Annual Report in English - Consilium

Annual Report in English - Consilium

Annual Report in English - Consilium

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

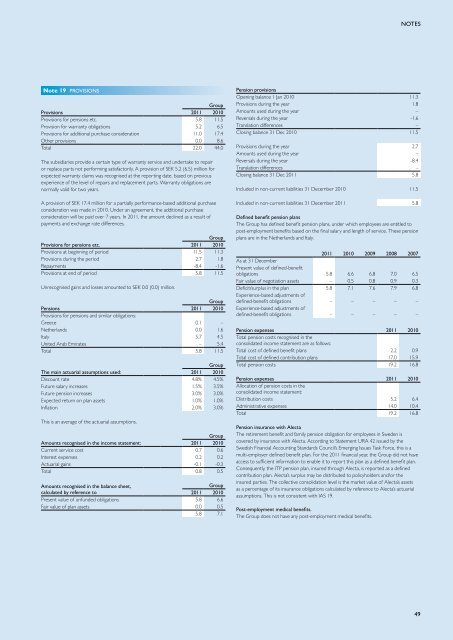

note 19 PRovIsIons<br />

Group<br />

Provisions 2011 2010<br />

provisions for pensions etc. 5.8 11.5<br />

provision for warranty obligations 5.2 6.5<br />

provisions for additional purchase consideration 11.0 17.4<br />

other provisions 0.0 8.6<br />

Total 22.0 44.0<br />

The subsidiaries provide a certa<strong>in</strong> type of warranty service and undertake to repair<br />

or replace parts not perform<strong>in</strong>g satisfactorily. A provision of seK 5.2 (6.5) million for<br />

expected warranty claims was recognised at the report<strong>in</strong>g date, based on previous<br />

experience of the level of repairs and replacement parts. Warranty obligations are<br />

normally valid for two years.<br />

A provision of seK 17.4 million for a partially performance-based additional purchase<br />

consideration was made <strong>in</strong> 2010. under an agreement, the additional purchase<br />

consideration will be paid over 7 years. <strong>in</strong> 2011, the amount decl<strong>in</strong>ed as a result of<br />

payments and exchange rate differences.<br />

Group<br />

Provisions for pensions etc. 2011 2010<br />

provisions at beg<strong>in</strong>n<strong>in</strong>g of period 11.5 11.3<br />

provisions dur<strong>in</strong>g the period 2.7 1.8<br />

Repayments -8.4 -1.6<br />

provisions at end of period 5.8 11.5<br />

unrecognised ga<strong>in</strong>s and losses amounted to seK 0.0 (0.0) million.<br />

Group<br />

Pensions 2011 2010<br />

provisions for pensions and similar obligations:<br />

Greece 0.1 –<br />

netherlands 0.0 1.6<br />

italy 5.7 4.5<br />

united Arab emirates – 5.4<br />

Total 5.8 11.5<br />

Group<br />

the ma<strong>in</strong> actuarial assumptions used: 2011 2010<br />

discount rate 4.8% 4.5%<br />

future salary <strong>in</strong>creases 1.5% 3.5%<br />

future pension <strong>in</strong>creases 3.0% 3.0%<br />

expected return on plan assets 1.0% 1.0%<br />

<strong>in</strong>flation 2.0% 3.0%<br />

This is an average of the actuarial assumptions.<br />

Group<br />

Amounts recognised <strong>in</strong> the <strong>in</strong>come statement: 2011 2010<br />

Current service cost 0.7 0.6<br />

<strong>in</strong>terest expenses 0.2 0.2<br />

Actuarial ga<strong>in</strong>s -0.1 -0.3<br />

Total 0.8 0.5<br />

Amounts recognised <strong>in</strong> the balance sheet,<br />

Group<br />

calculated by reference to<br />

2011 2010<br />

present value of unfunded obligations 5.8 6.6<br />

fair value of plan assets 0.0 0.5<br />

5.8 7.1<br />

notes<br />

Pension provisions<br />

open<strong>in</strong>g balance 1 Jan 2010 11.3<br />

provisions dur<strong>in</strong>g the year 1.8<br />

Amounts used dur<strong>in</strong>g the year –<br />

Reversals dur<strong>in</strong>g the year -1.6<br />

Translation differences –<br />

Clos<strong>in</strong>g balance 31 dec 2010 11.5<br />

provisions dur<strong>in</strong>g the year 2.7<br />

Amounts used dur<strong>in</strong>g the year –<br />

Reversals dur<strong>in</strong>g the year -8.4<br />

Translation differences –<br />

Clos<strong>in</strong>g balance 31 dec 2011 5.8<br />

<strong>in</strong>cluded <strong>in</strong> non-current liabilities 31 december 2010 11.5<br />

<strong>in</strong>cluded <strong>in</strong> non-current liabilities 31 december 2011 5.8<br />

Def<strong>in</strong>ed benefit pension plans<br />

The Group has def<strong>in</strong>ed benefit pension plans, under which employees are entitled to<br />

post-employment benefits based on the f<strong>in</strong>al salary and length of service. These pension<br />

plans are <strong>in</strong> the netherlands and italy.<br />

2011 2010 2009 2008 2007<br />

As at 31 december<br />

present value of def<strong>in</strong>ed-benefit<br />

obligations 5.8 6.6 6.8 7.0 6.5<br />

fair value of negotiation assets – 0.5 0.8 0.9 0.3<br />

deficit/surplus <strong>in</strong> the plan<br />

experience-based adjustments of<br />

5.8 7.1 7.6 7.9 6.8<br />

def<strong>in</strong>ed-benefit obligations<br />

experience-based adjustments of<br />

– – – – –<br />

def<strong>in</strong>ed-benefit obligations – – – – –<br />

Pension expenses 2011 2010<br />

Total pension costs recognised <strong>in</strong> the<br />

consolidated <strong>in</strong>come statement are as follows:<br />

Total cost of def<strong>in</strong>ed benefit plans 2.2 0.9<br />

Total cost of def<strong>in</strong>ed contribution plans 17.0 15.9<br />

Total pension costs 19.2 16.8<br />

Pension expenses 2011 2010<br />

Allocation of pension costs <strong>in</strong> the<br />

consolidated <strong>in</strong>come statement:<br />

distribution costs 5.2 6.4<br />

Adm<strong>in</strong>istrative expenses 14.0 10.4<br />

Total 19.2 16.8<br />

Pension <strong>in</strong>surance with Alecta<br />

The retirement benefit and family pension obligation for employees <strong>in</strong> sweden is<br />

covered by <strong>in</strong>surance with Alecta. Accord<strong>in</strong>g to statement uRA 42 issued by the<br />

swedish f<strong>in</strong>ancial Account<strong>in</strong>g standards Council’s emerg<strong>in</strong>g issues Task force, this is a<br />

multi-employer def<strong>in</strong>ed benefit plan. for the 2011 f<strong>in</strong>ancial year, the Group did not have<br />

access to sufficient <strong>in</strong>formation to enable it to report this plan as a def<strong>in</strong>ed benefit plan.<br />

Consequently, the iTp pension plan, <strong>in</strong>sured through Alecta, is reported as a def<strong>in</strong>ed<br />

contribution plan. Alecta’s surplus may be distributed to policyholders and/or the<br />

<strong>in</strong>sured parties. The collective consolidation level is the market value of Alecta’s assets<br />

as a percentage of its <strong>in</strong>surance obligations calculated by reference to Alecta’s actuarial<br />

assumptions. This is not consistent with iAs 19.<br />

Post-employment medical benefits.<br />

The Group does not have any post-employment medical benefits.<br />

49