V.A.T. Act 2007 - Kenya Revenue Authority

V.A.T. Act 2007 - Kenya Revenue Authority

V.A.T. Act 2007 - Kenya Revenue Authority

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

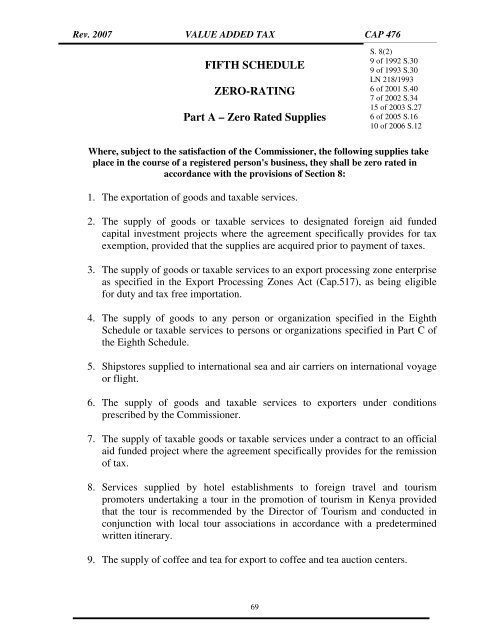

Rev. <strong>2007</strong> VALUE ADDED TAX CAP 476<br />

FIFTH SCHEDULE<br />

ZERO-RATING<br />

Part A – Zero Rated Supplies<br />

S. 8(2)<br />

9 of 1992 S.30<br />

9 of 1993 S.30<br />

LN 218/1993<br />

6 of 2001 S.40<br />

7 of 2002 S.34<br />

15 of 2003 S.27<br />

6 of 2005 S.16<br />

10 of 2006 S.12<br />

Where, subject to the satisfaction of the Commissioner, the following supplies take<br />

place in the course of a registered person's business, they shall be zero rated in<br />

accordance with the provisions of Section 8:<br />

1. The exportation of goods and taxable services.<br />

2. The supply of goods or taxable services to designated foreign aid funded<br />

capital investment projects where the agreement specifically provides for tax<br />

exemption, provided that the supplies are acquired prior to payment of taxes.<br />

3. The supply of goods or taxable services to an export processing zone enterprise<br />

as specified in the Export Processing Zones <strong>Act</strong> (Cap.517), as being eligible<br />

for duty and tax free importation.<br />

4. The supply of goods to any person or organization specified in the Eighth<br />

Schedule or taxable services to persons or organizations specified in Part C of<br />

the Eighth Schedule.<br />

5. Shipstores supplied to international sea and air carriers on international voyage<br />

or flight.<br />

6. The supply of goods and taxable services to exporters under conditions<br />

prescribed by the Commissioner.<br />

7. The supply of taxable goods or taxable services under a contract to an official<br />

aid funded project where the agreement specifically provides for the remission<br />

of tax.<br />

8. Services supplied by hotel establishments to foreign travel and tourism<br />

promoters undertaking a tour in the promotion of tourism in <strong>Kenya</strong> provided<br />

that the tour is recommended by the Director of Tourism and conducted in<br />

conjunction with local tour associations in accordance with a predetermined<br />

written itinerary.<br />

9. The supply of coffee and tea for export to coffee and tea auction centers.<br />

69