goodrich petroleum corporation - RR DONNELLEY FINANCIAL

goodrich petroleum corporation - RR DONNELLEY FINANCIAL

goodrich petroleum corporation - RR DONNELLEY FINANCIAL

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

GOODRICH PETROLEUM CORPORATION AND SUBSIDIARY<br />

NOTES TO CONSOLIDATED <strong>FINANCIAL</strong> STATEMENTS<br />

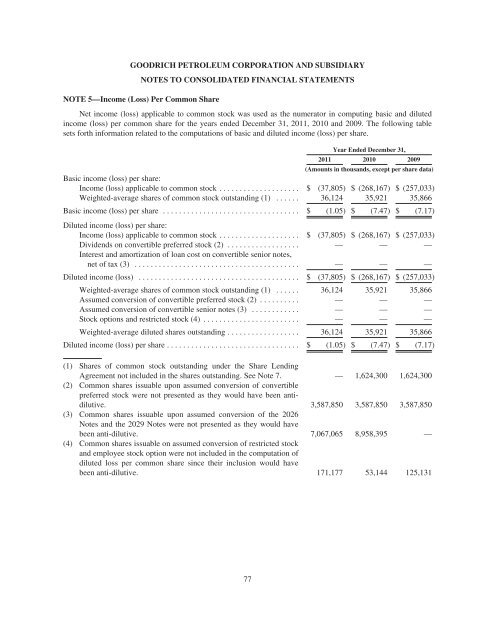

NOTE 5—Income (Loss) Per Common Share<br />

Net income (loss) applicable to common stock was used as the numerator in computing basic and diluted<br />

income (loss) per common share for the years ended December 31, 2011, 2010 and 2009. The following table<br />

sets forth information related to the computations of basic and diluted income (loss) per share.<br />

Year Ended December 31,<br />

2011 2010 2009<br />

(Amounts in thousands, except per share data)<br />

Basic income (loss) per share:<br />

Income (loss) applicable to common stock .................... $ (37,805) $ (268,167) $ (257,033)<br />

Weighted-average shares of common stock outstanding (1) ...... 36,124 35,921 35,866<br />

Basic income (loss) per share .................................. $ (1.05) $ (7.47) $ (7.17)<br />

Diluted income (loss) per share:<br />

Income (loss) applicable to common stock .................... $ (37,805) $ (268,167) $ (257,033)<br />

Dividends on convertible preferred stock (2) .................. — — —<br />

Interest and amortization of loan cost on convertible senior notes,<br />

netoftax(3) ......................................... — — —<br />

Diluted income (loss) ........................................ $ (37,805) $ (268,167) $ (257,033)<br />

Weighted-average shares of common stock outstanding (1) ...... 36,124 35,921 35,866<br />

Assumed conversion of convertible preferred stock (2) .......... — — —<br />

Assumed conversion of convertible senior notes (3) ............ — — —<br />

Stock options and restricted stock (4) ........................ — — —<br />

Weighted-average diluted shares outstanding .................. 36,124 35,921 35,866<br />

Diluted income (loss) per share ................................. $ (1.05) $ (7.47) $ (7.17)<br />

(1) Shares of common stock outstanding under the Share Lending<br />

Agreement not included in the shares outstanding. See Note 7. — 1,624,300 1,624,300<br />

(2) Common shares issuable upon assumed conversion of convertible<br />

preferred stock were not presented as they would have been antidilutive.<br />

3,587,850 3,587,850 3,587,850<br />

(3) Common shares issuable upon assumed conversion of the 2026<br />

Notes and the 2029 Notes were not presented as they would have<br />

been anti-dilutive. 7,067,065 8,958,395 —<br />

(4) Common shares issuable on assumed conversion of restricted stock<br />

and employee stock option were not included in the computation of<br />

diluted loss per common share since their inclusion would have<br />

been anti-dilutive. 171,177 53,144 125,131<br />

77