goodrich petroleum corporation - RR DONNELLEY FINANCIAL

goodrich petroleum corporation - RR DONNELLEY FINANCIAL

goodrich petroleum corporation - RR DONNELLEY FINANCIAL

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

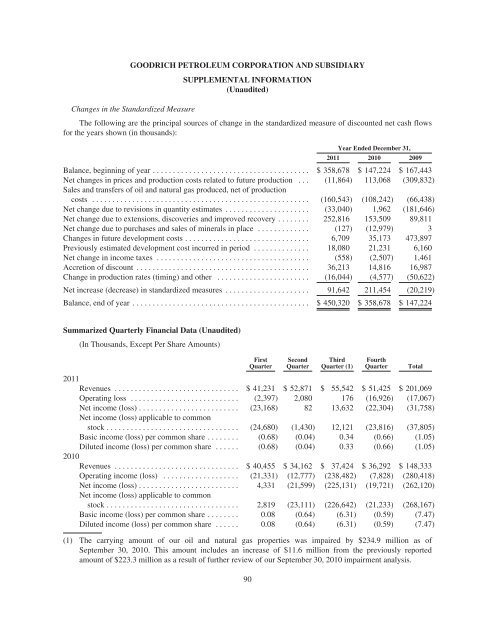

GOODRICH PETROLEUM CORPORATION AND SUBSIDIARY<br />

SUPPLEMENTAL INFORMATION<br />

(Unaudited)<br />

Changes in the Standardized Measure<br />

The following are the principal sources of change in the standardized measure of discounted net cash flows<br />

for the years shown (in thousands):<br />

Year Ended December 31,<br />

2011 2010 2009<br />

Balance, beginning of year ....................................... $358,678 $ 147,224 $ 167,443<br />

Net changes in prices and production costs related to future production . . . (11,864) 113,068 (309,832)<br />

Sales and transfers of oil and natural gas produced, net of production<br />

costs ...................................................... (160,543) (108,242) (66,438)<br />

Net change due to revisions in quantity estimates ..................... (33,040) 1,962 (181,646)<br />

Net change due to extensions, discoveries and improved recovery ........ 252,816 153,509 89,811<br />

Net change due to purchases and sales of minerals in place ............. (127) (12,979) 3<br />

Changes in future development costs ............................... 6,709 35,173 473,897<br />

Previously estimated development cost incurred in period .............. 18,080 21,231 6,160<br />

Net change in income taxes ...................................... (558) (2,507) 1,461<br />

Accretion of discount ........................................... 36,213 14,816 16,987<br />

Change in production rates (timing) and other ....................... (16,044) (4,577) (50,622)<br />

Net increase (decrease) in standardized measures ..................... 91,642 211,454 (20,219)<br />

Balance, end of year ............................................ $450,320 $ 358,678 $ 147,224<br />

Summarized Quarterly Financial Data (Unaudited)<br />

(In Thousands, Except Per Share Amounts)<br />

First<br />

Quarter<br />

Second<br />

Quarter<br />

Third<br />

Quarter (1)<br />

Fourth<br />

Quarter<br />

2011<br />

Revenues ............................... $41,231 $ 52,871 $ 55,542 $ 51,425 $ 201,069<br />

Operating loss ........................... (2,397) 2,080 176 (16,926) (17,067)<br />

Net income (loss) ......................... (23,168) 82 13,632 (22,304) (31,758)<br />

Net income (loss) applicable to common<br />

stock ................................. (24,680) (1,430) 12,121 (23,816) (37,805)<br />

Basic income (loss) per common share ........ (0.68) (0.04) 0.34 (0.66) (1.05)<br />

Diluted income (loss) per common share ...... (0.68) (0.04) 0.33 (0.66) (1.05)<br />

2010<br />

Revenues ............................... $40,455 $ 34,162 $ 37,424 $ 36,292 $ 148,333<br />

Operating income (loss) ................... (21,331) (12,777) (238,482) (7,828) (280,418)<br />

Net income (loss) ......................... 4,331 (21,599) (225,131) (19,721) (262,120)<br />

Net income (loss) applicable to common<br />

stock ................................. 2,819 (23,111) (226,642) (21,233) (268,167)<br />

Basic income (loss) per common share ........ 0.08 (0.64) (6.31) (0.59) (7.47)<br />

Diluted income (loss) per common share ...... 0.08 (0.64) (6.31) (0.59) (7.47)<br />

(1) The carrying amount of our oil and natural gas properties was impaired by $234.9 million as of<br />

September 30, 2010. This amount includes an increase of $11.6 million from the previously reported<br />

amount of $223.3 million as a result of further review of our September 30, 2010 impairment analysis.<br />

90<br />

Total