Sustainability Report - Bank Sarasin-Alpen

Sustainability Report - Bank Sarasin-Alpen

Sustainability Report - Bank Sarasin-Alpen

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Solar Energy 2005<br />

Grand coalition<br />

Export business<br />

increasingly important<br />

Short and mid-term forecast for<br />

the PV market in Germany<br />

The change of government following premature elections most probably does<br />

not signify any dramatic worsening of the conditions for government subsidies. A<br />

consensus still exists between the two coalition parties concerning the promotion<br />

of solar energy, particularly since approximately 30,000 people are now employed<br />

in Germany’s solar industry.<br />

Irrespective of what happens with the new government, it would be wise for<br />

Germany’s solar companies to use the period up to 2007, when the next regular<br />

review of feed-in tariffs is scheduled, to reduce their dependency on the German<br />

market by building up their export business. Important export markets include<br />

Spain, Portugal, France, Italy, Greece and Cypress. Some of these countries<br />

have also created subsidy programmes for solar installations. The growing market<br />

potential of India and China should also provide attractive opportunities for<br />

German solar companies. Our forecast shows a gradual convergence between<br />

German production and installed domestic capacity (see Fig. 9). It is therefore<br />

essential for the German solar industry to expand its international distribution<br />

network and significantly increase its export quota.<br />

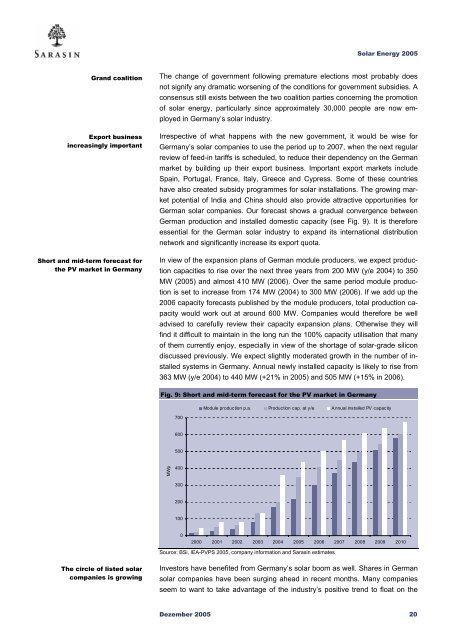

In view of the expansion plans of German module producers, we expect production<br />

capacities to rise over the next three years from 200 MW (y/e 2004) to 350<br />

MW (2005) and almost 410 MW (2006). Over the same period module production<br />

is set to increase from 174 MW (2004) to 300 MW (2006). If we add up the<br />

2006 capacity forecasts published by the module producers, total production capacity<br />

would work out at around 600 MW. Companies would therefore be well<br />

advised to carefully review their capacity expansion plans. Otherwise they will<br />

find it difficult to maintain in the long run the 100% capacity utilisation that many<br />

of them currently enjoy, especially in view of the shortage of solar-grade silicon<br />

discussed previously. We expect slightly moderated growth in the number of installed<br />

systems in Germany. Annual newly installed capacity is likely to rise from<br />

363 MW (y/e 2004) to 440 MW (+21% in 2005) and 505 MW (+15% in 2006).<br />

Fig. 9: Short and mid-term forecast for the PV market in Germany<br />

700<br />

Module production p.a. Production cap. at y/e Annual installed PV capacity<br />

600<br />

500<br />

MWp<br />

400<br />

300<br />

200<br />

100<br />

0<br />

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010<br />

Source: BSi, IEA-PVPS 2005, company information and <strong>Sarasin</strong> estimates<br />

The circle of listed solar<br />

companies is growing<br />

Investors have benefited from Germany’s solar boom as well. Shares in German<br />

solar companies have been surging ahead in recent months. Many companies<br />

seem to want to take advantage of the industry’s positive trend to float on the<br />

Dezember 2005 20