10-K - SCANA Corporation

10-K - SCANA Corporation

10-K - SCANA Corporation

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Table of Contents<br />

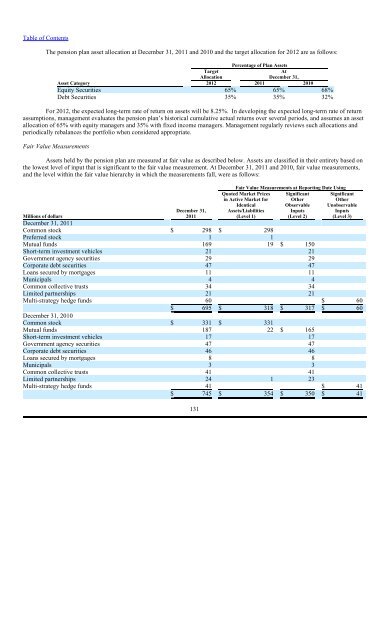

The pension plan asset allocation at December 31, 2011 and 20<strong>10</strong> and the target allocation for 2012 are as follows:<br />

Percentage of Plan Assets<br />

Target<br />

At<br />

Allocation<br />

December 31,<br />

Asset Category 2012 2011 20<strong>10</strong><br />

Equity Securities 65% 65% 68%<br />

Debt Securities 35% 35% 32%<br />

For 2012, the expected long-term rate of return on assets will be 8.25%. In developing the expected long-term rate of return<br />

assumptions, management evaluates the pension plan’s historical cumulative actual returns over several periods, and assumes an asset<br />

allocation of 65% with equity managers and 35% with fixed income managers. Management regularly reviews such allocations and<br />

periodically rebalances the portfolio when considered appropriate.<br />

Fair Value Measurements<br />

Assets held by the pension plan are measured at fair value as described below. Assets are classified in their entirety based on<br />

the lowest level of input that is significant to the fair value measurement. At December 31, 2011 and 20<strong>10</strong>, fair value measurements,<br />

and the level within the fair value hierarchy in which the measurements fall, were as follows:<br />

December 31,<br />

2011<br />

131<br />

Fair Value Measurements at Reporting Date Using<br />

Significant<br />

Other<br />

Observable<br />

Inputs<br />

(Level 2)<br />

Quoted Market Prices<br />

in Active Market for<br />

Identical<br />

Assets/Liabilities<br />

(Level 1)<br />

Significant<br />

Other<br />

Unobservable<br />

Inputs<br />

(Level 3)<br />

Millions of dollars<br />

December 31, 2011<br />

Common stock $ 298 $ 298<br />

Preferred stock 1 1<br />

Mutual funds 169 19 $ 150<br />

Short-term investment vehicles 21 21<br />

Government agency securities 29 29<br />

Corporate debt securities 47 47<br />

Loans secured by mortgages 11 11<br />

Municipals 4 4<br />

Common collective trusts 34 34<br />

Limited partnerships 21 21<br />

Multi-strategy hedge funds 60 $ 60<br />

$ 695 $ 318 $ 317 $ 60<br />

December 31, 20<strong>10</strong><br />

Common stock $ 331 $ 331<br />

Mutual funds 187 22 $ 165<br />

Short-term investment vehicles 17 17<br />

Government agency securities 47 47<br />

Corporate debt securities 46 46<br />

Loans secured by mortgages 8 8<br />

Municipals 3 3<br />

Common collective trusts 41 41<br />

Limited partnerships 24 1 23<br />

Multi-strategy hedge funds 41 $ 41<br />

$ 745 $ 354 $ 350 $ 41