V.A.T. Act 2007 - Kenya Revenue Authority

V.A.T. Act 2007 - Kenya Revenue Authority

V.A.T. Act 2007 - Kenya Revenue Authority

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

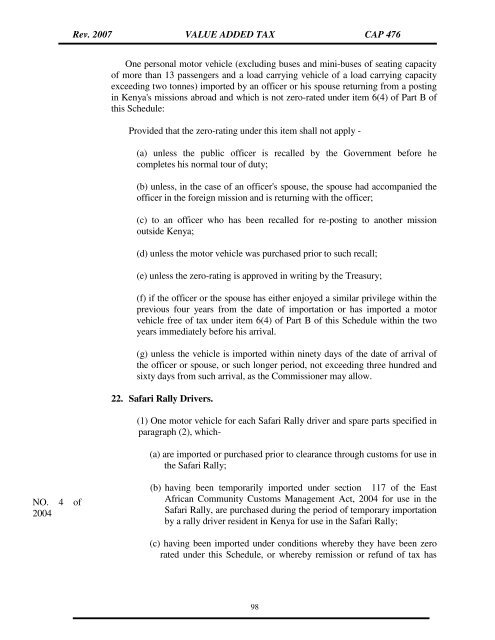

Rev. <strong>2007</strong> VALUE ADDED TAX CAP 476<br />

One personal motor vehicle (excluding buses and mini-buses of seating capacity<br />

of more than 13 passengers and a load carrying vehicle of a load carrying capacity<br />

exceeding two tonnes) imported by an officer or his spouse returning from a posting<br />

in <strong>Kenya</strong>'s missions abroad and which is not zero-rated under item 6(4) of Part B of<br />

this Schedule:<br />

Provided that the zero-rating under this item shall not apply -<br />

(a) unless the public officer is recalled by the Government before he<br />

completes his normal tour of duty;<br />

(b) unless, in the case of an officer's spouse, the spouse had accompanied the<br />

officer in the foreign mission and is returning with the officer;<br />

(c) to an officer who has been recalled for re-posting to another mission<br />

outside <strong>Kenya</strong>;<br />

(d) unless the motor vehicle was purchased prior to such recall;<br />

(e) unless the zero-rating is approved in writing by the Treasury;<br />

(f) if the officer or the spouse has either enjoyed a similar privilege within the<br />

previous four years from the date of importation or has imported a motor<br />

vehicle free of tax under item 6(4) of Part B of this Schedule within the two<br />

years immediately before his arrival.<br />

(g) unless the vehicle is imported within ninety days of the date of arrival of<br />

the officer or spouse, or such longer period, not exceeding three hundred and<br />

sixty days from such arrival, as the Commissioner may allow.<br />

22. Safari Rally Drivers.<br />

(1) One motor vehicle for each Safari Rally driver and spare parts specified in<br />

paragraph (2), which-<br />

(a) are imported or purchased prior to clearance through customs for use in<br />

the Safari Rally;<br />

NO. 4 of<br />

2004<br />

(b) having been temporarily imported under section 117 of the East<br />

African Community Customs Management <strong>Act</strong>, 2004 for use in the<br />

Safari Rally, are purchased during the period of temporary importation<br />

by a rally driver resident in <strong>Kenya</strong> for use in the Safari Rally;<br />

(c) having been imported under conditions whereby they have been zero<br />

rated under this Schedule, or whereby remission or refund of tax has<br />

98