Thorn-EMI 1995 Annual Report

Thorn-EMI 1995 Annual Report

Thorn-EMI 1995 Annual Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Financial review<br />

Other exceptional costs, amounting to €25.6m and reflecting the results ofour disposal<br />

activities have, as in previous years, been classified as non-operating exceptional items.The<br />

f,25.6m is calculated after charging €31.5m ofgoodwill that had previously been written off<br />

against shareholders' funds on acquisirion.<br />

Finance charges<br />

Net finance charges reduced by 17.0 per cent to f31.8m. The net beneficial impact ofacquisitions<br />

and disposals (f4.lm), strong underlying cashflow (f4.9m) and the full year beneflt oflast year's<br />

Redeemable Convertible Preference Shares (RCPS) conversion (!4.2m) were partially offset by<br />

the impact ofhigher interest rates (i5.4m) and the financing ofthe EBT (fl.7m). Interest cover has<br />

continued to improve and now stands at a very healthy 14.3 times (1994: 10.0 times).<br />

Taxation<br />

The tax charge offl57.6m includes f7.3m relating to exceptional items.Tax on underlying<br />

operations is ther-efore €150.3m at an underlying rate of 35.5 per cent (1994: 34.4 per cent).<br />

The increase in the underlying tax rate is due to the consolidation of TO<strong>EMI</strong>'s profits for<br />

the second halfofthe year, taxed at a higher rate inJapan.<br />

With most of the Group's profits coming from outside the UK, we continue to w te off<br />

significant amounts ofadvance corporation tax.The write-offin the yearwas f30.4m, bringing the<br />

cumulative total to f140.0m.This amount will be available for future use against the UK<br />

corporation tax charge.<br />

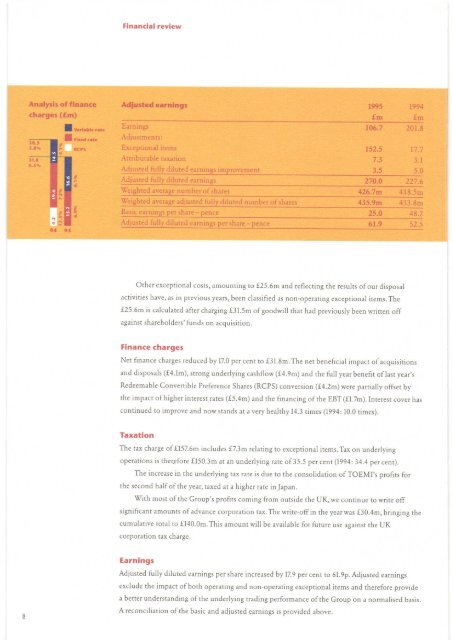

Earnings<br />

Adjusted fully diluted earnings per share increased by 179 per cent to 61.9p. Adjusted earnings<br />

exclude the impact ofboth operating and non-operating exceptional items and therefore provide<br />

a better understanding ofthe underlying trading performance ofthe Group on a normalised basis.<br />

A reconciliation ofthe basic and adjusted earnings is provided above.