Sustainability Report - Bank Sarasin-Alpen

Sustainability Report - Bank Sarasin-Alpen

Sustainability Report - Bank Sarasin-Alpen

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Solar Energy 2005<br />

production output, thin-film technologies (amorphous silicon, CdTe, CIS, etc.)<br />

were unable to keep pace with the market.<br />

Despite optimisation,<br />

significant cost savings only<br />

possible with new technologies<br />

We think the shortage of silicon will encourage the development of more efficient<br />

technologies. In crystalline silicon technology, the focus is on thinner wafers with<br />

bigger dimensions and improved efficiency. Most providers are not attempting to<br />

make any fundamental changes in the design and manufacture of cells, and<br />

have still managed to achieve significant progress so far with this strategy.<br />

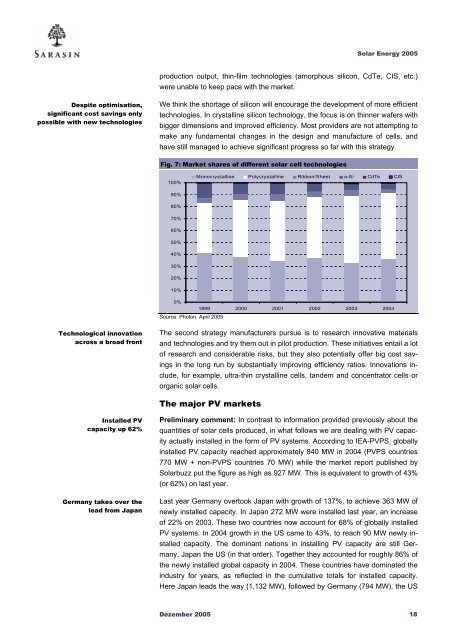

Fig. 7: Market shares of different solar cell technologies<br />

100%<br />

Monocrystalline Polycrystalline Ribbon/Sheet a-Si CdTe CIS<br />

90%<br />

80%<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

1999 2000 2001 2002 2003 2004<br />

Source: Photon, April 2005<br />

Technological innovation<br />

across a broad front<br />

The second strategy manufacturers pursue is to research innovative materials<br />

and technologies and try them out in pilot production. These initiatives entail a lot<br />

of research and considerable risks, but they also potentially offer big cost savings<br />

in the long run by substantially improving efficiency ratios. Innovations include,<br />

for example, ultra-thin crystalline cells, tandem and concentrator cells or<br />

organic solar cells.<br />

The major PV markets<br />

Installed PV<br />

capacity up 62%<br />

Germany takes over the<br />

lead from Japan<br />

Preliminary comment: In contrast to information provided previously about the<br />

quantities of solar cells produced, in what follows we are dealing with PV capacity<br />

actually installed in the form of PV systems. According to IEA-PVPS, globally<br />

installed PV capacity reached approximately 840 MW in 2004 (PVPS countries<br />

770 MW + non-PVPS countries 70 MW) while the market report published by<br />

Solarbuzz put the figure as high as 927 MW. This is equivalent to growth of 43%<br />

(or 62%) on last year.<br />

Last year Germany overtook Japan with growth of 137%, to achieve 363 MW of<br />

newly installed capacity. In Japan 272 MW were installed last year, an increase<br />

of 22% on 2003. These two countries now account for 68% of globally installed<br />

PV systems. In 2004 growth in the US came to 43%, to reach 90 MW newly installed<br />

capacity. The dominant nations in installing PV capacity are still Germany,<br />

Japan the US (in that order). Together they accounted for roughly 86% of<br />

the newly installed global capacity in 2004. These countries have dominated the<br />

industry for years, as reflected in the cumulative totals for installed capacity.<br />

Here Japan leads the way (1,132 MW), followed by Germany (794 MW), the US<br />

Dezember 2005 18