V.A.T. Act 2007 - Kenya Revenue Authority

V.A.T. Act 2007 - Kenya Revenue Authority

V.A.T. Act 2007 - Kenya Revenue Authority

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

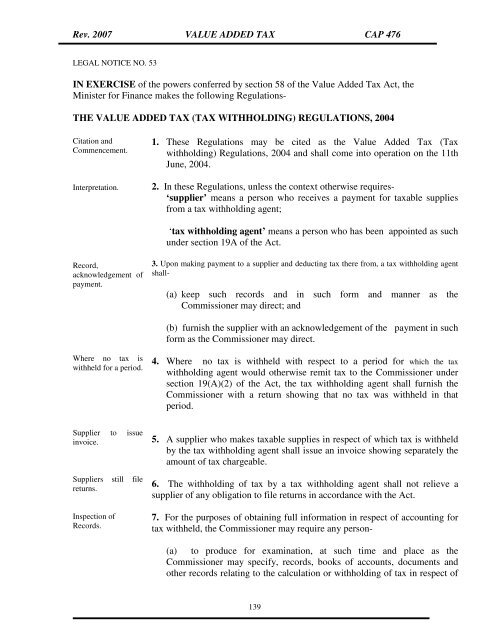

Rev. <strong>2007</strong> VALUE ADDED TAX CAP 476<br />

LEGAL NOTICE NO. 53<br />

IN EXERCISE of the powers conferred by section 58 of the Value Added Tax <strong>Act</strong>, the<br />

Minister for Finance makes the following Regulations-<br />

THE VALUE ADDED TAX (TAX WITHHOLDING) REGULATIONS, 2004<br />

Citation and<br />

Commencement.<br />

Interpretation.<br />

1. These Regulations may be cited as the Value Added Tax (Tax<br />

withholding) Regulations, 2004 and shall come into operation on the 11th<br />

June, 2004.<br />

2. In these Regulations, unless the context otherwise requires-<br />

‘supplier’ means a person who receives a payment for taxable supplies<br />

from a tax withholding agent;<br />

‘tax withholding agent’ means a person who has been appointed as such<br />

under section 19A of the <strong>Act</strong>.<br />

Record,<br />

acknowledgement of<br />

payment.<br />

3. Upon making payment to a supplier and deducting tax there from, a tax withholding agent<br />

shall-<br />

(a) keep such records and in such form and manner as the<br />

Commissioner may direct; and<br />

(b) furnish the supplier with an acknowledgement of the payment in such<br />

form as the Commissioner may direct.<br />

Where no tax is<br />

withheld for a period.<br />

4. Where no tax is withheld with respect to a period for which the tax<br />

withholding agent would otherwise remit tax to the Commissioner under<br />

section 19(A)(2) of the <strong>Act</strong>, the tax withholding agent shall furnish the<br />

Commissioner with a return showing that no tax was withheld in that<br />

period.<br />

Supplier to issue<br />

invoice.<br />

Suppliers still file<br />

returns.<br />

Inspection of<br />

Records.<br />

5. A supplier who makes taxable supplies in respect of which tax is withheld<br />

by the tax withholding agent shall issue an invoice showing separately the<br />

amount of tax chargeable.<br />

6. The withholding of tax by a tax withholding agent shall not relieve a<br />

supplier of any obligation to file returns in accordance with the <strong>Act</strong>.<br />

7. For the purposes of obtaining full information in respect of accounting for<br />

tax withheld, the Commissioner may require any person-<br />

(a) to produce for examination, at such time and place as the<br />

Commissioner may specify, records, books of accounts, documents and<br />

other records relating to the calculation or withholding of tax in respect of<br />

139