10-K - SCANA Corporation

10-K - SCANA Corporation

10-K - SCANA Corporation

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Table of Contents<br />

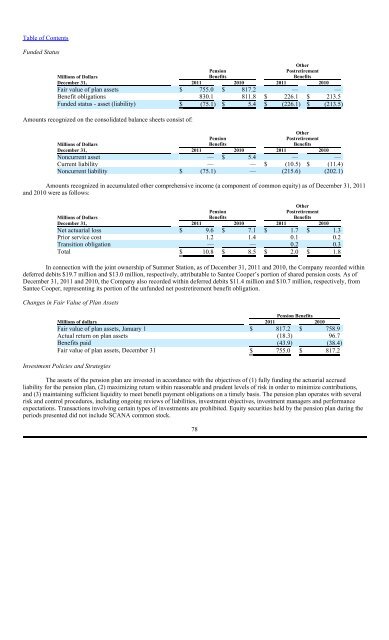

Funded Status<br />

Other<br />

Pension<br />

Postretirement<br />

Millions of Dollars<br />

Benefits<br />

Benefits<br />

December 31, 2011 20<strong>10</strong> 2011 20<strong>10</strong><br />

Fair value of plan assets $ 755.0 $ 817.2 — —<br />

Benefit obligations 830.1 811.8 $ 226.1 $ 213.5<br />

Funded status - asset (liability) $ (75.1) $ 5.4 $ (226.1) $ (213.5)<br />

Amounts recognized on the consolidated balance sheets consist of:<br />

Other<br />

Pension<br />

Postretirement<br />

Millions of Dollars<br />

Benefits<br />

Benefits<br />

December 31, 2011 20<strong>10</strong> 2011 20<strong>10</strong><br />

Noncurrent asset — $ 5.4 — —<br />

Current liability — — $ (<strong>10</strong>.5) $ (11.4)<br />

Noncurrent liability $ (75.1) — (215.6) (202.1)<br />

Amounts recognized in accumulated other comprehensive income (a component of common equity) as of December 31, 2011<br />

and 20<strong>10</strong> were as follows:<br />

Other<br />

Pension<br />

Postretirement<br />

Millions of Dollars<br />

Benefits<br />

Benefits<br />

December 31, 2011 20<strong>10</strong> 2011 20<strong>10</strong><br />

Net actuarial loss $ 9.6 $ 7.1 $ 1.7 $ 1.3<br />

Prior service cost 1.2 1.4 0.1 0.2<br />

Transition obligation — — 0.2 0.3<br />

Total $ <strong>10</strong>.8 $ 8.5 $ 2.0 $ 1.8<br />

In connection with the joint ownership of Summer Station, as of December 31, 2011 and 20<strong>10</strong>, the Company recorded within<br />

deferred debits $19.7 million and $13.0 million, respectively, attributable to Santee Cooper’s portion of shared pension costs. As of<br />

December 31, 2011 and 20<strong>10</strong>, the Company also recorded within deferred debits $11.4 million and $<strong>10</strong>.7 million, respectively, from<br />

Santee Cooper, representing its portion of the unfunded net postretirement benefit obligation.<br />

Changes in Fair Value of Plan Assets<br />

Pension Benefits<br />

Millions of dollars 2011 20<strong>10</strong><br />

Fair value of plan assets, January 1 $ 817.2 $ 758.9<br />

Actual return on plan assets (18.3) 96.7<br />

Benefits paid (43.9) (38.4)<br />

Fair value of plan assets, December 31 $ 755.0 $ 817.2<br />

Investment Policies and Strategies<br />

The assets of the pension plan are invested in accordance with the objectives of (1) fully funding the actuarial accrued<br />

liability for the pension plan, (2) maximizing return within reasonable and prudent levels of risk in order to minimize contributions,<br />

and (3) maintaining sufficient liquidity to meet benefit payment obligations on a timely basis. The pension plan operates with several<br />

risk and control procedures, including ongoing reviews of liabilities, investment objectives, investment managers and performance<br />

expectations. Transactions involving certain types of investments are prohibited. Equity securities held by the pension plan during the<br />

periods presented did not include <strong>SCANA</strong> common stock.<br />

78