goodrich petroleum corporation - RR DONNELLEY FINANCIAL

goodrich petroleum corporation - RR DONNELLEY FINANCIAL

goodrich petroleum corporation - RR DONNELLEY FINANCIAL

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

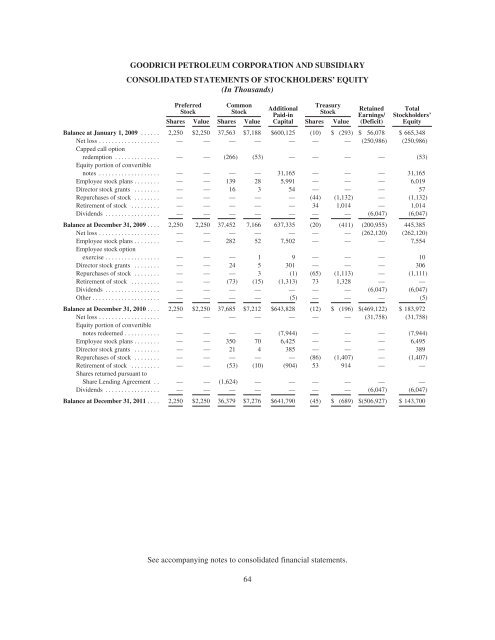

GOODRICH PETROLEUM CORPORATION AND SUBSIDIARY<br />

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY<br />

(In Thousands)<br />

Preferred Common<br />

Stock<br />

Stock<br />

Additional<br />

Treasury<br />

Paid-in<br />

Stock<br />

Shares Value Shares Value Capital Shares Value<br />

Retained<br />

Earnings/<br />

(Deficit)<br />

Total<br />

Stockholders’<br />

Equity<br />

Balance at January 1, 2009 ...... 2,250 $2,250 37,563 $7,188 $600,125 (10) $ (293) $ 56,078 $ 665,348<br />

Net loss ................... — — — — — — — (250,986) (250,986)<br />

Capped call option<br />

redemption .............. — — (266) (53) — — — — (53)<br />

Equity portion of convertible<br />

notes ................... — — — — 31,165 — — — 31,165<br />

Employee stock plans ........ — — 139 28 5,991 — — — 6,019<br />

Director stock grants ........ — — 16 3 54 — — — 57<br />

Repurchases of stock ........ — — — — — (44) (1,132) — (1,132)<br />

Retirement of stock ......... — — — — — 34 1,014 — 1,014<br />

Dividends ................. — — — — — — — (6,047) (6,047)<br />

Balance at December 31, 2009 .... 2,250 2,250 37,452 7,166 637,335 (20) (411) (200,955) 445,385<br />

Net loss ................... — — — — — — — (262,120) (262,120)<br />

Employee stock plans ........ — — 282 52 7,502 — — — 7,554<br />

Employee stock option<br />

exercise ................. — — — 1 9 — — — 10<br />

Director stock grants ........ — — 24 5 301 — — — 306<br />

Repurchases of stock ........ — — — 3 (1) (65) (1,113) — (1,111)<br />

Retirement of stock ......... — — (73) (15) (1,313) 73 1,328 — —<br />

Dividends ................. — — — — — — — (6,047) (6,047)<br />

Other ..................... — — — — (5) — — — (5)<br />

Balance at December 31, 2010 .... 2,250 $2,250 37,685 $7,212 $643,828 (12) $ (196) $(469,122) $ 183,972<br />

Net loss ................... — — — — — — — (31,758) (31,758)<br />

Equity portion of convertible<br />

notes redeemed ........... — — — — (7,944) — — — (7,944)<br />

Employee stock plans ........ — — 350 70 6,425 — — — 6,495<br />

Director stock grants ........ — — 21 4 385 — — — 389<br />

Repurchases of stock ........ — — — — — (86) (1,407) — (1,407)<br />

Retirement of stock ......... — — (53) (10) (904) 53 914 — —<br />

Shares returned pursuant to<br />

Share Lending Agreement . . — — (1,624) — — — — — —<br />

Dividends ................. — — — — — — — (6,047) (6,047)<br />

Balance at December 31, 2011 .... 2,250 $2,250 36,379 $7,276 $641,790 (45) $ (689) $(506,927) $ 143,700<br />

See accompanying notes to consolidated financial statements.<br />

64