goodrich petroleum corporation - RR DONNELLEY FINANCIAL

goodrich petroleum corporation - RR DONNELLEY FINANCIAL

goodrich petroleum corporation - RR DONNELLEY FINANCIAL

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Credit Risks<br />

Our exposure to non-payment or non-performance by our customers and counterparties presents a credit<br />

risk. Generally, non-payment or non-performance results from a customer’s or counterparty’s inability to satisfy<br />

obligations. We monitor the creditworthiness of our customers and counterparties and established credit limits<br />

according to our credit policies and guidelines. We have the ability to require cash collateral as well as letters of<br />

credit from our financial counterparties to mitigate our exposure above assigned credit thresholds. We routinely<br />

exercise our contractual right to net realized gains against realized losses when settling with our financial<br />

counterparties.<br />

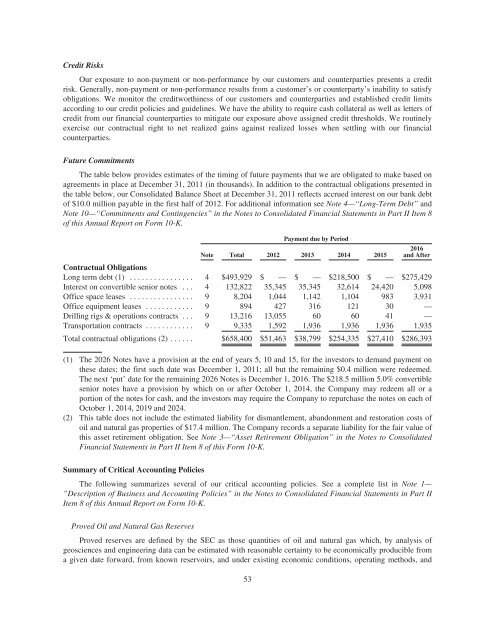

Future Commitments<br />

The table below provides estimates of the timing of future payments that we are obligated to make based on<br />

agreements in place at December 31, 2011 (in thousands). In addition to the contractual obligations presented in<br />

the table below, our Consolidated Balance Sheet at December 31, 2011 reflects accrued interest on our bank debt<br />

of $10.0 million payable in the first half of 2012. For additional information see Note 4—“Long-Term Debt” and<br />

Note 10—“Commitments and Contingencies” in the Notes to Consolidated Financial Statements in Part II Item 8<br />

of this Annual Report on Form 10-K.<br />

Payment due by Period<br />

Note Total 2012 2013 2014 2015<br />

2016<br />

and After<br />

Contractual Obligations<br />

Long term debt (1) ................ 4 $493,929 $ — $ — $218,500 $ — $275,429<br />

Interest on convertible senior notes . . . 4 132,822 35,345 35,345 32,614 24,420 5,098<br />

Office space leases ................ 9 8,204 1,044 1,142 1,104 983 3,931<br />

Office equipment leases ............ 9 894 427 316 121 30 —<br />

Drilling rigs & operations contracts . . . 9 13,216 13,055 60 60 41 —<br />

Transportation contracts ............ 9 9,335 1,592 1,936 1,936 1,936 1,935<br />

Total contractual obligations (2) ...... $658,400 $51,463 $38,799 $254,335 $27,410 $286,393<br />

(1) The 2026 Notes have a provision at the end of years 5, 10 and 15, for the investors to demand payment on<br />

these dates; the first such date was December 1, 2011; all but the remaining $0.4 million were redeemed.<br />

The next ‘put’ date for the remaining 2026 Notes is December 1, 2016. The $218.5 million 5.0% convertible<br />

senior notes have a provision by which on or after October 1, 2014, the Company may redeem all or a<br />

portion of the notes for cash, and the investors may require the Company to repurchase the notes on each of<br />

October 1, 2014, 2019 and 2024.<br />

(2) This table does not include the estimated liability for dismantlement, abandonment and restoration costs of<br />

oil and natural gas properties of $17.4 million. The Company records a separate liability for the fair value of<br />

this asset retirement obligation. See Note 3—“Asset Retirement Obligation” in the Notes to Consolidated<br />

Financial Statements in Part II Item 8 of this Form 10-K.<br />

Summary of Critical Accounting Policies<br />

The following summarizes several of our critical accounting policies. See a complete list in Note 1—<br />

”Description of Business and Accounting Policies” in the Notes to Consolidated Financial Statements in Part II<br />

Item 8 of this Annual Report on Form 10-K.<br />

Proved Oil and Natural Gas Reserves<br />

Proved reserves are defined by the SEC as those quantities of oil and natural gas which, by analysis of<br />

geosciences and engineering data can be estimated with reasonable certainty to be economically producible from<br />

a given date forward, from known reservoirs, and under existing economic conditions, operating methods, and<br />

53