goodrich petroleum corporation - RR DONNELLEY FINANCIAL

goodrich petroleum corporation - RR DONNELLEY FINANCIAL

goodrich petroleum corporation - RR DONNELLEY FINANCIAL

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

additional oil and natural gas lease bonus payments and related interest in an ongoing lawsuit involving the<br />

interpretation of a unique oil and natural gas lease provision. The lease provided for the payment of additional<br />

bonuses under certain circumstances in the event higher lease bonuses were paid by us, or our successors or<br />

assigns, within the surrounding area. Without our knowledge, one of the sub-lessees subject to the same lease<br />

paid substantially higher bonuses in the area. We accrued the full amount of $8.5 million as expense in the first<br />

quarter of 2010.<br />

On July 9, 2010, the sub-lessee agreed to reimburse us for one half of any sums for which we may be cast in<br />

judgment in this lawsuit in any final non-appealable judgment. We reduced our accrual by $4.2 million in the third<br />

quarter of 2010 and the remaining $4.3 million as of December 31, 2010 is reflected as “Operating Expenses—<br />

Other” in the Consolidated Statement of Operations in Part II Item 8 of this Annual Report on Form 10-K.<br />

On June 10, 2011, we filed an application for writ of certiorari with the Supreme Court of Louisiana which was<br />

denied on September 23, 2011. On October 13, 2011, the money judgment of $4.4 million, including interest, was<br />

paid to the plaintiffs consequently another $0.1 million was recorded in 2011 to “Other” as a result of the settlement.<br />

We accrued an additional $0.3 million to Other in 2011 representing potential settlements on two other minor<br />

litigation actions for a total of $0.4 million as of December 31, 2011 reflected as “Operating Expenses—Other” in<br />

the Consolidated Statement of Operations in Part II Item 8 of this Annual Report on Form 10-K.<br />

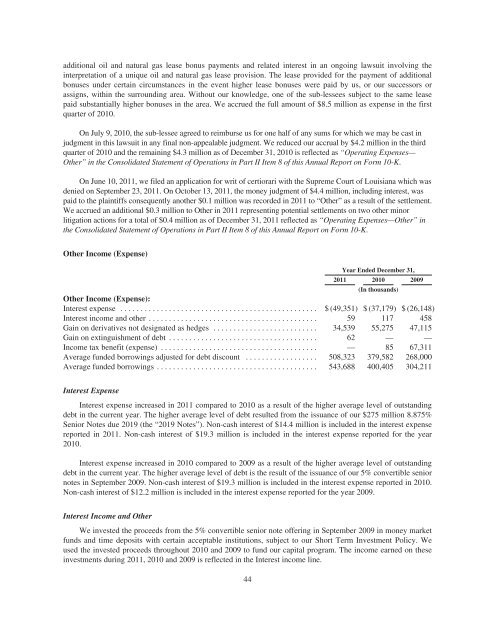

Other Income (Expense)<br />

Year Ended December 31,<br />

2011 2010 2009<br />

(In thousands)<br />

Other Income (Expense):<br />

Interest expense ................................................. $(49,351) $ (37,179) $ (26,148)<br />

Interest income and other .......................................... 59 117 458<br />

Gain on derivatives not designated as hedges .......................... 34,539 55,275 47,115<br />

Gain on extinguishment of debt ..................................... 62 — —<br />

Income tax benefit (expense) ....................................... — 85 67,311<br />

Average funded borrowings adjusted for debt discount .................. 508,323 379,582 268,000<br />

Average funded borrowings ........................................ 543,688 400,405 304,211<br />

Interest Expense<br />

Interest expense increased in 2011 compared to 2010 as a result of the higher average level of outstanding<br />

debt in the current year. The higher average level of debt resulted from the issuance of our $275 million 8.875%<br />

Senior Notes due 2019 (the “2019 Notes”). Non-cash interest of $14.4 million is included in the interest expense<br />

reported in 2011. Non-cash interest of $19.3 million is included in the interest expense reported for the year<br />

2010.<br />

Interest expense increased in 2010 compared to 2009 as a result of the higher average level of outstanding<br />

debt in the current year. The higher average level of debt is the result of the issuance of our 5% convertible senior<br />

notes in September 2009. Non-cash interest of $19.3 million is included in the interest expense reported in 2010.<br />

Non-cash interest of $12.2 million is included in the interest expense reported for the year 2009.<br />

Interest Income and Other<br />

We invested the proceeds from the 5% convertible senior note offering in September 2009 in money market<br />

funds and time deposits with certain acceptable institutions, subject to our Short Term Investment Policy. We<br />

used the invested proceeds throughout 2010 and 2009 to fund our capital program. The income earned on these<br />

investments during 2011, 2010 and 2009 is reflected in the Interest income line.<br />

44