V.A.T. Act 2007 - Kenya Revenue Authority

V.A.T. Act 2007 - Kenya Revenue Authority

V.A.T. Act 2007 - Kenya Revenue Authority

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

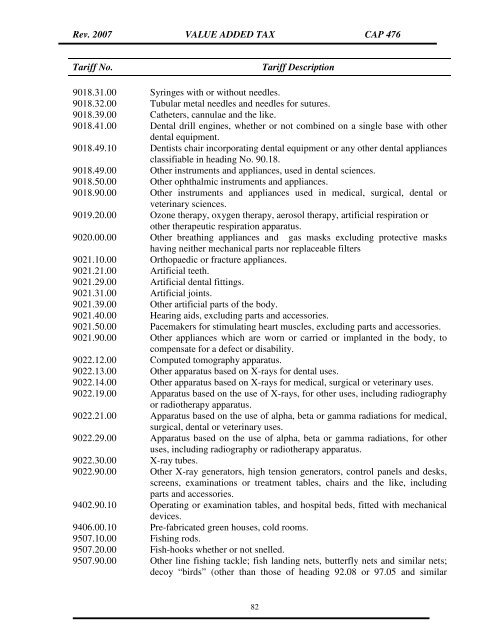

Rev. <strong>2007</strong> VALUE ADDED TAX CAP 476<br />

Tariff No.<br />

Tariff Description<br />

9018.31.00 Syringes with or without needles.<br />

9018.32.00 Tubular metal needles and needles for sutures.<br />

9018.39.00 Catheters, cannulae and the like.<br />

9018.41.00 Dental drill engines, whether or not combined on a single base with other<br />

dental equipment.<br />

9018.49.10 Dentists chair incorporating dental equipment or any other dental appliances<br />

classifiable in heading No. 90.18.<br />

9018.49.00 Other instruments and appliances, used in dental sciences.<br />

9018.50.00 Other ophthalmic instruments and appliances.<br />

9018.90.00 Other instruments and appliances used in medical, surgical, dental or<br />

veterinary sciences.<br />

9019.20.00 Ozone therapy, oxygen therapy, aerosol therapy, artificial respiration or<br />

other therapeutic respiration apparatus.<br />

9020.00.00 Other breathing appliances and gas masks excluding protective masks<br />

having neither mechanical parts nor replaceable filters<br />

9021.10.00 Orthopaedic or fracture appliances.<br />

9021.21.00 Artificial teeth.<br />

9021.29.00 Artificial dental fittings.<br />

9021.31.00 Artificial joints.<br />

9021.39.00 Other artificial parts of the body.<br />

9021.40.00 Hearing aids, excluding parts and accessories.<br />

9021.50.00 Pacemakers for stimulating heart muscles, excluding parts and accessories.<br />

9021.90.00 Other appliances which are worn or carried or implanted in the body, to<br />

compensate for a defect or disability.<br />

9022.12.00 Computed tomography apparatus.<br />

9022.13.00 Other apparatus based on X-rays for dental uses.<br />

9022.14.00 Other apparatus based on X-rays for medical, surgical or veterinary uses.<br />

9022.19.00 Apparatus based on the use of X-rays, for other uses, including radiography<br />

or radiotherapy apparatus.<br />

9022.21.00 Apparatus based on the use of alpha, beta or gamma radiations for medical,<br />

surgical, dental or veterinary uses.<br />

9022.29.00 Apparatus based on the use of alpha, beta or gamma radiations, for other<br />

uses, including radiography or radiotherapy apparatus.<br />

9022.30.00 X-ray tubes.<br />

9022.90.00 Other X-ray generators, high tension generators, control panels and desks,<br />

screens, examinations or treatment tables, chairs and the like, including<br />

parts and accessories.<br />

9402.90.10 Operating or examination tables, and hospital beds, fitted with mechanical<br />

devices.<br />

9406.00.10 Pre-fabricated green houses, cold rooms.<br />

9507.10.00 Fishing rods.<br />

9507.20.00 Fish-hooks whether or not snelled.<br />

9507.90.00 Other line fishing tackle; fish landing nets, butterfly nets and similar nets;<br />

decoy “birds” (other than those of heading 92.08 or 97.05 and similar<br />

82