goodrich petroleum corporation - RR DONNELLEY FINANCIAL

goodrich petroleum corporation - RR DONNELLEY FINANCIAL

goodrich petroleum corporation - RR DONNELLEY FINANCIAL

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

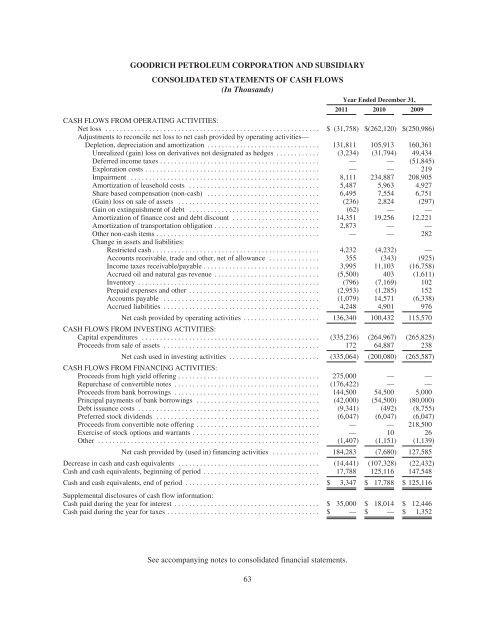

GOODRICH PETROLEUM CORPORATION AND SUBSIDIARY<br />

CONSOLIDATED STATEMENTS OF CASH FLOWS<br />

(In Thousands)<br />

Year Ended December 31,<br />

2011 2010 2009<br />

CASH FLOWS FROM OPERATING ACTIVITIES:<br />

Net loss ........................................................... $ (31,758) $(262,120) $(250,986)<br />

Adjustments to reconcile net loss to net cash provided by operating activities—<br />

Depletion, depreciation and amortization ............................... 131,811 105,913 160,361<br />

Unrealized (gain) loss on derivatives not designated as hedges ............ (3,234) (31,794) 49,434<br />

Deferred income taxes ............................................ — — (51,845)<br />

Exploration costs ................................................ — — 219<br />

Impairment .................................................... 8,111 234,887 208,905<br />

Amortization of leasehold costs .................................... 5,487 5,963 4,927<br />

Share based compensation (non-cash) ............................... 6,495 7,554 6,751<br />

(Gain) loss on sale of assets ....................................... (236) 2,824 (297)<br />

Gain on extinguishment of debt .................................... (62) — —<br />

Amortization of finance cost and debt discount ........................ 14,351 19,256 12,221<br />

Amortization of transportation obligation ............................. 2,873 — —<br />

Other non-cash items ............................................. — — 282<br />

Change in assets and liabilities:<br />

Restricted cash .............................................. 4,232 (4,232) —<br />

Accounts receivable, trade and other, net of allowance .............. 355 (343) (925)<br />

Income taxes receivable/payable ................................ 3,995 11,103 (16,758)<br />

Accrued oil and natural gas revenue ............................. (5,500) 403 (1,611)<br />

Inventory .................................................. (796) (7,169) 102<br />

Prepaid expenses and other .................................... (2,953) (1,285) 152<br />

Accounts payable ........................................... (1,079) 14,571 (6,338)<br />

Accrued liabilities ........................................... 4,248 4,901 976<br />

Net cash provided by operating activities ..................... 136,340 100,432 115,570<br />

CASH FLOWS FROM INVESTING ACTIVITIES:<br />

Capital expenditures ................................................. (335,236) (264,967) (265,825)<br />

Proceeds from sale of assets ........................................... 172 64,887 238<br />

Net cash used in investing activities ......................... (335,064) (200,080) (265,587)<br />

CASH FLOWS FROM FINANCING ACTIVITIES:<br />

Proceeds from high yield offering ....................................... 275,000 — —<br />

Repurchase of convertible notes ........................................ (176,422) — —<br />

Proceeds from bank borrowings ........................................ 144,500 54,500 5,000<br />

Principal payments of bank borrowings .................................. (42,000) (54,500) (80,000)<br />

Debt issuance costs .................................................. (9,341) (492) (8,755)<br />

Preferred stock dividends ............................................. (6,047) (6,047) (6,047)<br />

Proceeds from convertible note offering .................................. — — 218,500<br />

Exercise of stock options and warrants ................................... — 10 26<br />

Other ............................................................. (1,407) (1,151) (1,139)<br />

Net cash provided by (used in) financing activities ............. 184,283 (7,680) 127,585<br />

Decrease in cash and cash equivalents ....................................... (14,441) (107,328) (22,432)<br />

Cash and cash equivalents, beginning of period ................................ 17,788 125,116 147,548<br />

Cash and cash equivalents, end of period ..................................... $ 3,347 $ 17,788 $ 125,116<br />

Supplemental disclosures of cash flow information:<br />

Cash paid during the year for interest ........................................ $ 35,000 $ 18,014 $ 12,446<br />

Cash paid during the year for taxes .......................................... $ — $ — $ 1,352<br />

See accompanying notes to consolidated financial statements.<br />

63