10-K - SCANA Corporation

10-K - SCANA Corporation

10-K - SCANA Corporation

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Table of Contents<br />

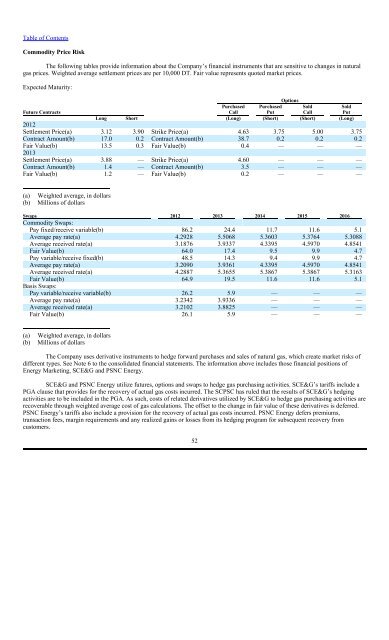

Commodity Price Risk<br />

The following tables provide information about the Company’s financial instruments that are sensitive to changes in natural<br />

gas prices. Weighted average settlement prices are per <strong>10</strong>,000 DT. Fair value represents quoted market prices.<br />

Expected Maturity:<br />

Options<br />

Purchased Purchased Sold<br />

Sold<br />

Future Contracts<br />

Call<br />

Put<br />

Call<br />

Put<br />

Long Short (Long) (Short) (Short) (Long)<br />

2012<br />

Settlement Price(a) 3.12 3.90 Strike Price(a) 4.63 3.75 5.00 3.75<br />

Contract Amount(b) 17.0 0.2 Contract Amount(b) 38.7 0.2 0.2 0.2<br />

Fair Value(b) 13.5 0.3 Fair Value(b) 0.4 — — —<br />

2013<br />

Settlement Price(a) 3.88 — Strike Price(a) 4.60 — — —<br />

Contract Amount(b) 1.4 — Contract Amount(b) 3.5 — — —<br />

Fair Value(b) 1.2 — Fair Value(b) 0.2 — — —<br />

(a)<br />

(b)<br />

Weighted average, in dollars<br />

Millions of dollars<br />

Swaps 2012 2013 2014 2015 2016<br />

Commodity Swaps:<br />

Pay fixed/receive variable(b) 86.2 24.4 11.7 11.6 5.1<br />

Average pay rate(a) 4.2928 5.5068 5.3603 5.3764 5.3088<br />

Average received rate(a) 3.1876 3.9337 4.3395 4.5970 4.8541<br />

Fair Value(b) 64.0 17.4 9.5 9.9 4.7<br />

Pay variable/receive fixed(b) 48.5 14.3 9.4 9.9 4.7<br />

Average pay rate(a) 3.2090 3.9361 4.3395 4.5970 4.8541<br />

Average received rate(a) 4.2887 5.3655 5.3867 5.3867 5.3163<br />

Fair Value(b) 64.9 19.5 11.6 11.6 5.1<br />

Basis Swaps:<br />

Pay variable/receive variable(b) 26.2 5.9 — — —<br />

Average pay rate(a) 3.2342 3.9336 — — —<br />

Average received rate(a) 3.2<strong>10</strong>2 3.8825 — — —<br />

Fair Value(b) 26.1 5.9 — — —<br />

(a)<br />

(b)<br />

Weighted average, in dollars<br />

Millions of dollars<br />

The Company uses derivative instruments to hedge forward purchases and sales of natural gas, which create market risks of<br />

different types. See Note 6 to the consolidated financial statements. The information above includes those financial positions of<br />

Energy Marketing, SCE&G and PSNC Energy.<br />

SCE&G and PSNC Energy utilize futures, options and swaps to hedge gas purchasing activities. SCE&G’s tariffs include a<br />

PGA clause that provides for the recovery of actual gas costs incurred. The SCPSC has ruled that the results of SCE&G’s hedging<br />

activities are to be included in the PGA. As such, costs of related derivatives utilized by SCE&G to hedge gas purchasing activities are<br />

recoverable through weighted average cost of gas calculations. The offset to the change in fair value of these derivatives is deferred.<br />

PSNC Energy’s tariffs also include a provision for the recovery of actual gas costs incurred. PSNC Energy defers premiums,<br />

transaction fees, margin requirements and any realized gains or losses from its hedging program for subsequent recovery from<br />

customers.<br />

52