Bigger Isn't Always Better - IndexUniverse.com

Bigger Isn't Always Better - IndexUniverse.com

Bigger Isn't Always Better - IndexUniverse.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

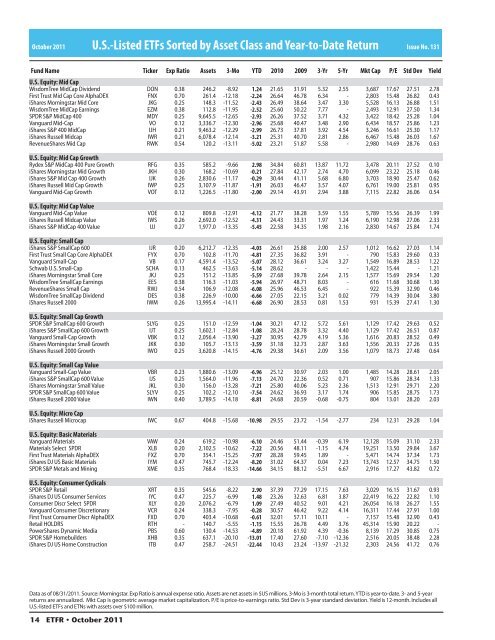

October 2011 U.S.-Listed ETFs Sorted by Asset Class and Year-to-Date Return<br />

Issue No. 131<br />

Fund Name Ticker Exp Ratio Assets 3-Mo YTD 2010 2009 3-Yr 5-Yr Mkt Cap P/E Std Dev<br />

U.S. Equity: Mid Cap<br />

WisdomTree MidCap Dividend DON 0.38 246.2 -8.92 1.24 21.65 31.91 5.32 2.55 3,687 17.67 27.51 2.78<br />

First Trust Mid Cap Core AlphaDEX FNX 0.70 261.4 -12.18 -2.24 26.64 46.78 6.34 - 2,803 15.48 26.82 0.43<br />

iShares Morningstar Mid Core JKG 0.25 148.3 -11.52 -2.43 26.49 38.64 3.47 3.30 5,528 16.13 26.88 1.51<br />

WisdomTree MidCap Earnings EZM 0.38 112.8 -11.95 -2.52 25.60 50.22 7.77 - 2,493 12.91 27.50 1.34<br />

SPDR S&P MidCap 400 MDY 0.25 9,645.5 -12.65 -2.93 26.26 37.52 3.71 4.32 3,422 18.42 25.28 1.04<br />

Vanguard Mid-Cap VO 0.12 3,336.7 -12.30 -2.96 25.68 40.47 3.48 2.90 6,434 18.57 25.86 1.23<br />

iShares S&P 400 MidCap IJH 0.21 9,463.2 -12.29 -2.99 26.73 37.81 3.92 4.54 3,246 16.61 25.30 1.17<br />

iShares Russell Midcap IWR 0.21 6,078.4 -12.14 -3.21 25.31 40.70 2.81 2.86 6,467 15.48 26.03 1.67<br />

RevenueShares Mid Cap RWK 0.54 120.2 -13.11 -5.02 23.21 51.87 5.58 - 2,980 14.69 28.76 0.63<br />

U.S. Equity: Mid Cap Growth<br />

Rydex S&P MidCap 400 Pure Growth RFG 0.35 585.2 -9.66 2.98 34.84 60.81 13.87 11.72 3,478 20.11 27.52 0.10<br />

iShares Morningstar Mid Growth JKH 0.30 168.2 -10.69 -0.21 27.84 42.17 2.74 4.70 6,099 23.22 25.18 0.46<br />

iShares S&P Mid Cap 400 Growth IJK 0.26 2,830.6 -11.17 -0.29 30.44 41.11 5.68 6.80 3,703 18.90 25.47 0.62<br />

iShares Russell Mid Cap Growth IWP 0.25 3,107.9 -11.87 -1.91 26.03 46.47 3.57 4.07 6,761 19.00 25.81 0.95<br />

Vanguard Mid-Cap Growth VOT 0.12 1,226.5 -11.80 -2.00 29.14 43.91 2.94 3.88 7,115 22.82 26.06 0.54<br />

U.S. Equity: Mid Cap Value<br />

Vanguard Mid-Cap Value VOE 0.12 809.8 -12.91 -4.12 21.77 38.28 3.59 1.55 5,789 15.56 26.39 1.99<br />

iShares Russell Midcap Value IWS 0.26 2,692.0 -12.52 -4.31 24.43 33.31 1.97 1.24 6,190 12.98 27.06 2.33<br />

iShares S&P MidCap 400 Value IJJ 0.27 1,977.0 -13.35 -5.45 22.58 34.35 1.98 2.16 2,830 14.67 25.84 1.74<br />

U.S. Equity: Small Cap<br />

iShares S&P SmallCap 600 IJR 0.20 6,212.7 -12.35 -4.03 26.61 25.88 2.00 2.57 1,012 16.62 27.03 1.14<br />

First Trust Small Cap Core AlphaDEX FYX 0.70 102.8 -11.70 -4.81 27.35 36.82 3.91 - 790 15.83 29.60 0.33<br />

Vanguard Small-Cap VB 0.17 4,591.4 -13.52 -5.07 28.12 36.61 3.24 3.27 1,549 16.89 28.53 1.22<br />

Schwab U.S. Small-Cap SCHA 0.13 462.5 -13.63 -5.14 28.62 - - - 1,422 15.44 - 1.21<br />

iShares Morningstar Small Core JKJ 0.25 151.2 -13.85 -5.59 27.68 39.78 2.64 2.15 1,577 15.69 29.54 1.20<br />

WisdomTree SmallCap Earnings EES 0.38 116.3 -11.03 -5.94 26.97 48.71 8.03 - 616 11.68 30.68 1.30<br />

