Download - IndexUniverse.com

Download - IndexUniverse.com

Download - IndexUniverse.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

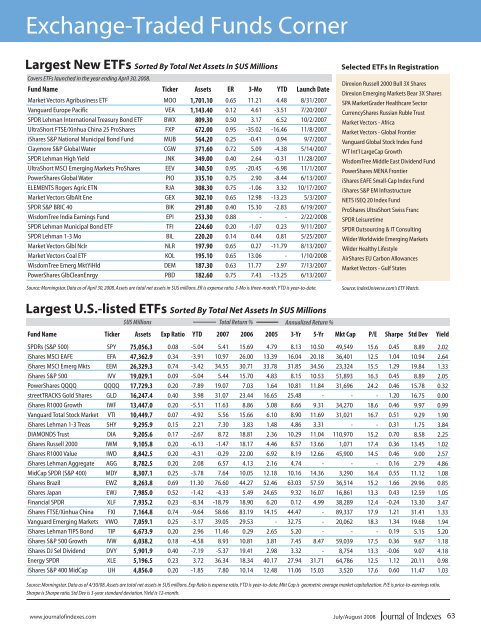

Exchange-Traded Funds Corner<br />

Largest New ETFs Sorted By Total Net Assets In $US Millions<br />

Covers ETFs launched in the year ending April 30, 2008.<br />

Fund Name<br />

Market Vectors Agribusiness ETF<br />

Vanguard Europe Pacific<br />

SPDR Lehman International Treasury Bond ETF<br />

UltraShort FTSE/Xinhua China 25 ProShares<br />

iShares S&P National Municipal Bond Fund<br />

Claymore S&P Global Water<br />

SPDR Lehman High Yield<br />

UltraShort MSCI Emerging Markets ProShares<br />

PowerShares Global Water<br />

ELEMENTS Rogers Agric ETN<br />

Market Vectors GlbAlt Ene<br />

SPDR S&P BRIC 40<br />

WisdomTree India Earnings Fund<br />

SPDR Lehman Municipal Bond ETF<br />

SPDR Lehman 1-3 Mo<br />

Market Vectors Glbl Nclr<br />

Market Vectors Coal ETF<br />

WisdomTree Emerg MktYiHld<br />

PowerShares GlbCleanEnrgy<br />

Ticker<br />

MOO<br />

VEA<br />

BWX<br />

FXP<br />

MUB<br />

CGW<br />

JNK<br />

EEV<br />

PIO<br />

RJA<br />

GEX<br />

BIK<br />

EPI<br />

TFI<br />

BIL<br />

NLR<br />

KOL<br />

DEM<br />

PBD<br />

Assets<br />

1,701.10<br />

1,143.40<br />

809.30<br />

672.00<br />

564.20<br />

371.60<br />

349.00<br />

340.50<br />

335.10<br />

308.30<br />

302.10<br />

291.80<br />

253.30<br />

224.60<br />

220.20<br />

197.90<br />

195.10<br />

187.30<br />

182.60<br />

ER<br />

0.65<br />

0.12<br />

0.50<br />

0.95<br />

0.25<br />

0.72<br />

0.40<br />

0.95<br />

0.75<br />

0.75<br />

0.65<br />

0.40<br />

0.88<br />

0.20<br />

0.14<br />

0.65<br />

0.65<br />

0.63<br />

0.75<br />

3-Mo<br />

11.21<br />

4.61<br />

3.17<br />

-35.02<br />

-0.41<br />

5.09<br />

2.64<br />

-20.45<br />

2.90<br />

-1.06<br />

12.98<br />

15.30<br />

-<br />

-1.07<br />

0.44<br />

0.27<br />

13.06<br />

11.77<br />

7.43<br />

YTD<br />

4.48<br />

-3.51<br />

6.52<br />

-16.46<br />

0.94<br />

-4.38<br />

-0.31<br />

-6.98<br />

-8.44<br />

3.32<br />

-13.23<br />

-2.83<br />

-<br />

0.23<br />

0.81<br />

-11.79<br />

-<br />

2.97<br />

-13.25<br />

Launch Date<br />

8/31/2007<br />

7/20/2007<br />

10/2/2007<br />

11/8/2007<br />

9/7/2007<br />

5/14/2007<br />

11/28/2007<br />

11/1/2007<br />

6/13/2007<br />

10/17/2007<br />

5/3/2007<br />

6/19/2007<br />

2/22/2008<br />

9/11/2007<br />

5/25/2007<br />

8/13/2007<br />

1/10/2008<br />

7/13/2007<br />

6/13/2007<br />

Selected ETFs In Registration<br />

Direxion Russell 2000 Bull 3X Shares<br />

Direxion Emerging Markets Bear 3X Shares<br />

SPA MarketGrader Healthcare Sector<br />

CurrencyShares Russian Ruble Trust<br />

Market Vectors - Africa<br />

Market Vectors - Global Frontier<br />

Vanguard Global Stock Index Fund<br />

WT Int'l LargeCap Growth<br />

WisdomTree Middle East Dividend Fund<br />

PowerShares MENA Frontier<br />

iShares EAFE Small-Cap Index Fund<br />

iShares S&P EM Infrastructure<br />

NETS ISEQ 20 Index Fund<br />

ProShares UltraShort Swiss Franc<br />

SPDR Leisuretime<br />

SPDR Outsourcing & IT Consulting<br />

Wilder Worldwide Emerging Markets<br />

Wilder Healthy Lifestyle<br />

AirShares EU Carbon Allowances<br />

Market Vectors - Gulf States<br />

Source: Morningstar. Data as of April 30, 2008. Assets are total net assets in $US millions. ER is expense ratio. 3-Mo is three-month. YTD is year-to-date.<br />

