.28<br />

SAPH CI 15 050 859 11.13<br />

Bank of <strong>Africa</strong> BN 5 029 608 3.72<br />

Total CI 5 017 785 3.71<br />

Palm CI 4 764 965 3.53<br />

SOGB CI 3 480 350 2.57<br />

Onatel BF 3 168 255 2.34<br />

CIE CI 2 653 713 1.96<br />

Ecobank Transnational Inc. 2 623 695 1.94<br />

Bank of <strong>Africa</strong> CI 2 305 261 1.71<br />

Source: BRVM/Hudson/IAS<br />

Top Picks for <strong>2011</strong><br />

ETI – Solid Q3 10 results; pan-<strong>Africa</strong>n expansion drive still<br />

ongoing; strong technology platform; alliance with<br />

Nedbank may receive more attention<br />

Palm – Strong palm oil demand and prices, capacity<br />

increases on the cards<br />

SAPH/SOGB – Higher oil prices mean increase in price of<br />

synthetic rubber and hence increase in demand for<br />

natural rubber; increase in demand from China in<br />

particular pushing prices for natural rubber<br />

Sonatel – Market bell weather; dividend yield remains<br />

attractive<br />

7