Study Session at 5:15 pm W - Rock Valley College

Study Session at 5:15 pm W - Rock Valley College

Study Session at 5:15 pm W - Rock Valley College

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

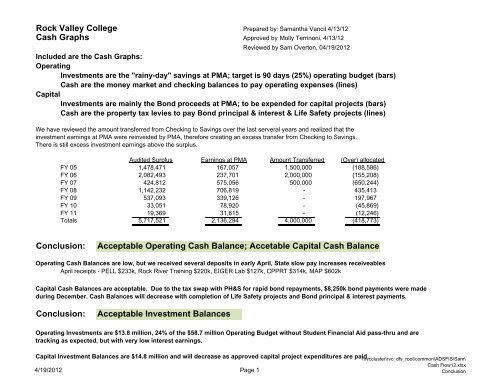

<strong>Rock</strong> <strong>Valley</strong> <strong>College</strong> Prepared by: Samantha Vancil 4/13/12<br />

Cash Graphs Approved by:Molly Terrinoni, 4/13/12<br />

Reviewed by Sam Overton, 04/19/2012<br />

Included are the Cash Graphs:<br />

Oper<strong>at</strong>ing<br />

Investments are the "rainy-day" savings <strong>at</strong> PMA; target is 90 days (25%) oper<strong>at</strong>ing budget (bars)<br />

Cash are the money market and checking balances to pay oper<strong>at</strong>ing expenses (lines)<br />

Capital<br />

Investments are mainly the Bond proceeds <strong>at</strong> PMA; to be expended for capital projects (bars)<br />

Cash are the property tax levies to pay Bond principal & interest & Life Safety projects (lines)<br />

We have reviewed the amount transferred from Checking to Savings over the last serveral years and realized th<strong>at</strong> the<br />

investment earnings <strong>at</strong> PMA were reinvested by PMA, therefore cre<strong>at</strong>ing an excess transfer from Checking to Savings.<br />

There is still excess investment earnings above the surplus.<br />

Audited Surplus Earnings <strong>at</strong> PMA Amount Transferred (Over) alloc<strong>at</strong>ed<br />

FY 05 1,478,471 167,057 1,500,000 (188,586)<br />

FY 06 2,082,493 237,701 2,000,000 (<strong>15</strong>5,208)<br />

FY 07 424,812 575,056 500,000 (650,244)<br />

FY 08 1,142,232 706,819 - 435,413<br />

FY 09 537,093 339,126 - 197,967<br />

FY 10 33,051 78,920 - (45,869)<br />

FY 11 19,369 31,6<strong>15</strong> - (12,246)<br />

Totals 5,717,521 2,136,294 4,000,000 (418,773)<br />

Conclusion:<br />

Acceptable Oper<strong>at</strong>ing Cash Balance; Accetable Capital Cash Balance<br />

Oper<strong>at</strong>ing Cash Balances are low, but we received several deposits in early April, St<strong>at</strong>e slow pay increases receiveables<br />

April receipts - PELL $233k, <strong>Rock</strong> River Training $220k, EIGER Lab $127k, CPPRT $314k, MAP $602k<br />

Capital Cash Balances are acceptable. Due to the tax swap with PH&S for rapid bond repayments, $8,250k bond payments were made<br />

during December. Cash Balances will decrease with completion of Life Safety projects and Bond principal & interest payments.<br />

Conclusion:<br />

Acceptable Investment Balances<br />

Oper<strong>at</strong>ing Investments are $13.8 million, 24% of the $58.7 million Oper<strong>at</strong>ing Budget without Student Financial Aid pass-thru and are<br />

tracking as expected, but with very low interest earnings.<br />

Capital Investment Balances are $14.8 million and will decrease as approved capital project expenditures are paid. \\rvccluster\rvc_dfs_root\common\ADSFIS\Sam\<br />

Cash Flow12.xlsx<br />

4/19/2012 Page 1<br />

Conclusion