Download - IndexUniverse.com

Download - IndexUniverse.com

Download - IndexUniverse.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

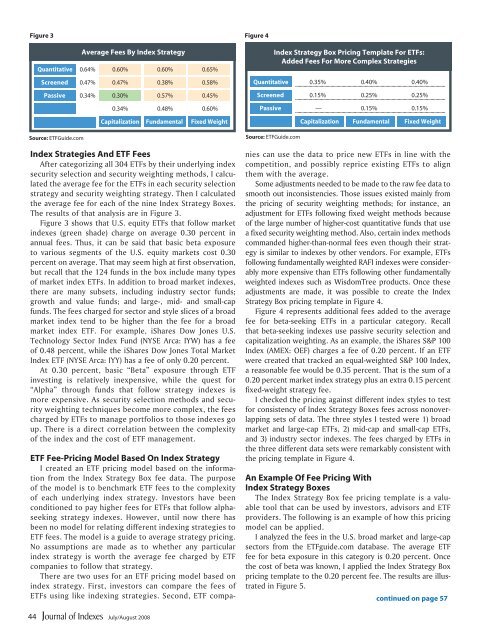

Figure 3<br />

Source: ETFGuide.<strong>com</strong><br />

Average Fees By Index Strategy<br />

Quantitative 0.64% 0.60% 0.60% 0.65%<br />

Screened 0.47% 0.47% 0.38% 0.58%<br />

Passive 0.34% 0.30% 0.57% 0.45%<br />

0.34% 0.48% 0.60%<br />

Capitalization Fundamental Fixed Weight<br />

Index Strategies And ETF Fees<br />

After categorizing all 304 ETFs by their underlying index<br />

security selection and security weighting methods, I calculated<br />

the average fee for the ETFs in each security selection<br />

strategy and security weighting strategy. Then I calculated<br />

the average fee for each of the nine Index Strategy Boxes.<br />

The results of that analysis are in Figure 3.<br />

Figure 3 shows that U.S. equity ETFs that follow market<br />

indexes (green shade) charge on average 0.30 percent in<br />

annual fees. Thus, it can be said that basic beta exposure<br />

to various segments of the U.S. equity markets cost 0.30<br />

percent on average. That may seem high at first observation,<br />

but recall that the 124 funds in the box include many types<br />

of market index ETFs. In addition to broad market indexes,<br />

there are many subsets, including industry sector funds;<br />

growth and value funds; and large-, mid- and small-cap<br />

funds. The fees charged for sector and style slices of a broad<br />

market index tend to be higher than the fee for a broad<br />

market index ETF. For example, iShares Dow Jones U.S.<br />

Technology Sector Index Fund (NYSE Arca: IYW) has a fee<br />

of 0.48 percent, while the iShares Dow Jones Total Market<br />

Index ETF (NYSE Arca: IYY) has a fee of only 0.20 percent.<br />

At 0.30 percent, basic “Beta” exposure through ETF<br />

investing is relatively inexpensive, while the quest for<br />

“Alpha” through funds that follow strategy indexes is<br />

more expensive. As security selection methods and security<br />

weighting techniques be<strong>com</strong>e more <strong>com</strong>plex, the fees<br />

charged by ETFs to manage portfolios to those indexes go<br />

up. There is a direct correlation between the <strong>com</strong>plexity<br />

of the index and the cost of ETF management.<br />

Figure 4<br />

Source: ETFGuide.<strong>com</strong><br />

Index Strategy Box Pricing Template For ETFs:<br />

Added Fees For More Complex Strategies<br />

Quantitative 0.35% 0.40% 0.40%<br />

Screened 0.15% 0.25% 0.25%<br />

Passive — 0.15% 0.15%<br />

Capitalization Fundamental Fixed Weight<br />

ETF Fee-Pricing Model Based On Index Strategy<br />

I created an ETF pricing model based on the information<br />

from the Index Strategy Box fee data. The purpose<br />

of the model is to benchmark ETF fees to the <strong>com</strong>plexity<br />

of each underlying index strategy. Investors have been<br />

conditioned to pay higher fees for ETFs that follow alphaseeking<br />

strategy indexes. However, until now there has<br />

been no model for relating different indexing strategies to<br />

ETF fees. The model is a guide to average strategy pricing.<br />

No assumptions are made as to whether any particular<br />

index strategy is worth the average fee charged by ETF<br />

<strong>com</strong>panies to follow that strategy.<br />

There are two uses for an ETF pricing model based on<br />

index strategy. First, investors can <strong>com</strong>pare the fees of<br />

ETFs using like indexing strategies. Second, ETF <strong>com</strong>panies<br />

can use the data to price new ETFs in line with the<br />

<strong>com</strong>petition, and possibly reprice existing ETFs to align<br />

them with the average.<br />

Some adjustments needed to be made to the raw fee data to<br />

smooth out inconsistencies. Those issues existed mainly from<br />

the pricing of security weighting methods; for instance, an<br />

adjustment for ETFs following fixed weight methods because<br />

of the large number of higher-cost quantitative funds that use<br />

a fixed security weighting method. Also, certain index methods<br />

<strong>com</strong>manded higher-than-normal fees even though their strategy<br />

is similar to indexes by other vendors. For example, ETFs<br />

following fundamentally weighted RAFI indexes were considerably<br />

more expensive than ETFs following other fundamentally<br />

weighted indexes such as WisdomTree products. Once these<br />

adjustments are made, it was possible to create the Index<br />

Strategy Box pricing template in Figure 4.<br />

Figure 4 represents additional fees added to the average<br />

fee for beta-seeking ETFs in a particular category. Recall<br />

that beta-seeking indexes use passive security selection and<br />

capitalization weighting. As an example, the iShares S&P 100<br />

Index (AMEX: OEF) charges a fee of 0.20 percent. If an ETF<br />

were created that tracked an equal-weighted S&P 100 Index,<br />

a reasonable fee would be 0.35 percent. That is the sum of a<br />

0.20 percent market index strategy plus an extra 0.15 percent<br />

fixed-weight strategy fee.<br />

I checked the pricing against different index styles to test<br />

for consistency of Index Strategy Boxes fees across nonoverlapping<br />

sets of data. The three styles I tested were 1) broad<br />

market and large-cap ETFs, 2) mid-cap and small-cap ETFs,<br />

and 3) industry sector indexes. The fees charged by ETFs in<br />

the three different data sets were remarkably consistent with<br />

the pricing template in Figure 4.<br />

An Example Of Fee Pricing With<br />

Index Strategy Boxes<br />

The Index Strategy Box fee pricing template is a valuable<br />

tool that can be used by investors, advisors and ETF<br />

providers. The following is an example of how this pricing<br />

model can be applied.<br />

I analyzed the fees in the U.S. broad market and large-cap<br />

sectors from the ETFguide.<strong>com</strong> database. The average ETF<br />

fee for beta exposure in this category is 0.20 percent. Once<br />

the cost of beta was known, I applied the Index Strategy Box<br />

pricing template to the 0.20 percent fee. The results are illustrated<br />

in Figure 5.<br />

continued on page 57<br />

44<br />

July/August 2008