o_18thitrba1dr417tbpqe1soiuvva.pdf

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Industry :: p21<br />

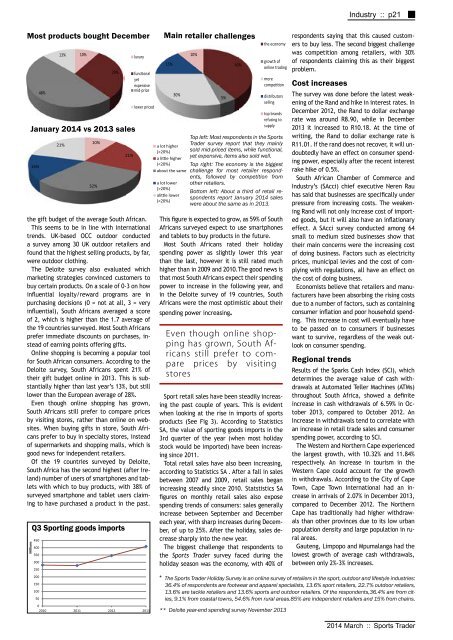

Most products bought December<br />

the gift budget of the average South African.<br />

This seems to be in line with international<br />

trends. UK-based OCC outdoor conducted<br />

a survey among 30 UK outdoor retailers and<br />

found that the highest selling products, by far,<br />

were outdoor clothing.<br />

The Deloite survey also evaluated which<br />

marketing strategies convinced customers to<br />

buy certain products. On a scale of 0-3 on how<br />

influential loyalty/reward programs are in<br />

purchasing decisions (0 = not at all, 3 = very<br />

influential), South Africans averaged a score<br />

of 2, which is higher than the 1.7 average of<br />

the 19 countries surveyed. Most South Africans<br />

prefer immediate discounts on purchases, instead<br />

of earning points offering gifts.<br />

Online shopping is becoming a popular tool<br />

for South African consumers. According to the<br />

Deloite survey, South Africans spent 21% of<br />

their gift budget online in 2013. This is substantially<br />

higher than last year’s 13%, but still<br />

lower than the European average of 28%.<br />

Even though online shopping has grown,<br />

South Africans still prefer to compare prices<br />

by visiting stores, rather than online on websites.<br />

When buying gifts in store, South Africans<br />

prefer to buy in specialty stores, instead<br />

of supermarkets and shopping malls, which is<br />

good news for independent retailers.<br />

Of the 19 countries surveyed by Deloite,<br />

South Africa has the second highest (after Ireland)<br />

number of users of smartphones and tablets<br />

with which to buy products, with 38% of<br />

surveyed smartphone and tablet users claiming<br />

to have purchased a product in the past.<br />

Millions<br />

48%<br />

13% 10%<br />

luxury<br />

29%<br />

January 2014 vs 2013 sales<br />

16%<br />

funconal<br />

yet<br />

expensive<br />

mid-price<br />

lower priced<br />

450<br />

400<br />

350<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

2010 2011 2012 2013<br />

15%<br />

30%<br />

10%<br />

21% a lot higher<br />

32%<br />

Q3 Sporting goods imports<br />

21%<br />

Main retailer challenges<br />

(>20%)<br />

a lile higher<br />

(20%)<br />

alile lower<br />

(