Annual Report in English - Consilium

Annual Report in English - Consilium

Annual Report in English - Consilium

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

SEK 14.70. At the end of 2011, <strong>Consilium</strong>’s market<br />

capitalisation was SEK 189 million.<br />

Turnover<br />

2,013,097 shares were traded dur<strong>in</strong>g the year at a<br />

value of SEK 38,026,479, which corresponds to a<br />

turnover rate of 18 percent.<br />

Shareholders<br />

The number of shareholders at 31 December 2011<br />

was 1,738 (2,004).<br />

Warrants<br />

600,000 warrants were issued to key management<br />

personnel <strong>in</strong> the Group and 95,000 of these warrants<br />

have been subsequently repurchased. Each warrant<br />

entitles the holder to subscribe for one new B share<br />

<strong>in</strong> the period 1 January 2012 to 30 June 2012. The<br />

largest shareholders<br />

subscription price was SEK 2.47 per warrant and the<br />

exercise price is SEK 68.20 before adjustments for<br />

share issues.<br />

Dividend policy<br />

<strong>Consilium</strong>’s Board has decided that a cautious dividend<br />

policy will be adopted dur<strong>in</strong>g an anticipated growth<br />

phase. The dividend will eventually correspond to onequarter<br />

of profit after net f<strong>in</strong>ancial items and tax.<br />

Proposed dividend<br />

The Board will propose to the AGM that no dividend<br />

be paid for the 2011 f<strong>in</strong>ancial year. The proposal is<br />

based on the cont<strong>in</strong>u<strong>in</strong>g uncerta<strong>in</strong>ty about the global<br />

economic recovery.<br />

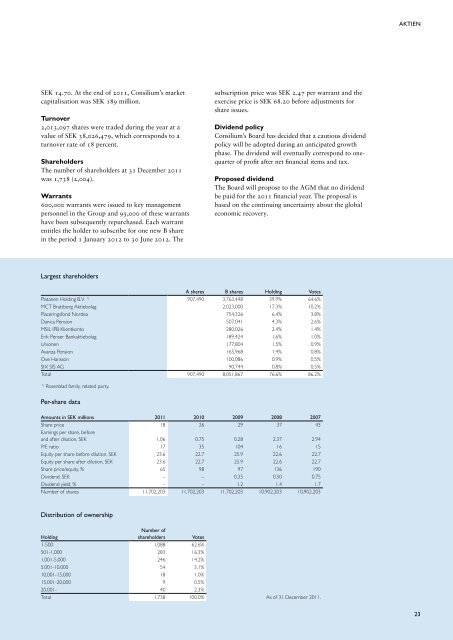

A shares B shares Hold<strong>in</strong>g votes<br />

platanen Hold<strong>in</strong>g B.V. 1) 907,490 3,763,448 39.9% 64.6%<br />

mCT Brattberg Aktiebolag 2,023,000 17.3% 10.2%<br />

placer<strong>in</strong>gsfond nordea 754,326 6.4% 3.8%<br />

danica pension 507,041 4.3% 2.6%<br />

msil ipB Klientkonto 280,026 2.4% 1.4%<br />

erik penser Bankaktiebolag 189,424 1.6% 1.0%<br />

unionen 177,804 1.5% 0.9%<br />

Avanza pension 165,968 1.4% 0.8%<br />

ove Hansson 100,086 0.9% 0.5%<br />

six sis AG 90,744 0.8% 0.5%<br />

Total 907,490 8,051,867 76.6% 86.2%<br />

1) Rosenblad family, related party.<br />

Per-share data<br />

Amounts <strong>in</strong> seK millions 2011 2010 2009 2008 2007<br />

share price 18 26 29 37 43<br />

earn<strong>in</strong>gs per share, before<br />

and after dilution, seK 1.06 0.75 0.28 2.37 2.94<br />

p/e ratio 17 35 104 16 15<br />

equity per share before dilution, seK 23.6 22.7 25.9 22.6 22.7<br />

equity per share after dilution, seK 23.6 22.7 25.9 22.6 22.7<br />

share price/equity, % 65 98 97 136 190<br />

dividend, seK – – 0.35 0.50 0.75<br />

dividend yield, % – – 1.2 1.4 1.7<br />

number of shares 11,702,203 11,702,203 11,702,203 10,902,203 10,902,203<br />

Distribution of ownership<br />

Hold<strong>in</strong>g<br />

number of<br />

shareholders votes<br />

1-500 1,088 62.6%<br />

501-1,000 283 16.3%<br />

1,001-5,000 246 14.2%<br />

5,001-10,000 54 3.1%<br />

10,001-15,000 18 1.0%<br />

15,001-20,000 9 0.5%<br />

20,001- 40 2.3%<br />

Total 1,738 100.0% As of 31 december 2011.<br />

AKtIen<br />

23