Sustainability Report - Bank Sarasin-Alpen

Sustainability Report - Bank Sarasin-Alpen

Sustainability Report - Bank Sarasin-Alpen

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Solar Energy 2005<br />

<br />

<br />

Higher interest rates. Because of the high capital costs associated with PV<br />

systems, rising financing costs due to higher interest rates exert their full impact<br />

on total costs, which could dampen demand. This is particularly true for<br />

commercial operators of PV systems.<br />

Increasing competition from their own camp in the form of alternative solar<br />

technologies such as solar power stations (see chapter 3).<br />

Threatening energy crisis<br />

implies upside potential<br />

Diminishing resources and soaring prices in the oil market could promise additional<br />

upside potential for solar energy. There has been a marked increase in<br />

governments’ willingness to promote renewable energies through incentives<br />

such as feed-in payments or tax breaks. In addition, conventional energy production<br />

is generally becoming more expensive, so the gap with solar energy is narrowing.<br />

In the field of hybrid systems, photovoltaics can either replace or supplement<br />

diesel generators. Here the price of oil has a direct influence on demand for PV<br />

systems. This market is limited mainly to the USA and developing countries, and<br />

is only of secondary importance compared with the currently dominant gridconnected<br />

applications.<br />

For thermal solar energy use, the costs of fossil alternatives (usually heating oil)<br />

are an even more important factor than for photovoltaics. This economic substitution<br />

mechanism is showing its first measurable results, since the oil price has<br />

been so high for a long time and because people think it will remain at that level.<br />

Conclusion: Modest but<br />

steady growth over<br />

the longer term<br />

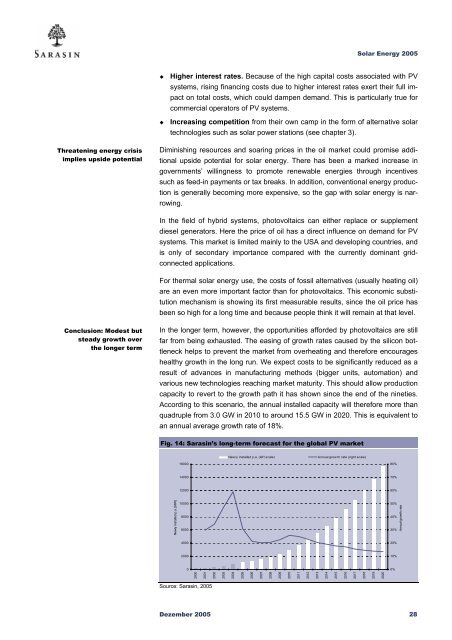

In the longer term, however, the opportunities afforded by photovoltaics are still<br />

far from being exhausted. The easing of growth rates caused by the silicon bottleneck<br />

helps to prevent the market from overheating and therefore encourages<br />

healthy growth in the long run. We expect costs to be significantly reduced as a<br />

result of advances in manufacturing methods (bigger units, automation) and<br />

various new technologies reaching market maturity. This should allow production<br />

capacity to revert to the growth path it has shown since the end of the nineties.<br />

According to this scenario, the annual installed capacity will therefore more than<br />

quadruple from 3.0 GW in 2010 to around 15.5 GW in 2020. This is equivalent to<br />

an annual average growth rate of 18%.<br />

Fig. 14: <strong>Sarasin</strong>’s long-term forecast for the global PV market<br />

New ly installed p.a. (left scale)<br />

Annual grow th rate (right scale)<br />

16000<br />

80%<br />

14000<br />

70%<br />

12000<br />

60%<br />

10000<br />

8000<br />

6000<br />

4000<br />

2000<br />

0<br />

2000<br />

2001<br />

2002<br />

2003<br />

2004<br />

2005<br />

2006<br />

2007<br />

2008<br />

2009<br />

2010<br />

2011<br />

2012<br />

2013<br />

2014<br />

2015<br />

2016<br />

2017<br />

2018<br />

2019<br />

2020<br />

Newly installed p.a. [MW]<br />

50%<br />

40%<br />

30%<br />

Annual growth rate<br />

20%<br />

10%<br />

0%<br />

Source: <strong>Sarasin</strong>, 2005<br />

Dezember 2005 28