V.A.T. Act 2007 - Kenya Revenue Authority

V.A.T. Act 2007 - Kenya Revenue Authority

V.A.T. Act 2007 - Kenya Revenue Authority

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

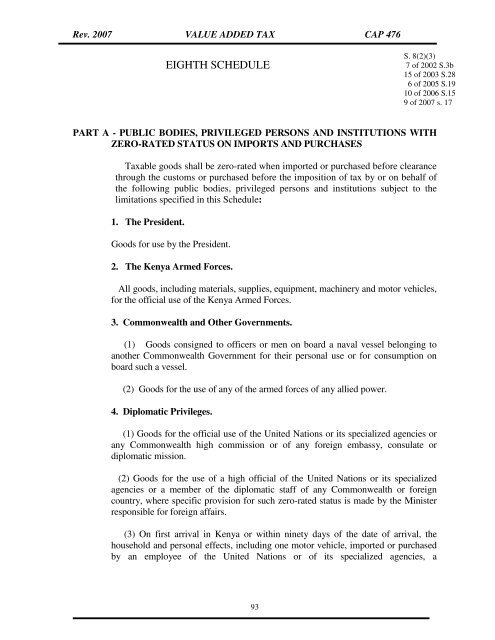

Rev. <strong>2007</strong> VALUE ADDED TAX CAP 476<br />

EIGHTH SCHEDULE<br />

S. 8(2)(3)<br />

7 of 2002 S.3b<br />

15 of 2003 S.28<br />

6 of 2005 S.19<br />

10 of 2006 S.15<br />

9 of <strong>2007</strong> s. 17<br />

PART A - PUBLIC BODIES, PRIVILEGED PERSONS AND INSTITUTIONS WITH<br />

ZERO-RATED STATUS ON IMPORTS AND PURCHASES<br />

Taxable goods shall be zero-rated when imported or purchased before clearance<br />

through the customs or purchased before the imposition of tax by or on behalf of<br />

the following public bodies, privileged persons and institutions subject to the<br />

limitations specified in this Schedule:<br />

1. The President.<br />

Goods for use by the President.<br />

2. The <strong>Kenya</strong> Armed Forces.<br />

All goods, including materials, supplies, equipment, machinery and motor vehicles,<br />

for the official use of the <strong>Kenya</strong> Armed Forces.<br />

3. Commonwealth and Other Governments.<br />

(1) Goods consigned to officers or men on board a naval vessel belonging to<br />

another Commonwealth Government for their personal use or for consumption on<br />

board such a vessel.<br />

(2) Goods for the use of any of the armed forces of any allied power.<br />

4. Diplomatic Privileges.<br />

(1) Goods for the official use of the United Nations or its specialized agencies or<br />

any Commonwealth high commission or of any foreign embassy, consulate or<br />

diplomatic mission.<br />

(2) Goods for the use of a high official of the United Nations or its specialized<br />

agencies or a member of the diplomatic staff of any Commonwealth or foreign<br />

country, where specific provision for such zero-rated status is made by the Minister<br />

responsible for foreign affairs.<br />

(3) On first arrival in <strong>Kenya</strong> or within ninety days of the date of arrival, the<br />

household and personal effects, including one motor vehicle, imported or purchased<br />

by an employee of the United Nations or of its specialized agencies, a<br />

93