10-K - SCANA Corporation

10-K - SCANA Corporation

10-K - SCANA Corporation

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Table of Contents<br />

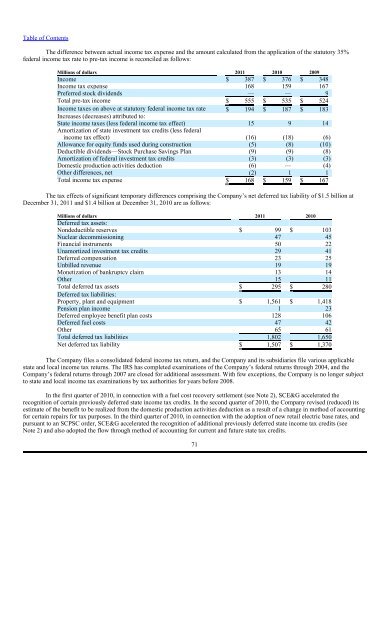

The difference between actual income tax expense and the amount calculated from the application of the statutory 35%<br />

federal income tax rate to pre-tax income is reconciled as follows:<br />

Millions of dollars 2011 20<strong>10</strong> 2009<br />

Income $ 387 $ 376 $ 348<br />

Income tax expense 168 159 167<br />

Preferred stock dividends — — 9<br />

Total pre-tax income $ 555 $ 535 $ 524<br />

Income taxes on above at statutory federal income tax rate $ 194 $ 187 $ 183<br />

Increases (decreases) attributed to:<br />

State income taxes (less federal income tax effect) 15 9 14<br />

Amortization of state investment tax credits (less federal<br />

income tax effect) (16) (18) (6)<br />

Allowance for equity funds used during construction (5) (8) (<strong>10</strong>)<br />

Deductible dividends—Stock Purchase Savings Plan (9) (9) (8)<br />

Amortization of federal investment tax credits (3) (3) (3)<br />

Other differences, net (2) 1 1<br />

Total income tax expense $ 168 $ 159 $ 167<br />

Domestic production activities deduction (6) — (4)<br />

The tax effects of significant temporary differences comprising the Company’s net deferred tax liability of $1.5 billion at<br />

December 31, 2011 and $1.4 billion at December 31, 20<strong>10</strong> are as follows:<br />

Millions of dollars 2011 20<strong>10</strong><br />

Deferred tax assets:<br />

Nondeductible reserves $ 99 $ <strong>10</strong>3<br />

Nuclear decommissioning 47 45<br />

Financial instruments 50 22<br />

Unamortized investment tax credits 29 41<br />

Deferred compensation 23 25<br />

Unbilled revenue 19 19<br />

Monetization of bankruptcy claim 13 14<br />

Other 15 11<br />

Total deferred tax assets $ 295 $ 280<br />

Deferred tax liabilities:<br />

Property, plant and equipment $ 1,561 $ 1,418<br />

Pension plan income 1 23<br />

Deferred employee benefit plan costs 128 <strong>10</strong>6<br />

Deferred fuel costs 47 42<br />

Other 65 61<br />

Total deferred tax liabilities 1,802 1,650<br />

Net deferred tax liability $ 1,507 $ 1,370<br />

The Company files a consolidated federal income tax return, and the Company and its subsidiaries file various applicable<br />

state and local income tax returns. The IRS has completed examinations of the Company’s federal returns through 2004, and the<br />

Company’s federal returns through 2007 are closed for additional assessment. With few exceptions, the Company is no longer subject<br />

to state and local income tax examinations by tax authorities for years before 2008.<br />

In the first quarter of 20<strong>10</strong>, in connection with a fuel cost recovery settlement (see Note 2), SCE&G accelerated the<br />

recognition of certain previously deferred state income tax credits. In the second quarter of 20<strong>10</strong>, the Company revised (reduced) its<br />

estimate of the benefit to be realized from the domestic production activities deduction as a result of a change in method of accounting<br />

for certain repairs for tax purposes. In the third quarter of 20<strong>10</strong>, in connection with the adoption of new retail electric base rates, and<br />

pursuant to an SCPSC order, SCE&G accelerated the recognition of additional previously deferred state income tax credits (see<br />

Note 2) and also adopted the flow through method of accounting for current and future state tax credits.<br />

71