Annual Report in English - Consilium

Annual Report in English - Consilium

Annual Report in English - Consilium

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

KeY FIGuRes AnD DeFInItIons<br />

Key figures and f<strong>in</strong>ancial ratios<br />

KeY FIGuRes AnD DeFInItIons<br />

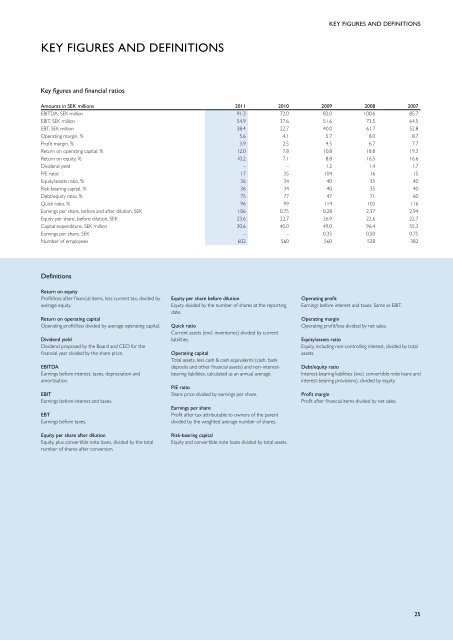

Amounts <strong>in</strong> seK millions 2011 2010 2009 2008 2007<br />

eBiTdA, seK million 91.3 72.0 82.0 100.6 85.7<br />

eBiT, seK million 54.9 37.6 51.6 73.5 64.5<br />

eBT, seK million 38.4 22.7 40.0 61.7 52.8<br />

operat<strong>in</strong>g marg<strong>in</strong>, % 5.6 4.1 5.7 8.0 8.7<br />

profit marg<strong>in</strong>, % 3.9 2.5 4.5 6.7 7.7<br />

Return on operat<strong>in</strong>g capital, % 12.0 7.8 10.8 18.8 19.3<br />

Return on equity, % 10.2 7.1 8.8 16.5 16.6<br />

dividend yield – – 1.2 1.4 1.7<br />

p/e ratio 17 35 104 16 15<br />

equity/assets ratio, % 36 34 40 35 40<br />

Risk-bear<strong>in</strong>g capital, % 36 34 40 35 40<br />

debt/equity ratio, % 75 77 47 71 60<br />

Quick ratio, % 96 99 114 103 116<br />

earn<strong>in</strong>gs per share, before and after dilution, seK 1.06 0.75 0.28 2.37 2.94<br />

equity per share, before dilution, seK 23.6 22.7 26.9 22.6 22.7<br />

Capital expenditure, seK million 30.6 40.0 49.0 96.4 55.3<br />

earn<strong>in</strong>gs per share, seK – – 0.35 0.50 0.75<br />

number of employees 602 560 560 528 382<br />

Def<strong>in</strong>itions<br />

Return on equity<br />

profit/loss after f<strong>in</strong>ancial items, less current tax, divided by<br />

average equity.<br />

Return on operat<strong>in</strong>g capital<br />

operat<strong>in</strong>g profit/loss divided by average operat<strong>in</strong>g capital.<br />

Dividend yield<br />

dividend proposed by the Board and Ceo for the<br />

f<strong>in</strong>ancial year divided by the share price.<br />

eBItDA<br />

earn<strong>in</strong>gs before <strong>in</strong>terest, taxes, depreciation and<br />

amortisation.<br />

eBIt<br />

earn<strong>in</strong>gs before <strong>in</strong>terest and taxes.<br />

eBt<br />

earn<strong>in</strong>gs before taxes.<br />

equity per share after dilution<br />

equity, plus convertible note loans, divided by the total<br />

number of shares after conversion.<br />

equity per share before dilution<br />

equity divided by the number of shares at the report<strong>in</strong>g<br />

date.<br />

Quick ratio<br />

Current assets (excl. <strong>in</strong>ventories) divided by current<br />

liabilities.<br />

operat<strong>in</strong>g capital<br />

Total assets, less cash & cash equivalents (cash, bank<br />

deposits and other f<strong>in</strong>ancial assets) and non-<strong>in</strong>terestbear<strong>in</strong>g<br />

liabilities, calculated as an annual average.<br />

P/e ratio<br />

share price divided by earn<strong>in</strong>gs per share.<br />

earn<strong>in</strong>gs per share<br />

profit after tax attributable to owners of the parent<br />

divided by the weighted average number of shares.<br />

Risk-bear<strong>in</strong>g capital<br />

equity and convertible note loans divided by total assets.<br />

operat<strong>in</strong>g profit<br />

earn<strong>in</strong>gs before <strong>in</strong>terest and taxes. same as eBiT.<br />

operat<strong>in</strong>g marg<strong>in</strong><br />

operat<strong>in</strong>g profit/loss divided by net sales.<br />

equity/assets ratio<br />

equity, <strong>in</strong>clud<strong>in</strong>g non-controll<strong>in</strong>g <strong>in</strong>terest, divided by total<br />

assets.<br />

Debt/equity ratio<br />

<strong>in</strong>terest-bear<strong>in</strong>g liabilities (excl. convertible note loans and<br />

<strong>in</strong>terest-bear<strong>in</strong>g provisions), divided by equity.<br />

Profit marg<strong>in</strong><br />

profit after f<strong>in</strong>ancial items divided by net sales.<br />

25