RevenueShares Small Cap RWJ 0.54 106.9 -12.08 -6.08 25.96 46.53 6.45 - 922 15.39 32.90 0.46<br />

WisdomTree SmallCap Dividend DES 0.38 226.9 -10.00 -6.66 27.05 22.15 3.21 0.02 779 14.39 30.04 3.80<br />

iShares Russell 2000 IWM 0.26 13,995.4 -14.11 -6.68 26.90 28.53 0.81 1.53 931 15.39 27.41 1.30<br />

U.S. Equity: Small Cap Growth<br />

SPDR S&P SmallCap 600 Growth SLYG 0.25 151.0 -12.59 -1.04 30.21 47.12 5.72 5.61 1,129 17.42 29.63 0.52<br />

iShares S&P SmallCap 600 Growth IJT 0.25 1,602.1 -12.84 -1.08 28.24 28.78 3.32 4.40 1,129 17.42 26.51 0.87<br />

Vanguard Small-Cap Growth VBK 0.12 2,056.4 -13.90 -3.27 30.95 42.79 4.19 5.36 1,616 20.83 28.52 0.49<br />

iShares Morningstar Small Growth JKK 0.30 105.7 -13.13 -3.59 31.18 32.73 2.87 3.63 1,556 20.33 27.26 0.35<br />

iShares Russell 2000 Growth IWO 0.25 3,620.8 -14.15 -4.76 29.38 34.61 2.09 3.56 1,079 18.73 27.48 0.64<br />

U.S. Equity: Small Cap Value<br />

Vanguard Small-Cap Value VBR 0.23 1,880.6 -13.09 -6.96 25.12 30.97 2.03 1.00 1,485 14.28 28.61 2.05<br />

iShares S&P SmallCap 600 Value IJS 0.25 1,564.0 -11.96 -7.13 24.70 22.36 0.52 0.71 907 15.86 28.34 1.33<br />

iShares Morningstar Small Value JKL 0.30 156.0 -13.28 -7.21 25.80 40.06 5.23 2.36 1,513 12.91 29.71 2.20<br />

SPDR S&P SmallCap 600 Value SLYV 0.25 102.2 -12.10 -7.54 24.62 36.93 3.17 1.74 906 15.85 28.75 1.73<br />

iShares Russell 2000 Value IWN 0.40 3,789.5 -14.18 -8.81 24.68 20.59 -0.68 -0.75 804 13.01 28.20 2.03<br />

U.S. Equity: Micro Cap<br />

iShares Russell Microcap IWC 0.67 404.8 -15.68 -10.98 29.55 23.72 -1.54 -2.77 234 12.31 29.28 1.04<br />

U.S. Equity: Basic Materials<br />

Vanguard Materials VAW 0.24 619.2 -10.98 -6.10 24.46 51.44 -0.39 6.19 12,128 15.09 31.10 2.33<br />

Materials Select SPDR XLB 0.20 2,102.5 -10.62 -7.22 20.56 48.11 -1.15 4.74 19,251 13.50 29.84 3.67<br />

First Trust Materials AlphaDEX FXZ 0.70 354.1 -15.25 -7.97 28.28 59.45 1.89 - 5,471 14.74 37.34 1.73<br />

iShares DJ US Basic Materials IYM 0.47 745.7 -12.24 -8.20 31.02 64.37 0.04 7.23 13,743 12.57 34.75 1.50<br />

SPDR S&P Metals and Mining XME 0.35 768.4 -18.33 -14.66 34.15 88.12 -5.51 6.67 2,916 17.27 43.82 0.72<br />

U.S. Equity: Consumer Cyclicals<br />

SPDR S&P Retail XRT 0.35 545.6 -8.22 2.90 37.39 77.29 17.15 7.63 3,029 16.15 31.67 0.93<br />

iShares DJ US Consumer Services IYC 0.47 225.7 -6.99 1.48 23.26 32.63 6.81 3.87 22,419 16.22 22.82 1.10<br />

Consumer Discr Select SPDR XLY 0.20 2,076.2 -6.79 1.09 27.49 40.52 9.01 4.21 26,054 16.18 26.27 1.55<br />

Vanguard Consumer Discretionary VCR 0.24 338.3 -7.95 -0.28 30.57 46.42 9.22 4.14 16,311 17.44 27.91 1.00<br />

First Trust Consumer Discr AlphaDEX FXD 0.70 403.4 -10.68 -0.61 32.01 57.11 10.11 - 7,157 15.48 32.90 0.43<br />

Retail HOLDRS RTH - 140.7 -5.55 -1.15 15.55 26.78 4.49 3.76 45,314 15.90 20.22 -<br />

PowerShares Dynamic Media PBS 0.60 130.4 -14.53 -4.89 20.18 61.92 4.39 -0.36 8,139 17.29 30.85 0.75<br />

SPDR S&P Homebuilders XHB 0.35 637.1 -20.10 -13.01 17.40 27.60 -7.10 -12.36 2,516 20.05 38.48 2.28<br />

iShares DJ US Home Construction ITB 0.47 258.7 -24.51 -22.44 10.43 23.24 -13.97 -21.32 2,303 24.56 41.72 0.76<br />

Yield<br />

Data as of 08/31/2011. Source: Morningstar. Exp Ratio is annual expense ratio. Assets are net assets in $US millions. 3-Mo is 3-month total return. YTD is year-to-date. 3- and 5-year<br />

returns are annualized. Mkt Cap is geometric average market capitalization. P/E is price-to-earnings ratio. Std Dev is 3-year standard deviation. Yield is 12-month. Includes all<br />

U.S.-listed ETFs and ETNs with assets over $100 million.<br />

14 ETFR • October 2011