V.A.T. Act 2007 - Kenya Revenue Authority

V.A.T. Act 2007 - Kenya Revenue Authority

V.A.T. Act 2007 - Kenya Revenue Authority

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

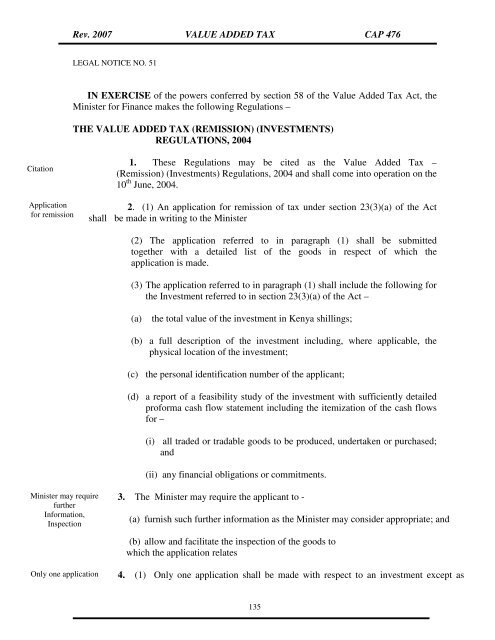

Rev. <strong>2007</strong> VALUE ADDED TAX CAP 476<br />

LEGAL NOTICE NO. 51<br />

IN EXERCISE of the powers conferred by section 58 of the Value Added Tax <strong>Act</strong>, the<br />

Minister for Finance makes the following Regulations –<br />

THE VALUE ADDED TAX (REMISSION) (INVESTMENTS)<br />

REGULATIONS, 2004<br />

Citation<br />

Application<br />

for remission<br />

1. These Regulations may be cited as the Value Added Tax –<br />

(Remission) (Investments) Regulations, 2004 and shall come into operation on the<br />

10 th June, 2004.<br />

2. (1) An application for remission of tax under section 23(3)(a) of the <strong>Act</strong><br />

shall be made in writing to the Minister<br />

(2) The application referred to in paragraph (1) shall be submitted<br />

together with a detailed list of the goods in respect of which the<br />

application is made.<br />

(3) The application referred to in paragraph (1) shall include the following for<br />

the Investment referred to in section 23(3)(a) of the <strong>Act</strong> –<br />

(a) the total value of the investment in <strong>Kenya</strong> shillings;<br />

(b) a full description of the investment including, where applicable, the<br />

physical location of the investment;<br />

(c) the personal identification number of the applicant;<br />

(d) a report of a feasibility study of the investment with sufficiently detailed<br />

proforma cash flow statement including the itemization of the cash flows<br />

for –<br />

(i) all traded or tradable goods to be produced, undertaken or purchased;<br />

and<br />

(ii) any financial obligations or commitments.<br />

Minister may require<br />

further<br />

Information,<br />

Inspection<br />

3. The Minister may require the applicant to -<br />

(a) furnish such further information as the Minister may consider appropriate; and<br />

(b) allow and facilitate the inspection of the goods to<br />

which the application relates<br />

Only one application<br />

4. (1) Only one application shall be made with respect to an investment except as<br />

135