Download - IndexUniverse.com

Download - IndexUniverse.com

Download - IndexUniverse.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Figure 2<br />

Figure 3<br />

463<br />

134<br />

ETF Spreads<br />

55<br />

14<br />

$0.01-$0.10 $0.11-$0.20 $0.21-$0.50 $0.51+<br />

Average Spreads<br />

Source: NYSE Arcavision. Data for January 1, 2008 through March 31, 2008.<br />

500<br />

450<br />

400<br />

350<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

that’s not really what investors paid. A spot check on April 18<br />

showed the bid/ask spread at $0.80; still high, but well below<br />

the artificial $10.99 figure.<br />

Number of ETFs<br />

74<br />

208<br />

175<br />

ETF Spread Percentage - Q1 2008<br />

85<br />

42<br />

Source: NYSE Arcavision. Data for January 1, 2008 through March 31, 2008.<br />

29<br />

15<br />

8 5 7<br />

0.0% 0.1% 0.2% 0.3% 0.4% 0.5% 0.6% 0.7% 0.8% 0.9% 1%<br />

or<br />

Spread %<br />

more<br />

Figure 4<br />

ETFs With Spreads Less Than 0.1% - Q1 2008<br />

18<br />

Number of ETFs<br />

The Spread On Spreads<br />

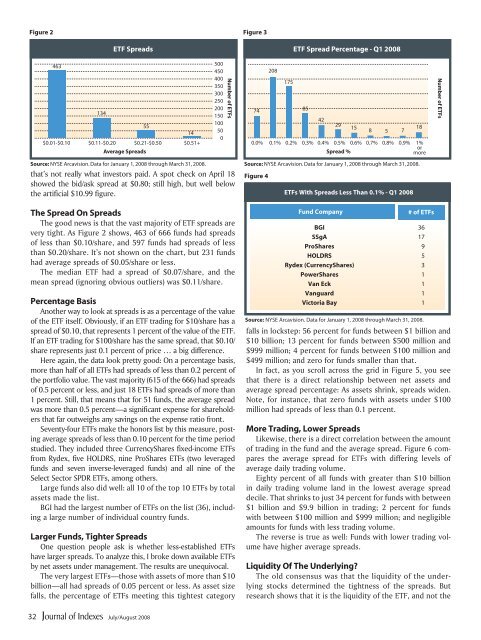

The good news is that the vast majority of ETF spreads are<br />

very tight. As Figure 2 shows, 463 of 666 funds had spreads<br />

of less than $0.10/share, and 597 funds had spreads of less<br />

than $0.20/share. It’s not shown on the chart, but 231 funds<br />

had average spreads of $0.05/share or less.<br />

The median ETF had a spread of $0.07/share, and the<br />

mean spread (ignoring obvious outliers) was $0.11/share.<br />

Percentage Basis<br />

Another way to look at spreads is as a percentage of the value<br />

of the ETF itself. Obviously, if an ETF trading for $10/share has a<br />

spread of $0.10, that represents 1 percent of the value of the ETF.<br />

If an ETF trading for $100/share has the same spread, that $0.10/<br />

share represents just 0.1 percent of price … a big difference.<br />

Here again, the data look pretty good: On a percentage basis,<br />

more than half of all ETFs had spreads of less than 0.2 percent of<br />

the portfolio value. The vast majority (615 of the 666) had spreads<br />

of 0.5 percent or less, and just 18 ETFs had spreads of more than<br />

1 percent. Still, that means that for 51 funds, the average spread<br />

was more than 0.5 percent—a significant expense for shareholders<br />

that far outweighs any savings on the expense ratio front.<br />

Seventy-four ETFs make the honors list by this measure, posting<br />

average spreads of less than 0.10 percent for the time period<br />

studied. They included three CurrencyShares fixed-in<strong>com</strong>e ETFs<br />

from Rydex, five HOLDRS, nine ProShares ETFs (two leveraged<br />

funds and seven inverse-leveraged funds) and all nine of the<br />

Select Sector SPDR ETFs, among others.<br />

Large funds also did well: all 10 of the top 10 ETFs by total<br />

assets made the list.<br />

BGI had the largest number of ETFs on the list (36), including<br />

a large number of individual country funds.<br />

Larger Funds, Tighter Spreads<br />

One question people ask is whether less-established ETFs<br />

have larger spreads. To analyze this, I broke down available ETFs<br />

by net assets under management. The results are unequivocal.<br />

The very largest ETFs—those with assets of more than $10<br />

billion—all had spreads of 0.05 percent or less. As asset size<br />

falls, the percentage of ETFs meeting this tightest category<br />

Fund Company<br />

# of ETFs<br />

BGI 36<br />

SSgA 17<br />

ProShares 9<br />

HOLDRS 5<br />

Rydex (CurrencyShares) 3<br />

PowerShares 1<br />

Van Eck 1<br />

Vanguard 1<br />

Victoria Bay 1<br />

Source: NYSE Arcavision. Data for January 1, 2008 through March 31, 2008.<br />

falls in lockstep: 56 percent for funds between $1 billion and<br />

$10 billion; 13 percent for funds between $500 million and<br />

$999 million; 4 percent for funds between $100 million and<br />

$499 million; and zero for funds smaller than that.<br />

In fact, as you scroll across the grid in Figure 5, you see<br />

that there is a direct relationship between net assets and<br />

average spread percentage: As assets shrink, spreads widen.<br />

Note, for instance, that zero funds with assets under $100<br />

million had spreads of less than 0.1 percent.<br />

More Trading, Lower Spreads<br />

Likewise, there is a direct correlation between the amount<br />

of trading in the fund and the average spread. Figure 6 <strong>com</strong>pares<br />

the average spread for ETFs with differing levels of<br />

average daily trading volume.<br />

Eighty percent of all funds with greater than $10 billion<br />

in daily trading volume land in the lowest average spread<br />

decile. That shrinks to just 34 percent for funds with between<br />

$1 billion and $9.9 billion in trading; 2 percent for funds<br />

with between $100 million and $999 million; and negligible<br />

amounts for funds with less trading volume.<br />

The reverse is true as well: Funds with lower trading volume<br />

have higher average spreads.<br />

Liquidity Of The Underlying?<br />

The old consensus was that the liquidity of the underlying<br />

stocks determined the tightness of the spreads. But<br />

research shows that it is the liquidity of the ETF, and not the<br />

32<br />

July/August 2008