Sustainability Report - Bank Sarasin-Alpen

Sustainability Report - Bank Sarasin-Alpen

Sustainability Report - Bank Sarasin-Alpen

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Solar Energy 2005<br />

stock market. After Conergy made a strong debut this year, companies such as<br />

Q-Cells, ErSol and others have followed suit.<br />

Germany as a driving force for<br />

achieving EU targets for<br />

renewables<br />

Very ambitious targets have been set in Germany for the growth of the PV market<br />

over the longer term, both on the part of the government and the industry associations<br />

(which are naturally more optimistic). Germany acts as a role model<br />

for the achievement of the goals set by the EU for renewables in its White Book<br />

in 1997: the percentage of renewables used is to be doubled from 6% to 12% by<br />

2010 across the whole of Europe. To achieve the target in 2010, growth has to<br />

continue at a rate of more than 30% p.a. This is an ambitious goal, and one that<br />

requires other countries to expand their photovoltaics as significantly as Germany.<br />

Japan<br />

Solar energy as a constituent of<br />

overriding energy targets<br />

In Japan, incentives to promote photovoltaics are an integral part of national energy<br />

policy. In sharp contrast to the US, the Kyoto protocol also plays a very important<br />

role. The government is committed to achieving a 7% reduction in 1990<br />

CO 2 emissions. Photovoltaics have been singled out as a means of achieving<br />

this reduction. The Ministry of Economy, Trade and Industry (METI) wants 10%<br />

of energy requirements to be met by renewables by 2030, with half of this<br />

(approx. 100 GW) coming from photovoltaics. A more concrete interim target of<br />

4.8 GW installed PV capacity has been set for 2010.<br />

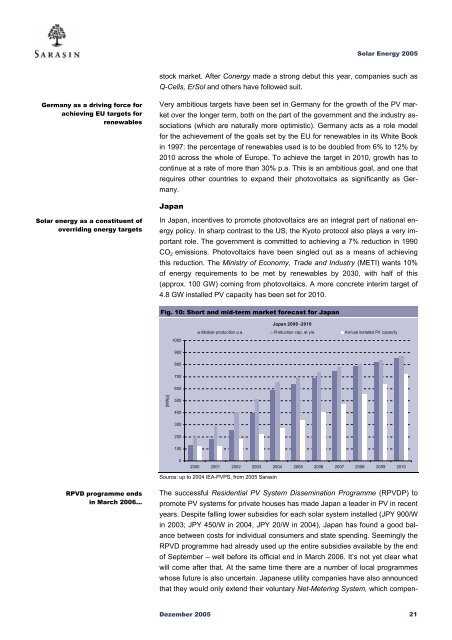

Fig. 10: Short and mid-term market forecast for Japan<br />

Japan 2000 -2010<br />

Module production p.a. Production cap. at y/e Annual installed PV capacity<br />

1000<br />

900<br />

800<br />

700<br />

600<br />

[MWp]<br />

500<br />

400<br />

300<br />

200<br />

100<br />

0<br />

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010<br />

Source: up to 2004 IEA-PVPS, from 2005 <strong>Sarasin</strong><br />

RPVD programme ends<br />

in March 2006…<br />

The successful Residential PV System Dissemination Programme (RPVDP) to<br />

promote PV systems for private houses has made Japan a leader in PV in recent<br />

years. Despite falling lower subsidies for each solar system installed (JPY 900/W<br />

in 2003; JPY 450/W in 2004, JPY 20/W in 2004), Japan has found a good balance<br />

between costs for individual consumers and state spending. Seemingly the<br />

RPVD programme had already used up the entire subsidies available by the end<br />

of September – well before its official end in March 2006. It’s not yet clear what<br />

will come after that. At the same time there are a number of local programmes<br />

whose future is also uncertain. Japanese utility companies have also announced<br />

that they would only extend their voluntary Net-Metering System, which compen-<br />

Dezember 2005 21