Source: <strong>IndexUniverse</strong>.<strong>com</strong>'s ETF Watch.<br />

Largest U.S.-listed ETFs Sorted By Total Net Assets In $US Millions<br />

$US Millions Total Return %<br />

Annualized Return %<br />

Fund Name Ticker Assets Exp Ratio YTD<br />

2007 2006 2005<br />

3-Yr 5-Yr Mkt Cap P/E<br />

Sharpe Std Dev Yield<br />

SPDRs (S&P 500)<br />

iShares MSCI EAFE<br />

iShares MSCI Emerg Mkts<br />

iShares S&P 500<br />

PowerShares QQQQ<br />

streetTRACKS Gold Shares<br />

iShares R1000 Growth<br />

Vanguard Total Stock Market<br />

iShares Lehman 1-3 Treas<br />

DIAMONDS Trust<br />

iShares Russell 2000<br />

iShares R1000 Value<br />

iShares Lehman Aggregate<br />

MidCap SPDR (S&P 400)<br />

iShares Brazil<br />

iShares Japan<br />

Financial SPDR<br />

iShares FTSE/Xinhua China<br />

Vanguard Emerging Markets<br />

iShares Lehman TIPS Bond<br />

iShares S&P 500 Growth<br />

iShares DJ Sel Dividend<br />

Energy SPDR<br />

iShares S&P 400 MidCap<br />

SPY<br />

EFA<br />

EEM<br />

IVV<br />

QQQQ<br />

GLD<br />

IWF<br />

VTI<br />

SHY<br />

DIA<br />

IWM<br />

IWD<br />

AGG<br />

MDY<br />

EWZ<br />

EWJ<br />

XLF<br />

FXI<br />

VWO<br />

TIP<br />

IVW<br />

DVY<br />

XLE<br />

IJH<br />

75,056.3<br />

47,362.9<br />

26,329.3<br />

19,029.1<br />

17,729.3<br />

16,247.4<br />

13,447.0<br />

10,449.7<br />

9,295.9<br />

9,205.6<br />

9,105.8<br />

8,842.5<br />

8,782.5<br />

8,307.1<br />

8,263.8<br />

7,985.0<br />

7,935.2<br />

7,164.8<br />

7,059.1<br />

6,673.9<br />

6,038.2<br />

5,901.9<br />

5,196.5<br />

4,856.0<br />

0.08<br />

0.34<br />

0.74<br />

0.09<br />

0.20<br />

0.40<br />

0.20<br />

0.07<br />

0.15<br />

0.17<br />

0.20<br />

0.20<br />

0.20<br />

0.25<br />

0.69<br />

0.52<br />

0.23<br />

0.74<br />

0.25<br />

0.20<br />

0.18<br />

0.40<br />

0.23<br />

0.20<br />

-5.04<br />

-3.91<br />

-3.42<br />

-5.04<br />

-7.89<br />

3.98<br />

-5.51<br />

-4.92<br />

2.21<br />

-2.67<br />

-6.13<br />

-4.31<br />

2.08<br />

-3.78<br />

11.30<br />

-1.42<br />

-8.34<br />

-9.64<br />

-3.17<br />

2.96<br />

-4.58<br />

-7.19<br />

3.72<br />

-1.85<br />

5.41<br />

10.97<br />

34.55<br />

5.44<br />

19.07<br />

31.07<br />

11.63<br />

5.56<br />

7.30<br />

8.72<br />

-1.47<br />

-0.29<br />

6.57<br />

7.64<br />

76.60<br />

-4.33<br />

-18.79<br />

58.66<br />

39.05<br />

11.46<br />

8.93<br />

-5.37<br />

36.34<br />

7.80<br />

15.69<br />

26.00<br />

30.71<br />

15.70<br />

7.03<br />

23.44<br />

8.86<br />

15.66<br />

3.83<br />

18.81<br />

18.17<br />

22.00<br />

4.13<br />

10.05<br />

44.27<br />

5.49<br />

18.90<br />

83.19<br />

29.53<br />

0.29<br />

