V.A.T. Act 2007 - Kenya Revenue Authority

V.A.T. Act 2007 - Kenya Revenue Authority

V.A.T. Act 2007 - Kenya Revenue Authority

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

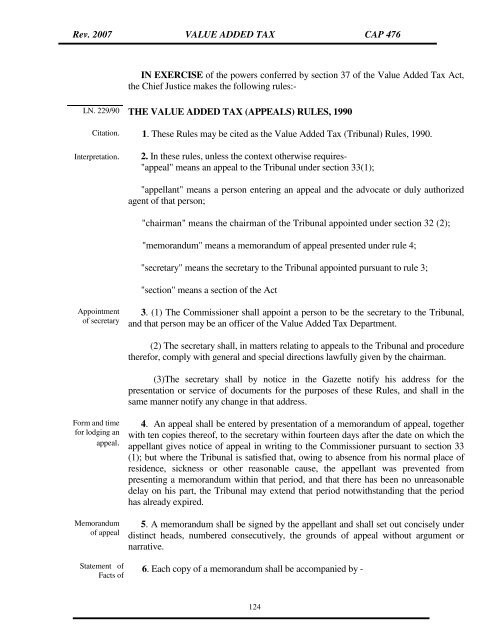

Rev. <strong>2007</strong> VALUE ADDED TAX CAP 476<br />

IN EXERCISE of the powers conferred by section 37 of the Value Added Tax <strong>Act</strong>,<br />

the Chief Justice makes the following rules:-<br />

LN. 229/90 THE VALUE ADDED TAX (APPEALS) RULES, 1990<br />

Citation. 1. These Rules may be cited as the Value Added Tax (Tribunal) Rules, 1990.<br />

Interpretation.<br />

2. In these rules, unless the context otherwise requires-<br />

"appeal" means an appeal to the Tribunal under section 33(1);<br />

"appellant" means a person entering an appeal and the advocate or duly authorized<br />

agent of that person;<br />

"chairman" means the chairman of the Tribunal appointed under section 32 (2);<br />

"memorandum" means a memorandum of appeal presented under rule 4;<br />

"secretary" means the secretary to the Tribunal appointed pursuant to rule 3;<br />

"section" means a section of the <strong>Act</strong><br />

Appointment<br />

of secretary<br />

3. (1) The Commissioner shall appoint a person to be the secretary to the Tribunal,<br />

and that person may be an officer of the Value Added Tax Department.<br />

(2) The secretary shall, in matters relating to appeals to the Tribunal and procedure<br />

therefor, comply with general and special directions lawfully given by the chairman.<br />

(3)The secretary shall by notice in the Gazette notify his address for the<br />

presentation or service of documents for the purposes of these Rules, and shall in the<br />

same manner notify any change in that address.<br />

Form and time<br />

for lodging an<br />

appeal.<br />

Memorandum<br />

of appeal<br />

Statement of<br />

Facts of<br />

4. An appeal shall be entered by presentation of a memorandum of appeal, together<br />

with ten copies thereof, to the secretary within fourteen days after the date on which the<br />

appellant gives notice of appeal in writing to the Commissioner pursuant to section 33<br />

(1); but where the Tribunal is satisfied that, owing to absence from his normal place of<br />

residence, sickness or other reasonable cause, the appellant was prevented from<br />

presenting a memorandum within that period, and that there has been no unreasonable<br />

delay on his part, the Tribunal may extend that period notwithstanding that the period<br />

has already expired.<br />

5. A memorandum shall be signed by the appellant and shall set out concisely under<br />

distinct heads, numbered consecutively, the grounds of appeal without argument or<br />

narrative.<br />

6. Each copy of a memorandum shall be accompanied by -<br />

124