Sustainability Report - Bank Sarasin-Alpen

Sustainability Report - Bank Sarasin-Alpen

Sustainability Report - Bank Sarasin-Alpen

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Solar Energy 2005<br />

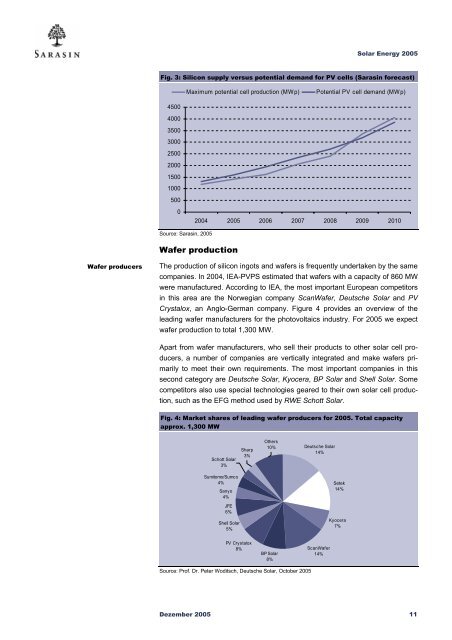

Fig. 3: Silicon supply versus potential demand for PV cells (<strong>Sarasin</strong> forecast)<br />

Maximum potential cell production (MWp)<br />

Potential PV cell demand (MWp)<br />

4500<br />

4000<br />

3500<br />

3000<br />

2500<br />

2000<br />

1500<br />

1000<br />

500<br />

0<br />

2004 2005 2006 2007 2008 2009 2010<br />

Source: <strong>Sarasin</strong>, 2005<br />

Wafer production<br />

Wafer producers<br />

The production of silicon ingots and wafers is frequently undertaken by the same<br />

companies. In 2004, IEA-PVPS estimated that wafers with a capacity of 860 MW<br />

were manufactured. According to IEA, the most important European competitors<br />

in this area are the Norwegian company ScanWafer, Deutsche Solar and PV<br />

Crystalox, an Anglo-German company. Figure 4 provides an overview of the<br />

leading wafer manufacturers for the photovoltaics industry. For 2005 we expect<br />

wafer production to total 1,300 MW.<br />

Apart from wafer manufacturers, who sell their products to other solar cell producers,<br />

a number of companies are vertically integrated and make wafers primarily<br />

to meet their own requirements. The most important companies in this<br />

second category are Deutsche Solar, Kyocera, BP Solar and Shell Solar. Some<br />

competitors also use special technologies geared to their own solar cell production,<br />

such as the EFG method used by RWE Schott Solar.<br />

Fig. 4: Market shares of leading wafer producers for 2005. Total capacity<br />

approx. 1,300 MW<br />

Schott Solar<br />

3%<br />

Sharp<br />

3%<br />

Others<br />

10%<br />

Deutsche Solar<br />

14%<br />

Sumitomo/Sumco<br />

4%<br />

Sanyo<br />

4%<br />

Setek<br />

14%<br />

JFE<br />

6%<br />

Shell Solar<br />

5%<br />

Kyocera<br />

7%<br />

PV Crystalox<br />

8%<br />

BP Solar<br />

8%<br />

ScanWafer<br />

14%<br />

Source: Prof. Dr. Peter Woditsch, Deutsche Solar, October 2005<br />

Dezember 2005 11