10.81<br />

19.41<br />

18.34<br />

10.14<br />

4.79<br />

13.39<br />

33.78<br />

4.83<br />

1.64<br />

16.65<br />

5.08<br />

6.10<br />

1.48<br />

2.36<br />

4.46<br />

6.92<br />

2.16<br />

12.18<br />

52.46<br />

24.65<br />

6.20<br />

14.15<br />

-<br />

2.65<br />

3.81<br />

2.98<br />

40.17<br />

12.48<br />

8.13<br />

16.04<br />

31.85<br />

8.15<br />

10.81<br />

25.48<br />

8.66<br />

8.90<br />

4.86<br />

10.29<br />

8.57<br />

8.19<br />

4.74<br />

10.16<br />

63.03<br />

9.32<br />

0.12<br />

44.47<br />

32.75<br />

5.20<br />

7.45<br />

3.32<br />

27.94<br />

11.06<br />

10.50<br />

20.18<br />

34.56<br />

10.53<br />

11.84<br />

-<br />

9.31<br />

11.69<br />

3.31<br />

11.04<br />

13.66<br />

12.66<br />

-<br />

14.36<br />

57.59<br />

16.07<br />

4.99<br />

-<br />

-<br />

-<br />

8.47<br />

-<br />

31.71<br />

15.03<br />

49,549<br />

36,401<br />

23,324<br />

51,893<br />

31,696<br />

-<br />

34,270<br />

31,021<br />

-<br />

110,970<br />

1,071<br />

45,900<br />

-<br />

3,290<br />

36,514<br />

16,861<br />

38,289<br />

89,337<br />

20,062<br />

-<br />

59,039<br />

8,754<br />

64,786<br />

3,520<br />

15.6<br />

12.5<br />

15.5<br />

16.3<br />

24.2<br />

-<br />

18.6<br />

16.7<br />

-<br />

15.2<br />

17.4<br />

14.5<br />

-<br />

16.4<br />

15.2<br />

13.3<br />

12.4<br />

17.9<br />

18.3<br />

-<br />

17.5<br />

13.3<br />

12.5<br />

17.6<br />

0.45<br />

1.04<br />

1.29<br />

0.45<br />

0.46<br />

1.20<br />

0.46<br />

0.51<br />

0.31<br />

0.70<br />

0.36<br />

0.46<br />

0.16<br />

0.55<br />

1.66<br />

0.43<br />

-0.24<br />

1.21<br />

1.34<br />

0.19<br />

0.36<br />

-0.06<br />

1.12<br />

0.60<br />

8.89<br />

10.94<br />

19.84<br />

8.89<br />

15.78<br />

16.75<br />

9.97<br />

9.29<br />

1.75<br />

8.58<br />

13.45<br />

9.00<br />

2.79<br />

11.12<br />

29.96<br />

12.59<br />

13.30<br />

31.41<br />

19.68<br />

5.15<br />

9.67<br />

9.07<br />

20.11<br />

11.47<br />

2.02<br />

2.64<br />

1.33<br />

2.05<br />

0.32<br />

0.00<br />

0.99<br />

1.90<br />

3.84<br />

2.25<br />

1.02<br />

2.57<br />

4.86<br />

1.08<br />

0.85<br />

1.05<br />

3.47<br />

1.33<br />

1.94<br />

5.20<br />

1.18<br />

4.18<br />

0.98<br />

1.03<br />

Source: Morningstar. Data as of 4/30/08. Assets are total net assets in $US millions. Exp Ratio is expense ratio. YTD is year-to-date. Mkt Cap is geometric average market capitalization. P/E is price-to-earnings ratio.<br />

Sharpe is Sharpe ratio. Std Dev is 3-year standard deviation. Yield is 12-month.<br />

www.journalofindexes.<strong>com</strong><br />

July/August 2008<br />

63