goodrich petroleum corporation - RR DONNELLEY FINANCIAL

goodrich petroleum corporation - RR DONNELLEY FINANCIAL

goodrich petroleum corporation - RR DONNELLEY FINANCIAL

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

GOODRICH PETROLEUM CORPORATION AND SUBSIDIARY<br />

NOTES TO CONSOLIDATED <strong>FINANCIAL</strong> STATEMENTS<br />

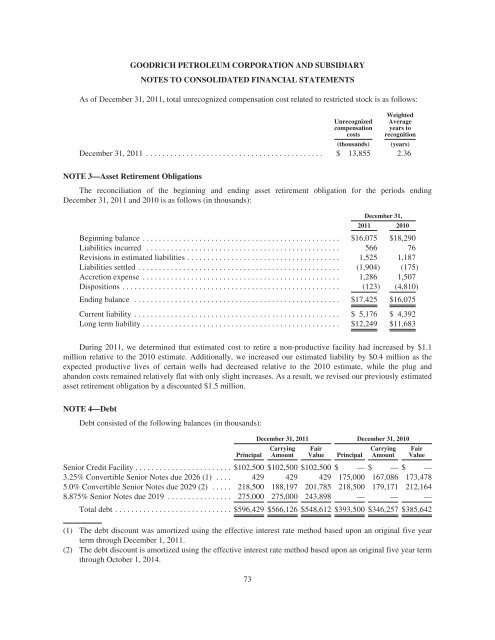

As of December 31, 2011, total unrecognized compensation cost related to restricted stock is as follows:<br />

Unrecognized<br />

compensation<br />

costs<br />

(thousands)<br />

Weighted<br />

Average<br />

years to<br />

recognition<br />

(years)<br />

December 31, 2011 ............................................ $ 13,855 2.36<br />

NOTE 3—Asset Retirement Obligations<br />

The reconciliation of the beginning and ending asset retirement obligation for the periods ending<br />

December 31, 2011 and 2010 is as follows (in thousands):<br />

December 31,<br />

2011 2010<br />

Beginning balance ................................................. $16,075 $18,290<br />

Liabilities incurred ................................................ 566 76<br />

Revisions in estimated liabilities ...................................... 1,525 1,187<br />

Liabilities settled .................................................. (1,904) (175)<br />

Accretion expense ................................................. 1,286 1,507<br />

Dispositions ...................................................... (123) (4,810)<br />

Ending balance ................................................... $17,425 $16,075<br />

Current liability ................................................... $ 5,176 $ 4,392<br />

Long term liability ................................................. $12,249 $11,683<br />

During 2011, we determined that estimated cost to retire a non-productive facility had increased by $1.1<br />

million relative to the 2010 estimate. Additionally, we increased our estimated liability by $0.4 million as the<br />

expected productive lives of certain wells had decreased relative to the 2010 estimate, while the plug and<br />

abandon costs remained relatively flat with only slight increases. As a result, we revised our previously estimated<br />

asset retirement obligation by a discounted $1.5 million.<br />

NOTE 4—Debt<br />

Debt consisted of the following balances (in thousands):<br />

Principal<br />

December 31, 2011 December 31, 2010<br />

Carrying<br />

Amount<br />

Fair<br />

Value<br />

Principal<br />

Carrying<br />

Amount<br />

Fair<br />

Value<br />

Senior Credit Facility ........................ $102,500 $102,500 $102,500 $ — $ — $ —<br />

3.25% Convertible Senior Notes due 2026 (1) .... 429 429 429 175,000 167,086 173,478<br />

5.0% Convertible Senior Notes due 2029 (2) ..... 218,500 188,197 201,785 218,500 179,171 212,164<br />

8.875% Senior Notes due 2019 ................ 275,000 275,000 243,898 — — —<br />

Total debt ............................. $596,429 $566,126 $548,612 $393,500 $346,257 $385,642<br />

(1) The debt discount was amortized using the effective interest rate method based upon an original five year<br />

term through December 1, 2011.<br />

(2) The debt discount is amortized using the effective interest rate method based upon an original five year term<br />

through October 1, 2014.<br />

73