V.A.T. Act 2007 - Kenya Revenue Authority

V.A.T. Act 2007 - Kenya Revenue Authority

V.A.T. Act 2007 - Kenya Revenue Authority

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

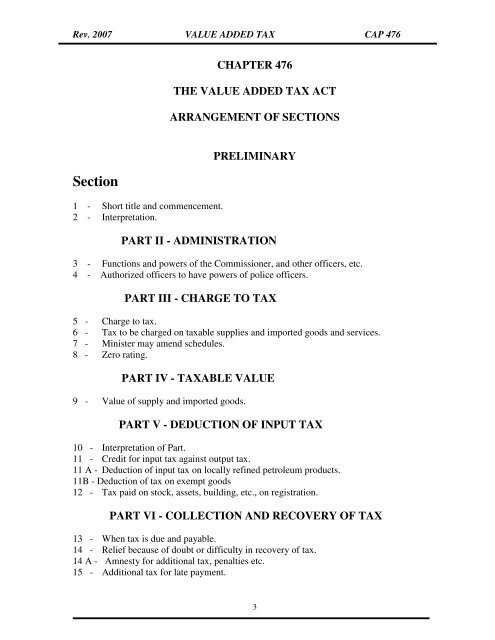

Rev. <strong>2007</strong> VALUE ADDED TAX CAP 476<br />

CHAPTER 476<br />

THE VALUE ADDED TAX ACT<br />

ARRANGEMENT OF SECTIONS<br />

Section<br />

1 - Short title and commencement.<br />

2 - Interpretation.<br />

PRELIMINARY<br />

PART II - ADMINISTRATION<br />

3 - Functions and powers of the Commissioner, and other officers, etc.<br />

4 - Authorized officers to have powers of police officers.<br />

PART III - CHARGE TO TAX<br />

5 - Charge to tax.<br />

6 - Tax to be charged on taxable supplies and imported goods and services.<br />

7 - Minister may amend schedules.<br />

8 - Zero rating.<br />

PART IV - TAXABLE VALUE<br />

9 - Value of supply and imported goods.<br />

PART V - DEDUCTION OF INPUT TAX<br />

10 - Interpretation of Part.<br />

11 - Credit for input tax against output tax.<br />

11 A - Deduction of input tax on locally refined petroleum products.<br />

11B - Deduction of tax on exempt goods<br />

12 - Tax paid on stock, assets, building, etc., on registration.<br />

PART VI - COLLECTION AND RECOVERY OF TAX<br />

13 - When tax is due and payable.<br />

14 - Relief because of doubt or difficulty in recovery of tax.<br />

14 A - Amnesty for additional tax, penalties etc.<br />

15 - Additional tax for late payment.<br />

3