goodrich petroleum corporation - RR DONNELLEY FINANCIAL

goodrich petroleum corporation - RR DONNELLEY FINANCIAL

goodrich petroleum corporation - RR DONNELLEY FINANCIAL

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

GOODRICH PETROLEUM CORPORATION AND SUBSIDIARY<br />

SUPPLEMENTAL INFORMATION<br />

(Unaudited)<br />

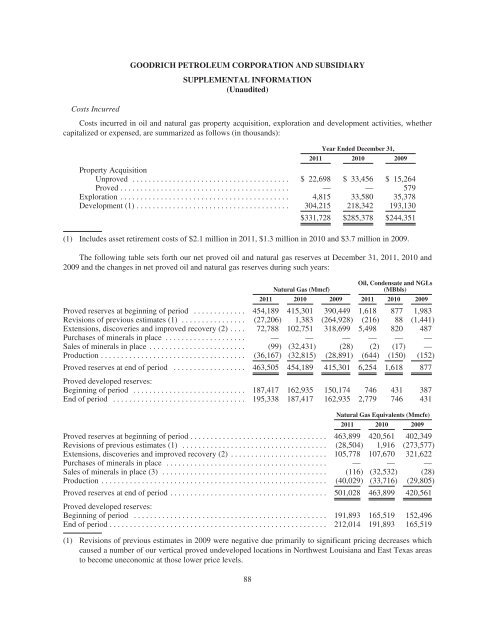

Costs Incurred<br />

Costs incurred in oil and natural gas property acquisition, exploration and development activities, whether<br />

capitalized or expensed, are summarized as follows (in thousands):<br />

Year Ended December 31,<br />

2011 2010 2009<br />

Property Acquisition<br />

Unproved ....................................... $ 22,698 $ 33,456 $ 15,264<br />

Proved .......................................... — — 579<br />

Exploration .......................................... 4,815 33,580 35,378<br />

Development (1) ...................................... 304,215 218,342 193,130<br />

$331,728 $285,378 $244,351<br />

(1) Includes asset retirement costs of $2.1 million in 2011, $1.3 million in 2010 and $3.7 million in 2009.<br />

The following table sets forth our net proved oil and natural gas reserves at December 31, 2011, 2010 and<br />

2009 and the changes in net proved oil and natural gas reserves during such years:<br />

Oil, Condensate and NGLs<br />

Natural Gas (Mmcf)<br />

(MBbls)<br />

2011 2010 2009 2011 2010 2009<br />

Proved reserves at beginning of period ............. 454,189 415,301 390,449 1,618 877 1,983<br />

Revisions of previous estimates (1) ................ (27,206) 1,383 (264,928) (216) 88 (1,441)<br />

Extensions, discoveries and improved recovery (2) .... 72,788 102,751 318,699 5,498 820 487<br />

Purchases of minerals in place .................... — — — — — —<br />

Sales of minerals in place ........................ (99) (32,431) (28) (2) (17) —<br />

Production .................................... (36,167) (32,815) (28,891) (644) (150) (152)<br />

Proved reserves at end of period .................. 463,505 454,189 415,301 6,254 1,618 877<br />

Proved developed reserves:<br />

Beginning of period ............................ 187,417 162,935 150,174 746 431 387<br />

End of period ................................. 195,338 187,417 162,935 2,779 746 431<br />

Natural Gas Equivalents (Mmcfe)<br />

2011 2010 2009<br />

Proved reserves at beginning of period .................................. 463,899 420,561 402,349<br />

Revisions of previous estimates (1) .................................... (28,504) 1,916 (273,577)<br />

Extensions, discoveries and improved recovery (2) ........................ 105,778 107,670 321,622<br />

Purchases of minerals in place ........................................ — — —<br />

Sales of minerals in place (3) ......................................... (116) (32,532) (28)<br />

Production ........................................................ (40,029) (33,716) (29,805)<br />

Proved reserves at end of period ....................................... 501,028 463,899 420,561<br />

Proved developed reserves:<br />

Beginning of period ................................................ 191,893 165,519 152,496<br />

End of period ...................................................... 212,014 191,893 165,519<br />

(1) Revisions of previous estimates in 2009 were negative due primarily to significant pricing decreases which<br />

caused a number of our vertical proved undeveloped locations in Northwest Louisiana and East Texas areas<br />

to become uneconomic at those lower price levels.<br />

88