Bigger Isn't Always Better - IndexUniverse.com

Bigger Isn't Always Better - IndexUniverse.com

Bigger Isn't Always Better - IndexUniverse.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Why I Own: EWM<br />

iShares MSCI<br />

Malaysia ETF<br />

Name: Gary Gordon<br />

Title: President<br />

Firm: Pacific Park Financial Inc.<br />

Founded: 1984<br />

Location: Aliso Viejo, CA<br />

AUM: $95 million<br />

All ETFs? No (75%)<br />

ETFR: Why did you pick EWM?<br />

Gordon: Malaysia has been one of my<br />

favorites for three years. EWM only has<br />

about, over last year, a 0.5 correlation<br />

with VWO, which is kind of a weak correlation<br />

in the world of stocks, where correlations<br />

tend to be 0.8, or 0.9. The fund<br />

is also one-fifth as volatile, with a beta of<br />

0.17 with the S&P 500. You often can’t<br />

even get bonds with volatility that low in<br />

the current market environment.<br />

ETFR: Why not Indonesia, through the<br />

iShares MSCI Indonesia Investable Market<br />

Index Fund (NYSE Arca: EIDO)?<br />

Gordon: For one, Indonesia is far more<br />

volatile. Secondly, Indonesia’s economy<br />

has much higher inflation—double that<br />

of Malaysia. And its growth is expected<br />

to decline in 2012 because they’re going<br />

to have to fight that inflation.<br />

In contrast, inflation is stable in Malaysia.<br />

It has the lowest inflation in all of<br />

Asia, except for Taiwan. And its growth<br />

is expected to accelerate in 2012. With<br />

the Japanese rebuilding, they’ll need lots<br />

of tropical timber and liquefied natural<br />

gas that <strong>com</strong>es from Malaysia. Because<br />

of that, Malaysia’s growth is going to increase<br />

in the next year, but its inflation—<br />

unlike everywhere else in the region—is<br />

expected to be stable.<br />

Indonesia and India, for example,<br />

have incredible growth stories, but they<br />

both have to slow it down, so that’s the<br />

difference. Meanwhile, Malaysian unemployment<br />

is only 3.2 percent. It doesn’t<br />

get much better than that.<br />

top-performing funds. This year, it’s better<br />

than most of the emerging markets, and<br />

it’s on par with the S&P 500 right now.<br />

ETFR: I noticed that financials are the<br />

biggest part of the portfolio.<br />

Gordon: What’s interesting is what it<br />

dosen’t have: a lot of industrials or materials.<br />

With emerging markets, particularly<br />

Russia, Brazil—any of the BRIC countries—<br />

you usually get a lot of energy and materials,<br />

or industrials. The opposite is true<br />

for Malaysia. So you’re getting a different<br />

area of the emerging market field that you<br />

can’t get from big funds like Vanguard<br />

Emerging Markets (NYSE Arca: VWO).<br />

The first reaction people have when<br />

they see the financials is to panic. But<br />

here’s the twist on that: The safest banks<br />

in the world are Asian in origin. If we<br />

were left dealing with an Asia currency<br />

crisis like in ’98, it might be a different<br />

story. But China’s been tightening its reserves<br />

and raising bank reserves so that<br />

they could avoid the problems that happen<br />

here. And Malaysia is in a good situation<br />

as far as that’s concerned.<br />

Sure, there are drawbacks. But the<br />

risk, the beta itself, tells you that it hasn’t<br />

been something subject to rapid swings.<br />

That’s attractive to people who are trying<br />

to lower the volatility of their portfolio.<br />

So if the macroeconomic picture is<br />

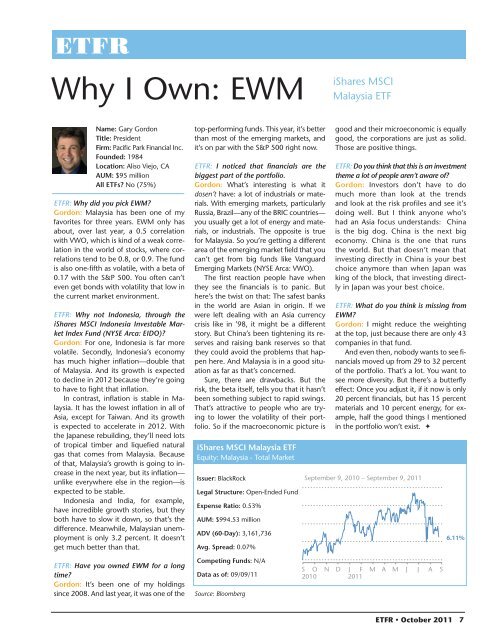

iShares MSCI Malaysia ETF<br />

Equity: Malaysia - Total Market<br />

Issuer: BlackRock<br />

Legal Structure: Open-Ended Fund<br />

Expense Ratio: 0.53%<br />

AUM: $994.53 million<br />

ADV (60-Day): 3,161,736<br />

Avg. Spread: 0.07%<br />

good and their microeconomic is equally<br />

good, the corporations are just as solid.<br />

Those are positive things.<br />

ETFR: Do you think that this is an investment<br />

theme a lot of people aren’t aware of?<br />

Gordon: Investors don’t have to do<br />

much more than look at the trends<br />

and look at the risk profiles and see it’s<br />

doing well. But I think anyone who’s<br />

had an Asia focus understands: China<br />

is the big dog. China is the next big<br />

economy. China is the one that runs<br />

the world. But that doesn’t mean that<br />

investing directly in China is your best<br />

choice anymore than when Japan was<br />

king of the block, that investing directly<br />

in Japan was your best choice.<br />

ETFR: What do you think is missing from<br />

EWM?<br />

Gordon: I might reduce the weighting<br />

at the top, just because there are only 43<br />

<strong>com</strong>panies in that fund.<br />

And even then, nobody wants to see financials<br />

moved up from 29 to 32 percent<br />

of the portfolio. That’s a lot. You want to<br />

see more diversity. But there’s a butterfly<br />

effect: Once you adjust it, if it now is only<br />

20 percent financials, but has 15 percent<br />

materials and 10 percent energy, for example,<br />

half the good things I mentioned<br />

in the portfolio won’t exist. <br />

September 9, 2010 – September 9, 2011<br />

6.11%<br />

ETFR: Have you owned EWM for a long<br />

time?<br />

Gordon: It’s been one of my holdings<br />

since 2008. And last year, it was one of the<br />

Competing Funds: N/A<br />

Data as of: 09/09/11<br />

Source: Bloomberg<br />

S O<br />

2010<br />

N<br />

D<br />

J F M A M J J A<br />

2011<br />

S<br />

ETFR • October 2011 7