Module 19 - Self Assessed Clearance Declarations - Cargo Support

Module 19 - Self Assessed Clearance Declarations - Cargo Support

Module 19 - Self Assessed Clearance Declarations - Cargo Support

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

AMENDING A SAC DECLARATION<br />

The SAC (short form) declaration can only be amended if the SAC declaration<br />

includes imported goods that contain alcohol and/or tobacco products. The format<br />

differs for goods imported by sea or air. SAC declarations cannot be amended if<br />

they do not contain any tariff lines, they can only be withdrawn.<br />

Amendment of a SAC (short form) declaration is initiated by clicking on the Amend<br />

button from the <strong>Self</strong> <strong>Assessed</strong> <strong>Clearance</strong> Declaration Header View screen.<br />

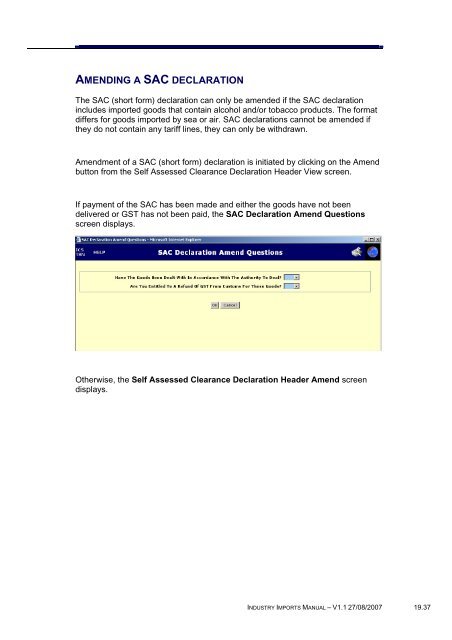

If payment of the SAC has been made and either the goods have not been<br />

delivered or GST has not been paid, the SAC Declaration Amend Questions<br />

screen displays.<br />

Otherwise, the <strong>Self</strong> <strong>Assessed</strong> <strong>Clearance</strong> Declaration Header Amend screen<br />

displays.<br />

INDUSTRY IMPORTS MANUAL – V1.1 27/08/2007 <strong>19</strong>.37